Nvidia Earnings Preview—Over 10% Stock Price Move Expected

Nvidia Earnings Preview—Over 10% Stock Price Move Expected

By:Mike Butler

Advances in efficiency may maintain the company’s momentum while competitors make big splashes

NVIDIA is set to report quarterly earnings after the market closes Aug. 28.

The chip giant consistently exceeds anticipated revenue and earnings-per-share.

NVIDIA is expected to report earnings per share of $0.64 on $28.64 billion in revenue—both figures notably higher than estimates last quarter.

A focal point for this quarter will likely be 2024 guidance and efficiency advancements to keep momentum rolling with competitors making big splashes in the sector.

NVIDIA earnings preview

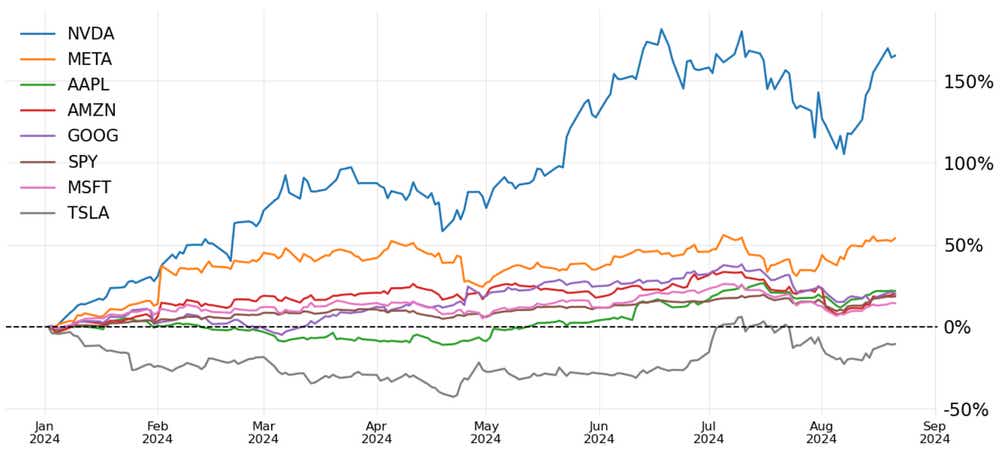

Nvida (NVDA) is the new tech king leading the charge of stock price gains in 2024, and its competing Magnificent Seven stocks, aren’t particularly close. After opening 2024 at a split-adjusted $49.24, NVDA stock has ripped to around $128 per share a week before the next quarterly earnings announcement a whopping 160% gain from January.

Meta Platforms (META) is the second-largest gainer in the MAG 7, up over 50% on the year.

But the focus is on Nvidia, which is expected to announce a earnings per share (EPS) of $0.64 on $28.64 billion in revenue. Both figures are higher than last quarter, and Nvidia has exceeded EPS and revenue estimates four quarters in a row.

Jensen Huang, NVIDIA founder and CEO, offered strong positive sentiment for last quarter's results and the future of the company: “The next industrial revolution has begun,” he wrote. “Companies and countries are partnering with NVIDIA to shift the trillion-dollar traditional data centers to accelerated computing and build a new type of data center—AI factories—to produce a new commodity: artificial intelligence."

He went on to say that ”AI will bring significant productivity gains to nearly every industry and help companies be more cost- and energy-efficient, while expanding revenue opportunities."

While the drum keeps beating for NVDA stock—even through the recent market volatility early in August—the company has legit competitors on their trail.

NVIDIA's competitor Advanced Micro Devices (AMD) recently announced plans to acquire ZT Systems, a leading provider of AI infrastructure, prompting NVDA to say this: "The strategic transaction marks the next major step in AMD’s AI strategy to deliver leadership AI training and inferencing solutions based on innovating across silicon, software and systems. ZT Systems’ extensive experience designing and optimizing cloud computing solutions will also help cloud and enterprise customers significantly accelerate the deployment of AMD-powered AI infrastructure at scale.”

