The Primary Risks of Selling Short-Term Options

The Primary Risks of Selling Short-Term Options

By:Kai Zeng

These equities can potentially lead to higher returns, but they carry higher risks

Short duration short premium trades can have much higher P/L volatility

Trading short term options can lead to many more consecutive losses compared to longer duration trades

Management of trades is very limited with short term option contracts

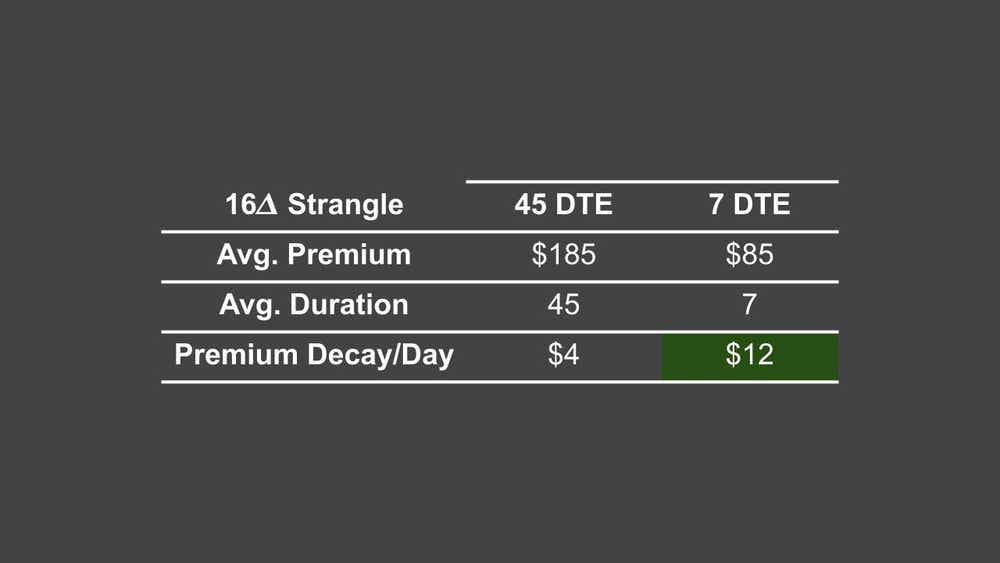

The main advantage of short-term options is they lose value much faster in the final days before expiration because of a factor called "theta." This means the value (or premium) of these options decreases rapidly as the expiration date approaches.

For example, options that expire weekly lose their value faster each day compared to options that expire in 45 days. This rapid decrease can potentially lead to higher returns over time if you keep trading them.

In markets with high volatility, as we sometimes see with S&P 500 ETF (SPY), these short-term options can seem even more appealing.

However, there are significant downsides to using short-term options, such as those expiring in a week or even the same day:

You can experience larger cumulative losses during consecutive losing days or weeks.

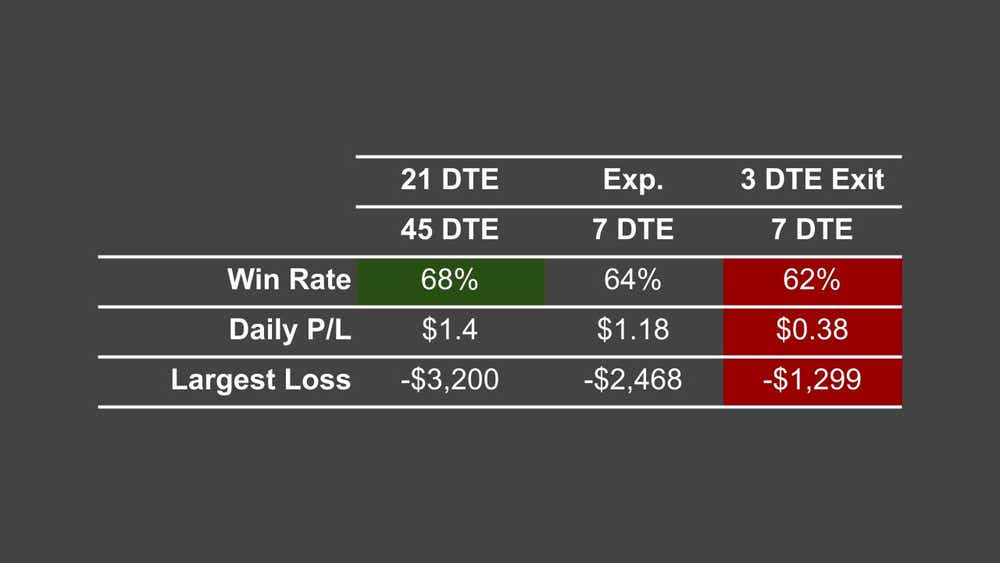

Strategies designed to reduce volatility and losses, such as exiting early, might not work as well.

Key Points:

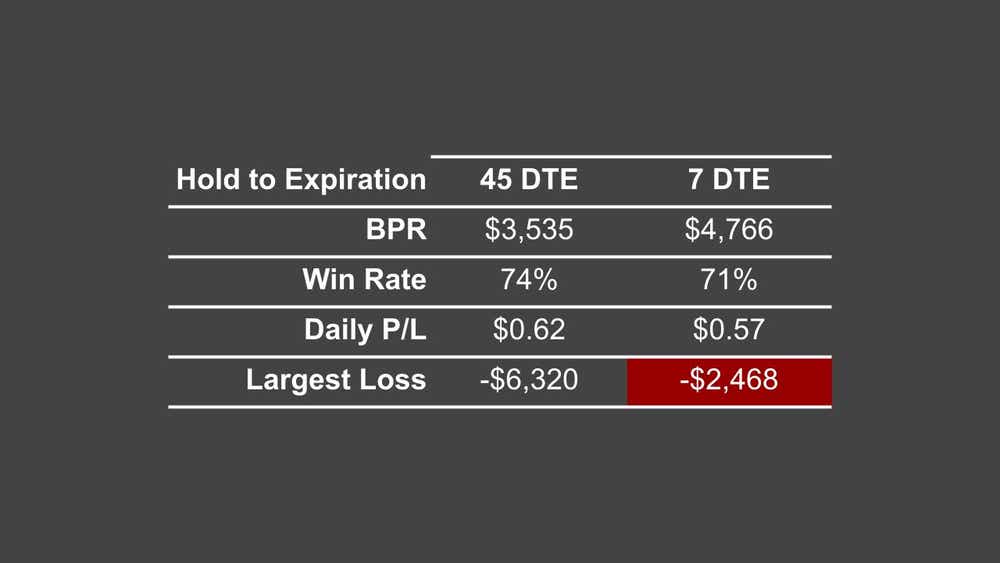

Risk of Consecutive Losses: While a single loss might be smaller with weekly options, there's a greater risk of multiple consecutive losses over the same period. This is particularly risky in one-sided markets, such as the crises seen in 2008 and 2020. Additionally, weekly options often underperform compared to options expiring in 45 days.

Limited Effectiveness of Management: Managing short-term options proactively doesn’t improve their performance as effectively as it does for longer-term options. Overall, short-term options still perform worse than their longer-term counterparts.

When comparing short-term options to those with longer durations, such as 45 days to expiration, it's evident that short-term options often underperform. For example, during financial downturns like those in 2008 and 2020, short-term options struggled significantly. Proactive management, such as adjusting or exiting trades early, does not improve the performance of short-term options as effectively as it does for their longer-term counterparts.

In summary, while short-term options might promise quick gains, traders should be wary of their high volatility and the risk of cumulative losses. Longer-term options generally offer a more stable investment, with better overall performance and more effective risk management strategies.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.