Platinum Prices, Homebuilders and a Lithium Rebound Play

Platinum Prices, Homebuilders and a Lithium Rebound Play

By:James Melton

A weekly look inside Luckbox magazine

If gold looks too expensive, consider platinum in 2024

Platinum has declined in value this year by about 10%. At present, more than two ounces of platinum are required to purchase a single ounce of gold.

The current gold/platinum price ratio suggests gold is expensive compared to platinum, potentially making platinum attractive to investors.

Another crucial factor is the supply-demand dynamic. Last year, miners produced 190 tons of platinum globally, whereas total gold production was closer to 3,100 tons. The automotive industry is traditionally the largest consumer of platinum, primarily because it’s a key component in catalytic converters. Read the whole story.

Home-building heroes

With only a few days left in the year, the two largest homebuilder exchange-traded ffunds (ETFs)—the iShares U.S. Home Construction ETF (ITB) and the SPDR S&P Homebuilders ETF (XHB)—are up 66% and 57%, respectively, on the year. With mortgage rates hovering at multi-year highs, homebuilders seem like one of the market's most unlikely heroes in 2023.

However, any pullback in housing starts—especially a sustained downward trend—could weigh heavily on this sector, making it susceptible to a correction. Read the whole story.

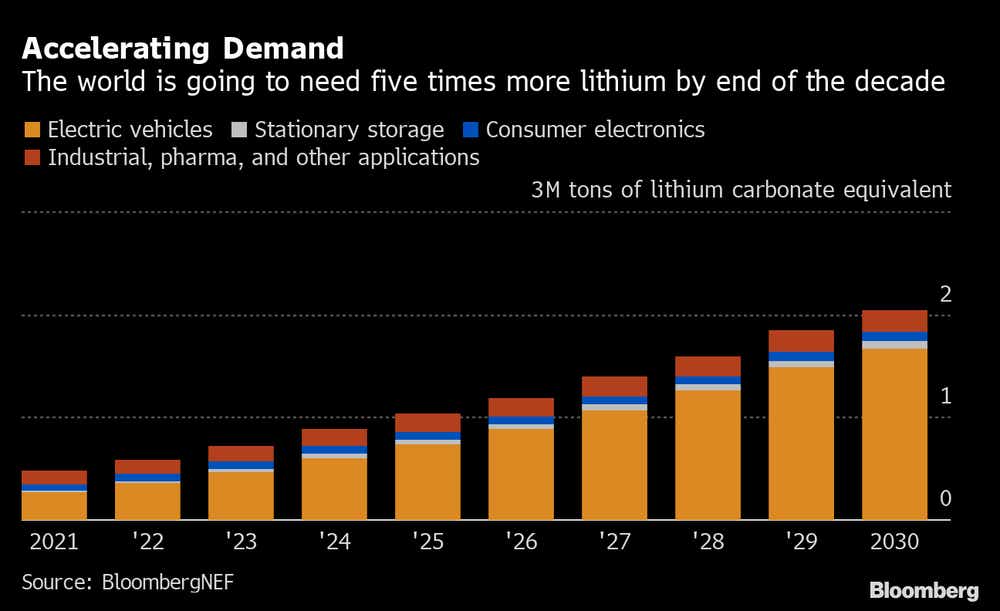

Playing a potential lithium rebound with LEAPS

After an 80% price correction in 2023, the lithium market appears poised for a rebound in 2024, especially if the global economy grows at a faster-than-expected pace during the first half of 2024.

Lithium production is expected to outstrip demand in 2024. However, those projections assume economic growth remains anemic. Strong economic growth would boost demand for electric vehicles, which use a lot of lithium carbonate.

Investors and traders bullish on the lithium market can consider using futures, equities or options to play a rebound in prices, including longer-dated LEAPS options. Read the whole story.

Beyond Meat is beyond rationality

Despite myriad financial woes, stock in Beyond Meat (BYND), a maker of plant-based “meat,” is still trading. In fact, it’s one of today’s most widely “shorted stocks.” Investors shouldn't bother pondering the faulty fundamentals of Beyond Meat. The best plan is to watch out for short-sellers and follow the money. Read the whole story.

Read the latest edition of Luckbox magazine here.

Not a Luckbox subscriber? Sign up for free at getluckbox.com.

James Melton is managing editor of Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.