Stock Markets May Revert to Defense Mode After U.S. PCE Data

Stock Markets May Revert to Defense Mode After U.S. PCE Data

By:Ilya Spivak

Monday’s appearance of sudden and unresolved uncertainty about AI could make for a rocky end to the trading week

- The Fed policy meeting and U.S. GDP report didn’t change expectation for cuts in interest rates.

- U.S. PCE inflation data comes into focus next, but a meaningful surprise appears unlikely.

- Stocks are at risk if sentiment reverts to “risk off” after the macro news passes.

If the mission for the Federal Reserve was to get through this month’s policy announcement without creating a commotion in the markets, it has succeeded. By the close of yesterday’s trade, Treasury yields were barely changed across maturities. The central bank left its interest rate target range unchanged at 4.25%-4.50%.

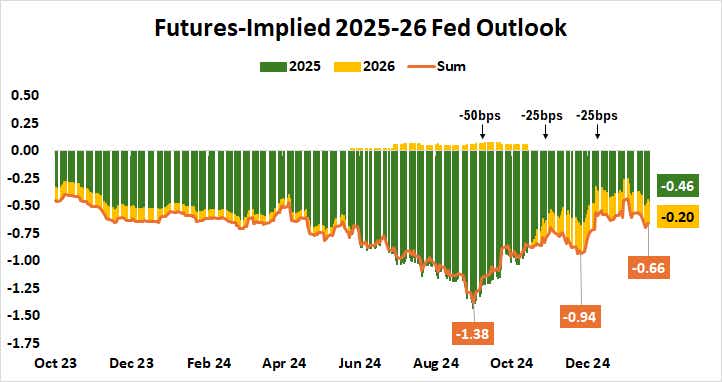

The markets overwhelmingly expected that outcome. More importantly, Fed Chair Jerome Powell and company managed to keep forward-looking expectations broadly anchored. The priced-in 2025-2026 rate cut path implied in Fed funds futures has moved by a meager 4 basis points (bps) since the beginning of the week.

Markets shrug off Fed policy update and GDP data

The statement from the policy-setting Federal Open Market Committee (FOMC) saw only minor changes from December’s assessment, and those seemed geared toward communicating as neutral a stance as possible. Labor market conditions “remain solid,” it said, while inflation “remains somewhat elevated.”

Powell deftly navigated journalists’ questions without controversy in the post-meeting presser. Perhaps most tellingly, he said officials broadly agree that “we don’t need to be in a hurry to adjust our policy stance.” He added that the recent rise in long rates reflects term premium—that is, uncertainty—and not the result of Fed policy.

Disappointing fourth-quarter U.S. gross domestic product (GDP) data seemed to pass without incident. Output grew at an annualized rate of 2.3%, a touch lower than the 2.6% expected. Consumption growth accelerated for the fourth consecutive period, but investment unexpectedly fell for the first time since the first quarter of 2023.

Stock markets may wobble after PCE data

Incoming inflation data seems unlikely to introduce much ground-shaking novelty. The Fed-favored personal consumption expenditures (PCE) price growth measure is expected to have risen 2.6% year-on-year in December, marking the fastest increase since May. The core rate is seen at 2.8% for a third month, the highest since April’s 2.9%.

.png?format=pjpg&auto=webp&quality=50&width=754&disable=upscale)

Market-watchers are typically adept at accurately projecting PCE figures once consumer (CPI) and producer (PPI) reports for the same period are released by the Bureau of Labor Statistics (BLS). That means the probability of a sizable, market-moving deviation from consensus forecasts is unlikely.

This leaves the markets with an interesting conundrum. The week began with brutal bloodletting on Wall Street amid the unveiling of an AI model from China’s DeepSeek that appears to rival leading U.S. offerings. That sell-off was interrupted by the arrival of back-to-back macro event risk. Traders understandably withheld conviction in the interim.

If the PCE data prints broadly as anticipated and the Fed outlook is left undisturbed yet again, risk sentiment trends will be left rudderless, but for Monday’s appearance of sudden and unresolved uncertainty about AI buildout expectations. That could make for a rocky end to the trading week for stock markets.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.