Exploring the Probability of Touch Across Various Deltas

Exploring the Probability of Touch Across Various Deltas

By:Kai Zeng

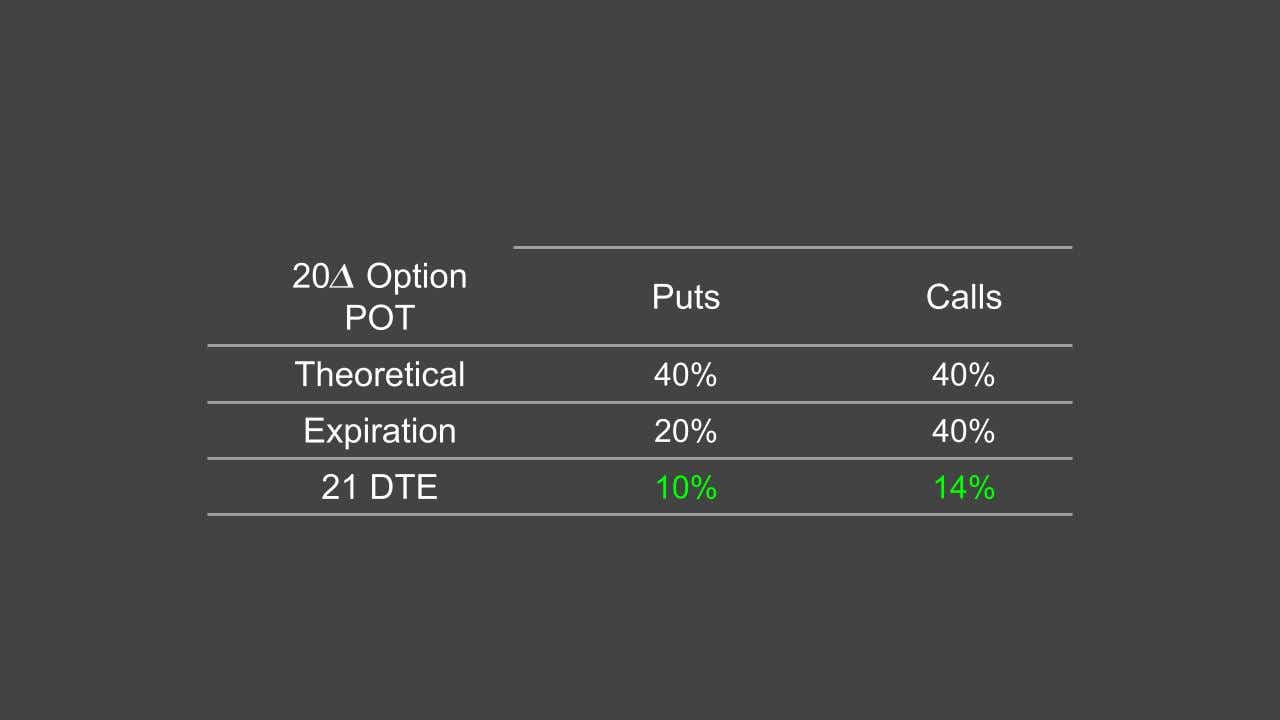

Managing options at 21 DTE affects real POT vs. theoretical values

- For index options, puts have a lower actual POT than calls across all deltas.

- Managing positions at 21 DTE significantly reduces the likelihood of being tested at strikes compared to doing nothing.

- On average, the realized POT on the put side is slightly smaller than delta, while it is almost the same on the call side.

- The difference between put and call sides becomes marginal when positions are managed.

We've discussed the fact that the realized probabilities of touching (POT) the strikes in short options strategies are often much lower than the theoretical probabilities. This reduction becomes more pronounced when positions are exited at 21 days to expiration (DTE).

To gauge the effectiveness of realized POT, consider the ratio between the realized POT at 21 DTE and the delta, which represents half of the theoretical POT. For options with a delta of 20, this ratio averages about 0.3

.

.jpg?format=pjpg&auto=webp&quality=50&width=1280&disable=upscale)

However, focusing solely on a delta of 20 might not provide a comprehensive view. Therefore, we analyzed SPY out-of-the-money (OTM) puts and calls with deltas ranging from 10 to 45, which are the most commonly used OTM deltas. All options were initiated with 45 DTE and exited at 21 DTE.

Let's examine the put side first.

The POTs at expiration for all deltas are lower than the theoretical values (2x delta), but managing positions at 21 DTE significantly improves results across all deltas. The average POT when managed at 21 DTE is approximately 0.8x delta.

.jpg?format=pjpg&auto=webp&quality=50&width=1280&disable=upscale)

A graph illustrates how exiting positions early enhances our short put strategy. The trend also shows that the gap between theoretical and realized POT narrows as delta increases, indicating a higher risk of touching with larger delta options.

.jpg?format=pjpg&auto=webp&quality=50&width=1280&disable=upscale)

On the call side, although the realized POTs are higher than those for puts, the 21 DTE management approach keeps the POT ratio surprisingly close to that of the put side, around 1.0x delta.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

A similar pattern emerges in the graph: High delta calls also present a greater risk of being tested, and managing positions becomes less effective compared to lower delta options.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.