Pending PMI Release: Aggressive Rate Hikes Ahead?

Pending PMI Release: Aggressive Rate Hikes Ahead?

By:Ilya Spivak

Key economic data may trigger harsher punishment from global central banks—potentially putting stocks back on defense and boosting the U.S. Dollar.

- PMI surveys are set to show global economic activity slowed in June.

- A downturn may be insufficient to continue cooling global inflation.

- Stocks may fall if central banks are seen clamping down harder.

The global economy will slow in June.

That’s the message expected in back-to-back releases of this month’s preliminary purchasing manager index (PMI) reports. The surveys poll corporate officers charged with anticipating global demand for their take on economic trends across key metrics—such as employment, new orders and prices—in the manufacturing and services sectors.

The outcomes are presented as indices with a “neutral” center line at 50. Values above that represent expansion, while those below it signal contraction. Distance from 50 in either direction represents speed: the higher above 50, the faster the expansion; the lower below it, the faster the contraction.

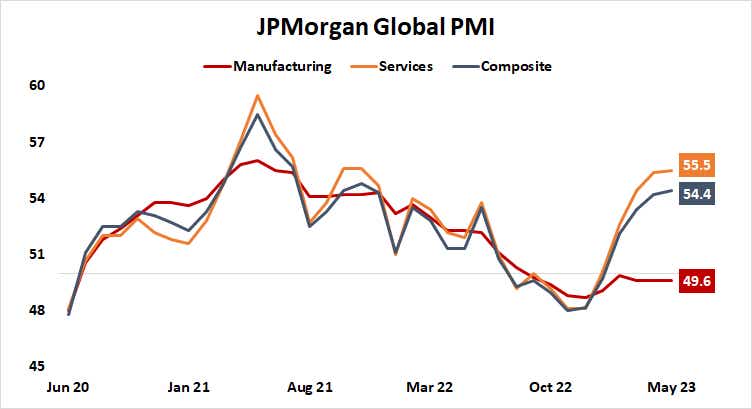

Slowdown in global economic activity set to continue

Reports out Friday covering the Eurozone, U.K. and U.S. economies are expected to show broad-based deterioration on nearly all fronts. The gauge of manufacturing activity in the Euro area is projected to print unchanged from May’s outcome, a cold comfort considering it is lingering deep in contractionary territory.

The slowdown is not unexpected.

Central banks have been hard at work trying to contain a post-pandemic runup in inflation. That has pushed interest rates sharply higher worldwide, making it more expensive to finance all manner of economic activity. The recovery in global trade volumes from COVID outbreak lows set in the first half of 2020 tellingly topped in March 2022, just as the Federal Reserve began the steepest rate-hike cycle in four decades. Turnover fell to a six-month low by February.

Service sector strength frustrates central banks’ inflation fight

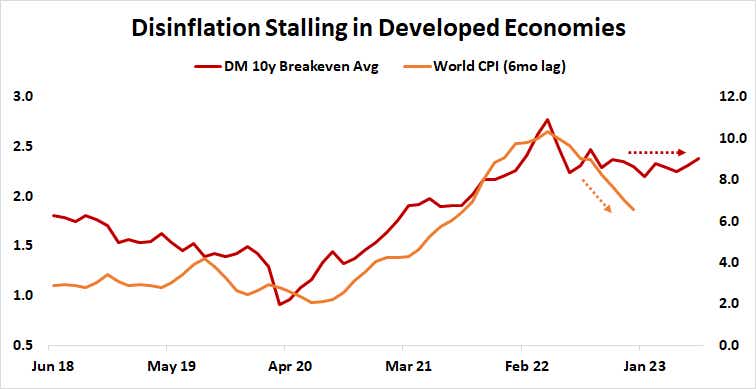

The worry for markets is not so much that there’s a downturn but that its severity still seems insufficient to power disinflation back to policymakers’ targets. Price growth remains too high in the major economies. There has been some improvement—global consumer price index (CPI) inflation has fallen from a peak above 10% in October 2022 to 6.5% this month. However, bond markets are warning that progress has stalled as priced-in inflation expectations stop falling.

Divergence between the manufacturing and services sectors since the beginning of this year seems to be at the heart of the problem. While the former has dutifully slumped, the latter has reaccelerated. That is particularly worrying because the service sector’s share of employment dwarfs that of manufacturing in most developed economies. Resilience here is a potent driver of wage growth, which feeds the kind of sticky inflation that central banks are loathe to tolerate.

Officials’ appetite to reboot disinflation seems evident. The Reserve Bank of Australia and Bank of Canada surprised the markets by increasing interest rates this month. The Bank of England unexpectedly delivered a 50 basis points rise, where only 25 basis points were priced in. The hike by the European Central Bank transpired as anticipated, but President Christine Lagarde and company struck a more hawkish tone than traders envisioned. The Fed loudly talked up its inflation-fighting focus, even as it paused after increasing rates at 10 consecutive policy meetings.

June’s PMI data is expected to fall in broadly with recent trends. Absent an unexpectedly severe deceleration, investors may see such numbers as beckoning a harder clamp-down. That might bode ill for stocks and precious metals, as well as cyclical commodities and related currencies—the Australian dollar comes to mind as a prime example. The U.S. dollar may benefit, however, as capital flows seek a haven from volatility in the greenback’s unrivaled liquidity.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, specializing in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.