PMI Preview: Market Mood May Sour on Global Recession Fears

PMI Preview: Market Mood May Sour on Global Recession Fears

By:Ilya Spivak

Financial markets are at risk if PMI data warns hawkish Fed may trigger global recession

- The global economy is slowing as service sector outperformance fizzles.

- PMI data expected to show the downturn continues in August, U.S. in focus.

- Risk appetite may sour as markets fear hawkish Fed triggering recession.

Momentum is draining out of global economic growth.

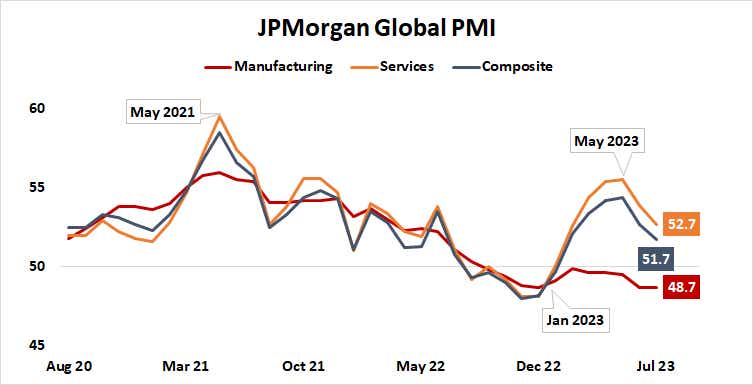

Activity growth slowed across the manufacturing and service sectors after peaking in May 2021 as global central banks led by the Federal Reserve launched into a spirited battle with inflation. That drove up financing costs worldwide, taking the air out of an economy revved up by stimulus and a burst of pent-up demand unleashed as COVID lockdowns eased.

The start of 2023 marked a second wave of catch-up spending on services that were previously sidelined, first by health ordinances and then by lingering anxieties, like travel, dining and in-person entertainment. This was helped along by China’s belated exit from pandemic restrictions. That uplift looks to have crested in May.

Global growth slows as service sector resilience fades

Now, a deflating service sector is catching up downward to anemic manufacturing, which has been contracting at a gently accelerating pace since September 2022.

A slew of Purchasing Manager Index (PMI) surveys is expected to show continued deterioration in August. Eurozone manufacturing- and service-sector activity is expected contract for a third month straight while growth in the US grinds to the slowest since February. Numbers tracking Australia, Japan, and the U.K. are also due. All three have seen growth decelerate since mid-year.

Of the major drivers of global growth, the U.S. stands out as a pocket of relative strength. The Eurozone is on the doorstep of recession and China’s reopening has failed to get off the ground after an initial burst of enthusiasm unraveled. This makes for a worrying backdrop as the Federal Reserve digs in on its battle with inflation.

Fed inflation fight fuels global recession risk

The U.S. central bank has loudly signaled that it is singularly focused on pulling inflation back to its target of 2%, even at the cost of significantly hurting growth. Fed chair Jerome Powell is likely to reassert as much when he takes the podium at the annual Jackson Hole symposium later this week.

Markets are dubious about another rate hike before year-end, but traders have been cautiously scaling back the expected scope for easing after the rate setting Federal Open Market Committee (FOMC) is expected to begin loosening credit conditions in the second quarter of next year.

Interest rate futures now price in a Fed Funds rate of 4.36% at the close of 2024, up from 4% just two weeks ago. That’s still implying that officials will feel the need to reduce borrowing costs by a full 100 basis points (bps) from current levels.

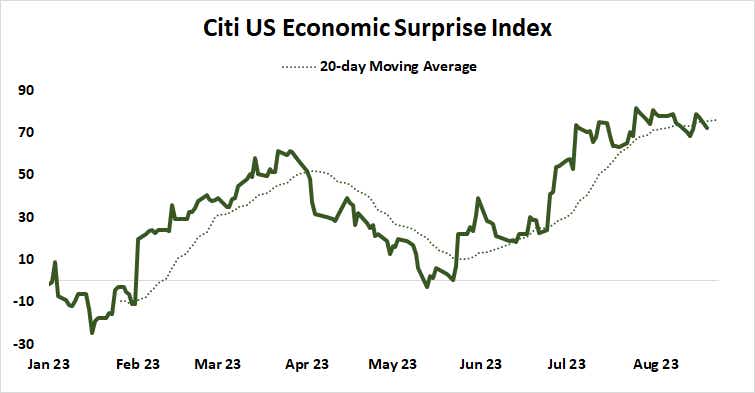

This leaves ample room for further readjustment if U.S. PMI readings top expectations, echoing Citigroup data showing recent economic outcomes have tended to outperform relative to baseline forecasts.

If this is not matched by emphatically positive numbers out of Europe—a seemingly distant prospect – the takeaway for investors may well be that firmer U.S. performance now amounts to greater chance for global recession in the months ahead, in that it would harden Chair Powell and company’s hawkish conviction.

Such an interpretation will probably bode ill for stocks, cyclically minded commodities like crude oil and copper, and sentiment-sentiment sensitive currencies like the Australian dollar. Meanwhile, haven demand may lift the U.S. dollar alongside the Japanese yen. Deeper inversion of the yield seems likely too, with the front end supported by “higher for longer” Fed rate expectations while the long end is depressed by haven-seeking capital flows.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.