AMD has agreed to acquire ZT Systems in a cash and stock transaction valued at $4.9 billion, inclusive of a contingent payment of up to $400 million based on certain post-closing milestones. AMD expects the transaction to be accretive on a non-GAAP basis by the end of 2025."

This is a big move for AMD, and this naturally puts pressure on Nvidia to keep performance sky high if they intend to maintain the stranglehold they have on the sector as of now.

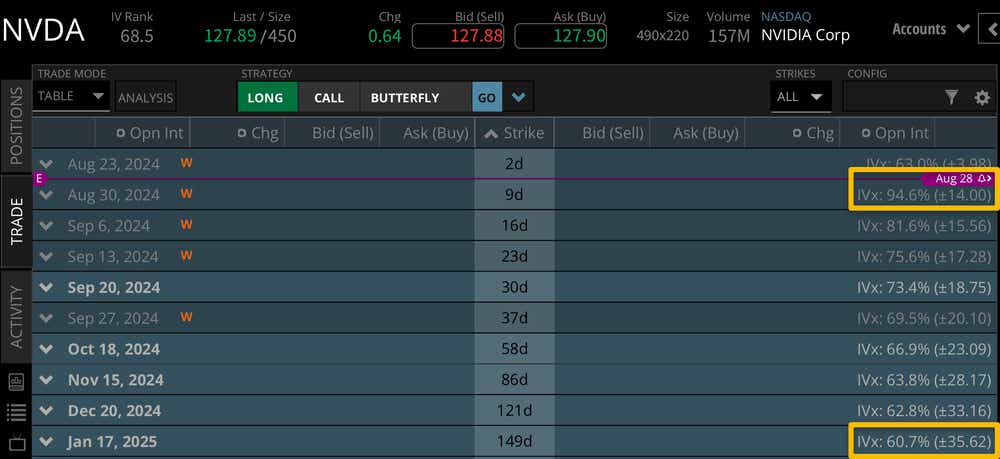

Looking to the options market can help us put context around expected stock price moves for earnings reports. Implied volatility gives us an idea of what range we can expect for the stock price after adjusting for time to expiration for the options contracts.

Through next week, NVDA stock has a +/- $14.00 stock price expected range. Given that the stock currently sits around $128 per share, the range exceeds 10% of the current notional value of the stock. This is on the higher-end of the range for earnings expected moves, which typically land between 5-10% of the stock price.

NVDA reached the all-time high price of $140.76 on June 20, which could easily be exceeded based on the current implied volatility around the earnings report. This is especially true if the realized stock price move exceeds the range to the upside.

Looking further to the Jan 2025 options cycle, we can see a +-$35.62 expected stock price move. Considering the fact that next week's implied volatility makes up almost 40% of the expected range through the rest of the year and then some, there is plenty of hype and uncertainty around NVIDIA's earnings report on Aug 28 after the stock market closes.

Bullish on Nvidia for Earnings

If you're bullish on NVIDIA earnings, you're expecting another stellar quarterly performance from the chip giant, with plenty of positive sentiment from the executive team for the rest of the year.

Addressing efficiency improvements and strong demand will be a key factor for continued positive momentum in the stock price. If NVDA stock exceeds the expected move to the upside after the earnings report, we will have a new all time high in NVDA stock overnight.

Bearish on Nvidia for earnings

If you're a bearish NVDA stock trader, you're certainly looking for an earnings miss and weak guidance. The fact that competitors are making big strides in isolation could worry NVDA investors and create some selling pressure if there is any weakness in the report.

It's not uncommon to see a company post a strong earnings report and have the stock sell off either—this is especially likely for high-flying tech stocks that have already seen massive gains over the years. We've seen this happen in Netflix (NFLX), Google (GOOGL) and many more just this year alone. If NVIDIA exceeds the earnings expected move to the downside, we may see the stock price retreat below July highs.

Tune in to Options Trading Concepts Live at 11 a.m. CDT on Aug. 28 ahead of NVIDIA earnings after the bell!

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.