Nvidia: A Stellar Q3 Reinforces the Bull Case for an AI Leader

Nvidia: A Stellar Q3 Reinforces the Bull Case for an AI Leader

Another blowout earnings report—here’s why it bolsters the long-term investment case

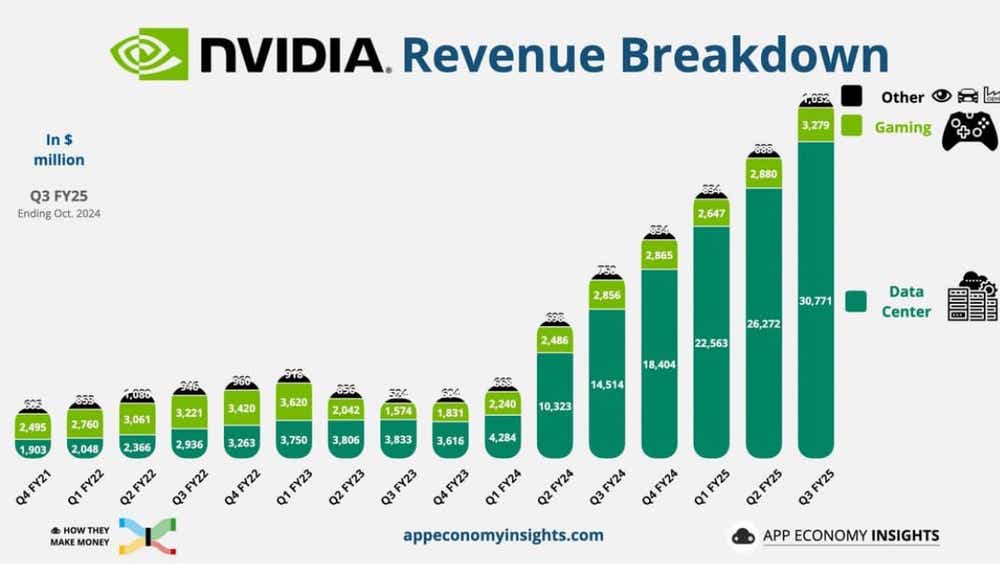

- Nvidia reported strong Q3 earnings, with $35.1 billion in revenue, a 94% year-over-year increase driven by record data center sales.

- While quarter-over-quarter growth has slowed, Nvidia’s long-term outlook remains robust, with revenue projected to grow by more than 50% next year, to $200 billion or more.

- Representing the backbone of AI infrastructure, Nvidia’s products, innovation and financial strength solidify its position as a cornerstone of the industry and a compelling long-term investment.

Nvidia (NVDA), the undisputed leader in AI chip technology, continues to deliver staggering financial results, with its data center division accounting for 88% of its Q3 revenue—a record $30.8 billion of the company’s total $35.1 billion.

However, the company’s Q4 guidance, pegged at $37.5 billion, landed only slightly ahead of analyst expectations of $37.1 billion, falling short of the dramatic “beats” investors have come to expect. Shares fell about 3% in the immediate aftermath of earnings, as the market recalibrated to the idea of moderating growth.

Yet, this near-term reaction obscures the larger picture. Nvidia remains a cornerstone of AI, dominating a rapidly expanding market and maintaining an unrivaled position in the data center industry. For investors with a long-term outlook, the company’s trajectory—fueled by innovation, financial strength and the global surge in AI adoption—continues to make Nvidia a clear “buy.”

Driving innovation in a fast-growing market

Nvidia has firmly established itself as the undisputed leader in the AI chip market, particularly in data centers, where its cutting-edge technology underpins much of the modern digital infrastructure. The company commands an estimated 80% share of the market for AI chips, far outpacing competitors like Intel (INTC) and Advanced Micro Devices (AMD).

This dominance is built on a foundation of technological superiority, highlighted by Nvidia’s GPUs, which offer unparalleled computational power and efficiency for the complex workloads demanded by artificial intelligence. Supporting this hardware is the CUDA software ecosystem, which has become an industry standard for developers, embedding Nvidia’s technology in countless applications.

Nvidia’s partnerships with major cloud providers, including Amazon Web Services, Microsoft Azure, and Google Cloud, reinforce its leadership. These alliances not only broaden Nvidia’s reach but also ensure its chips remain integral to the AI infrastructure powering everything from search engines to generative AI models.

Meanwhile, the company’s relentless innovation—most recently with the development of the Blackwell AI processors—positions it to meet the ever-growing demands of data centers. In a market increasingly defined by scalability and versatility, Nvidia continues to set the benchmark for performance and reliability, ensuring its technology remains indispensable to its customers.

