Stocks at Risk if PMI Data Shows U.S. Economy Leaving the World Behind

Stocks at Risk if PMI Data Shows U.S. Economy Leaving the World Behind

By:Ilya Spivak

U.S. economic strength may be a problem for the world economy as interest rates turn higher

- October purchasing managers’ index data is expected to see the U.S. economy outperforming most of the rest of the world.

- Recalibrating to fewer Federal Reserve interest rate cuts is lifting global lending rates at a bad time.

- Stocks may accelerate lower if new economic data fuels a further hawkish rethink of Fed bets.

The global economy has split into two camps, with the United States on one side and the rest of the world on the other. The American behemoth is powering along at a brisk clip even as the other two big engines of global growth—the Eurozone and China—continue to struggle. That has hurt performance for the world at large.

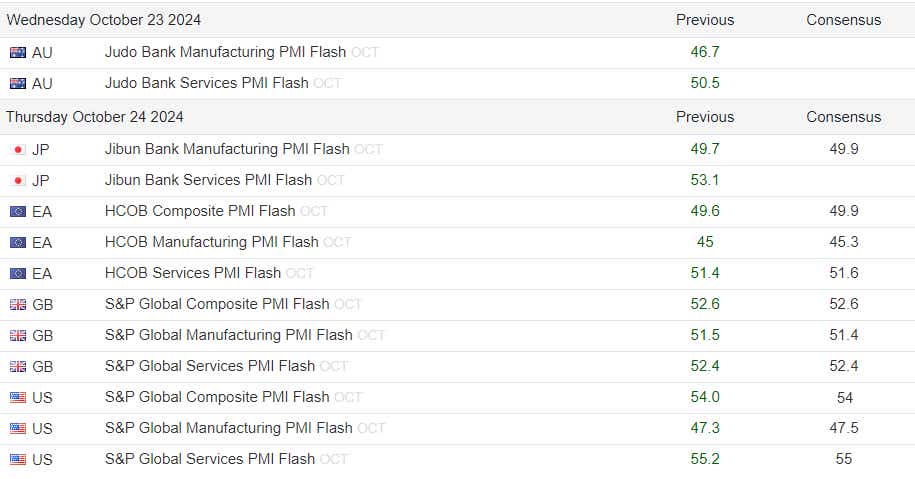

Purchasing managers’ index (PMI) data from S&P Global is a closely watched approximation of the trend in economic growth because it is released on a timelier monthly schedule than perennially lagged quarterly gross domestic product (GDP) figures. October’s reports are expected to show U.S. outperformance will continue.

PMI data expected to show the U.S. economy will outperform

Median forecasts suggest the U.S. will sustain economic activity growth at a healthy pace for a fifth consecutive month. The composite PMI index capturing the manufacturing and services sectors—close to 90% of the economy—jumped to a 12-month high in May and has held within a hair of that level since.

The Eurozone looks glum by comparison. Its PMI data showed economic activity unexpectedly shrank in September for the first time since February. October’s report is expected to bring a second month in the red, although the pace of contraction is seen slowing a bit.

The situation in China is not much better. Government-issued PMI data issued via the China Federation of Logistics and Purchasing (CFLP) has economic activity at near-standstill since June. The S&P Global version – produced together with Chinese media group Caixin – tells a similar story, albeit with a bit more seesaw volatility in monthly data.

Taken together, this has amounted to bad news for the world economy. Global PMI data from S&P Global and J.P. Morgan show that the pace of economic growth has been slowing since peaking in May. September’s numbers were the most sluggish since January as manufacturing sank into a deeper slump and services activity cooled.

Stock markets at risk if U.S. strength continues to boost interest rates

U.S. resilience has not extended very far beyond the country’s borders because spending is concentrated on services rather than goods, which favors domestic firms over foreign ones. U.S. consumers splurged on a goods-buying spree amid the COVID-19 outbreak, but that has since stalled.

Personal consumption expenditure (PCE) data from the Bureau of Economic Analysis (BEA) shows that core services excluding food, energy, and housing contributed 1.66 percentage points (ppt) of the 2.2% year-on-year rise in overall prices in August. Core goods detracted 0.12ppt. The gap between the two is the largest in nearly two decades.

![World - Purchasing Managers' Index [PMI].png](https://images.contentstack.io/v3/assets/blt40263f25ec36953f/blt05f3ae0a93e458b0/67196e45684d0c10999bd898/World_-_Purchasing_Managers_Index_[PMI].png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

The optimist might argue that this disparity is primed for reversion to the mean, bringing rebalancing that boosts goods demand and filters U.S. prosperity abroad. The pessimist might counter that higher-than-expected interest rates will make things worse before they get better.

Indeed, signs of U.S. economic strength have eaten into Federal Reserve interest rate cut expectations for next year. That has pushed the 10-to-2-year Treasury yield curve to its steepest in over two years. Global yields have ticked up in tandem because the liquidity of the U.S. dollar in international commerce means the Fed’s actions reverberate broadly.

The latter view seems to be prevailing recently, with bonds sinking as yields rise and stocks struggling for lasting progress. If U.S. PMI data tops forecasts – extending a recent trend of upside surprises – another push in the same direction may hurt Wall Street as rates and the U.S. dollar extend upward.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.