PMI Data Preview: Stocks, Bonds and the U.S. Dollar Facing Trend Change

PMI Data Preview: Stocks, Bonds and the U.S. Dollar Facing Trend Change

By:Ilya Spivak

Stocks, bonds, and the U.S. dollar face trend reversal risk on global PMI data.

- Bets on a rebound in U.S. inflation have defined the markets for two months

- The story now struggles to keep going in bonds markets and the U.S. dollar

- November’s Global PMI data may trigger a broad-based reversal across assets

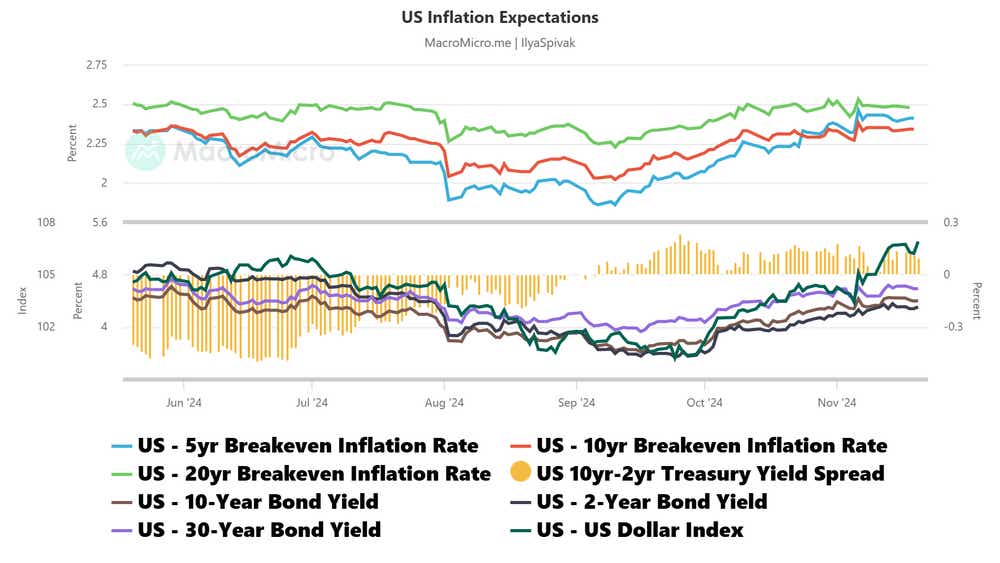

Financial markets have embraced a singular narrative for nearly two months: U.S. inflation will be higher than previously expected. That has pushed up Treasury bond yields and the U.S. dollar while punishing gold prices (albeit with some delayed effect). These moves now look to be struggling for follow-through. A turnaround may follow.

The forces driving markets to this juncture seem straight-forward. A stream of upbeat data showed the U.S. economy leaving the rest of the world in the rearview mirror even as Federal Reserve has launched a rate cut cycle while triumphant President-elect Trump loudly champions trade barriers and large-scale deportation of migrants.

Financial markets’ favorite story for two months may be ending

Look now, and it seems as though the story has run out of fresh fodder to power ongoing progress. Rates at the long end of the yield curve have oscillated in a choppy range for most of this month, with bond markets apparently struggling to dilute next year’s rate cut outlook further.

Meanwhile, the dollar has tellingly idled since Fed Chair Jerome Powell embraced a more hawkish stance in a closely watched policy speech last week (as expected). Here too, price action seems to signal that speculative appetite has been exhausted. Gold prices bottomed out at the same time, then moved to erase half of the intra-month selloff.

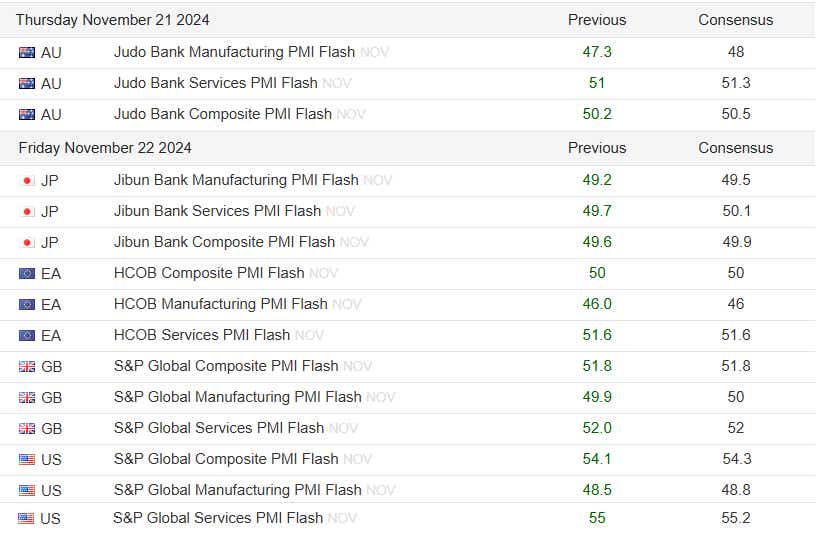

Rethinking regional economic growth dynamics may mark the next inflection point. Incoming purchasing managers index (PMI) data from S&P Global is expected to show that the U.S. continues to power ahead with accelerating economic activity growth while Europe and Japan tread water. A modest pickup is penciled in for Australia.

Global PMI data may trigger trend reversal across markets

While that would seem to fall in line with familiar trends, analytics from Citigroup suggest that economic news-flow from non-U.S. economies has quietly improved relative to expectations recently. The Eurozone is a standout. The third-largest engine of global growth after the U.S. and China now tends toward positive data surprises.

If this translates into upbeat Eurozone PMI figures, the markets may be inspired to reposition for fewer interest rate cuts from the European Central Bank (ECB). To the extent that a stronger Eurozone economy may lift broader non-U.S. inflation expectations, the hawkish adjustment may spread more generally.

The U.S. dollar stands out as the first casualty in such a scenario as yield differentials with other currencies become narrower. Stock markets might turn lower as the prospect of higher borrowing costs across the board cools risk appetite. Curiously, that might push bonds higher as capital flows search for safer harbor.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.