The growth trajectory of the AI chip market is closely tied to the rapid expansion of the global data center industry. Valued at $256 billion in 2024, the data center market is projected to surge to $775 billion by 2034, growing at a compound annual rate of 11.72%, as highlighted below. As data centers expand to meet rising AI demand, Nvidia’s revenues and earnings are poised to scale accordingly, solidifying not only its leadership in this fast-evolving industry but also its financial position.

.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Impressive Q3 earnings, in-line Q4 guidance

Nvidia’s Q3 2025 results once again highlight its remarkable earnings quality, though the data reveals a slight deceleration in growth compared to previous quarters. Revenue surged 94% year-over-year, reaching a record $35.1 billion, while net income more than doubled to $19.3 billion, or $0.78/share in GAAP terms ($0.81/share in non-GAAP terms), up from $9.24 billion, or $0.37/share, in the same quarter last year. These figures firmly underscore Nvidia’s position as the leader in AI chip technology and its pivotal role in driving the ongoing AI infrastructure boom.

However, when viewed quarter-over-quarter, the story becomes more nuanced. Revenue increased 17% from Q2 2025’s $30 billion—a strong result, but notably more modest than the 122% year-over-year growth achieved in Q2. Similarly, net income grew 16% sequentially, a slowdown from prior quarters. Nvidia’s gross margin slipped slightly to 74.6%, down from 75.1% in Q2, reflecting slight pressure as the company ramps up production of its next-generation Blackwell chips.

The data center division remains Nvidia’s cornerstone, with revenue climbing 112% year-over-year to a record $30.8 billion, accounting for the majority of total sales (highlighted below). Quarter-over-quarter, the division also grew 17%, driven by sustained demand for Nvidia’s Hopper and H200 AI processors and the early rollout of its Blackwell chips. These processors are at the heart of generative AI platforms used by leading tech companies like Microsoft (MSFT), Oracle (ORCL) and privately-owned OpenAI.

Yet, even as Nvidia cements its dominance in AI, growth in the data center division is beginning to moderate, signaling the company’s transition to a more stable expansion phase. Networking components contributed $3.1 billion to the division’s revenue, reflecting Nvidia’s diversification within the AI ecosystem. The company noted ongoing supply constraints for both Hopper and Blackwell systems, with demand for Blackwell expected to exceed supply well into fiscal 2026.

Nvidia’s guidance for Q4 2025 is for revenue of $37.5 billion, which translates to approximately 70% year-over-year growth. While this is a robust outlook, it aligns closely with analyst expectations of $37.1 billion, offering little in the way of a positive surprise. Investors may view this as a tempered signal compared to prior quarters, when Nvidia consistently outpaced expectations by wide margins. The guidance implies continued strong performance but suggests the meteoric growth of the past year is normalizing.

Outside of data centers, Nvidia’s gaming business posted $3.3 billion in revenue, up 15% year-over-year. The rise was attributed to increased sales of GPUs for PCs, laptops and game consoles. Meanwhile, the automotive segment grew 72% year-over-year to $449 million, and professional visualization increased 17% year-over-year to $486 million. While smaller in scale, these segments provide Nvidia with diversified revenue streams and opportunities for future growth.

Nvidia’s Q3 results affirm its exceptional earnings quality, supported by industry leadership, strong profitability and sustained demand for AI infrastructure. However, the deceleration in quarter-over-quarter growth, coupled with in-line guidance for Q4, suggests Nvidia’s breakneck pace of expansion may be stabilizing. For long-term investors, this normalization is not a cause for concern but instead a natural progression for a company that has achieved extraordinary growth over the past two years. With its data center business thriving and new products like Blackwell poised to fuel future innovation, Nvidia remains a compelling choice for those seeking exposure to the AI-driven transformation of the technology sector.

Share buybacks contribute to rosy outlook

Nvidia’s embrace of share buybacks highlights its confidence in sustained long-term growth and a strong commitment to delivering value to shareholders. In the past two years, the company has authorized substantial repurchase programs, including a $25 billion plan in 2023 and an impressive $50 billion authorization announced with its Q2 earnings. These initiatives have already made a considerable impact, with Nvidia buying back billions in shares each quarter. In Q3 alone, the company set a new record by repurchasing $11 billion in stock—roughly $3 billion more than its previous quarterly high. This strategic approach strikes a careful balance between supporting the stock price and ensuring sufficient resources for Nvidia’s bold investments in AI and data center technology, cementing its position as a leader in the industry.

The mechanics of a buyback add to its appeal. By reducing the total number of outstanding shares, buybacks synthetically increase the earnings per share (EPS) ratio—a key financial metric. For example, if Nvidia generates $100 in net earnings and has 100 shares outstanding, its EPS is $1. But if the company repurchases 20 of those shares, leaving only 80 outstanding, the EPS rises to $1.25 without any change in the company’s actual earnings. This magnification effect can make a company’s stock more attractive to investors, boosting its valuation. For Nvidia, which has seen its quarterly revenues soar from $7 billion in early 2023 to $35 billion in Q3 2024, the ability to amplify these earnings through buybacks is particularly meaningful.

While buybacks sometimes face criticism for prioritizing shareholder returns over broader investments, Nvidia’s case is different. The company has simultaneously funneled billions into R&D and next-generation technologies, such as its Blackwell AI chips, while rewarding shareholders through buybacks. This dual approach has positioned Nvidia as a leader not just in AI infrastructure but also in balancing innovation with capital efficiency.

In the broader context, Nvidia’s buybacks mirror a broader trend of companies spending trillions on share repurchases in recent years. Yet Nvidia stands out, not just for the scale of its buybacks but for their timing, occurring during a transformative period for AI and data centers. For long-term investors, these buybacks represent more than just a financial maneuver—they reflect Nvidia’s vision for sustained growth, while delivering tangible rewards to loyal shareholders.

Nvidia, the future of AI, remains a “buy”

Growth remains the central theme at Nvidia, from expanding its product offerings, such as the highly anticipated Blackwell chips, to delivering record-breaking revenue and earnings. The company’s growth story is deeply intertwined with the relentless demand for AI infrastructure, a trend reshaping industries and showing no signs of slowing.

As a result, Nvidia stands out as a clear long-term buy, propelled by its unrivaled dominance in AI technology, extraordinary financial performance and unshakable investor confidence. Revenues are projected to reach $200 billion or more in fiscal year 2026, and some analysts predict earnings per share could double in the coming year. These expectations underscore Nvidia’s ability to consistently outperform forecasts, even as it navigates a rapidly evolving industry.

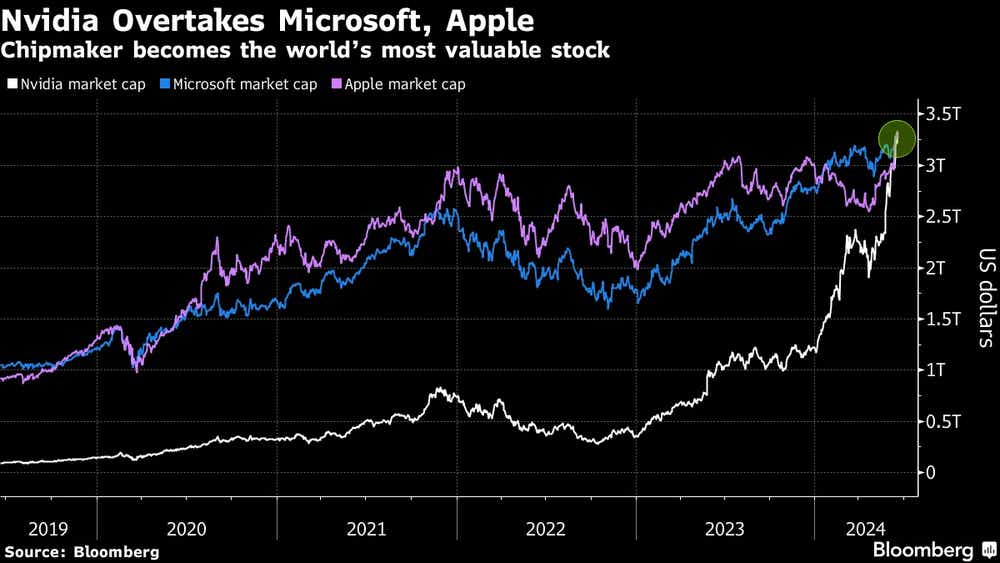

With a market capitalization of $3.5 trillion, Nvidia has become a cornerstone of the tech sector, commanding overwhelming support from analysts. Among the 66 analysts covering the company, 51 rate its shares as a “buy,” nine rate them “overweight” and six a “hold.” Not one assigns the stock a “sell” or “underweight” rating—a rare consensus that speaks volumes. Moreover, the average price target of $160 per share hints at further upside, particularly as Nvidia cements its position as the backbone of AI infrastructure globally.

Adding to its appeal, Nvidia’s most recent $50 billion share buyback program demonstrates the company’s commitment to returning value to shareholders. While buybacks often draw criticism, they provide tangible benefits by boosting earnings per share and signaling management’s confidence in the stock’s long-term value. For a company already delivering record-breaking revenue and reshaping a cutting-edge industry, the buyback program serves as yet another positive for the stock.

As the adoption of AI accelerates across sectors, Nvidia remains at the epicenter of this technological revolution. Its groundbreaking products, financial strength and proven track record of exceeding expectations make it one of the most compelling investment opportunities of this era. For those looking to align their portfolios with the future, Nvidia offers a rare blend of innovation, growth and resilience—qualities that ensure its staying power in the years ahead.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.