30-Second, Post-Election Review

30-Second, Post-Election Review

Trump boosts Bitcoin to record highs, and AI does the same for Nvidia

If you don't follow the market every day, it is nice to get a review.

After the U.S. election, the S&P 500 ticked up.

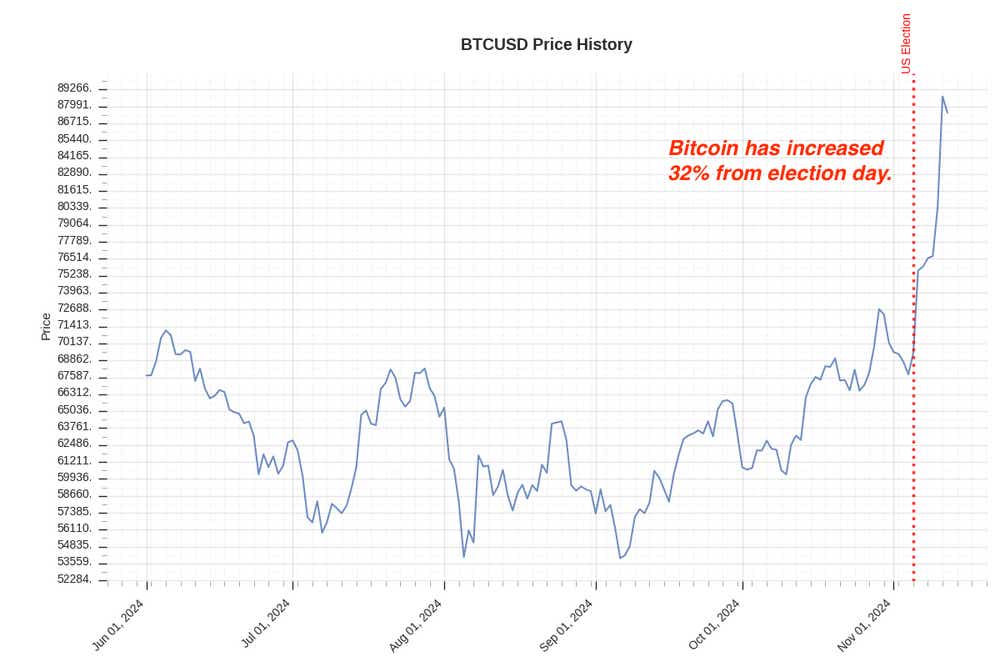

With a Trump Administration expected to be more favorable toward crypto, has rallied to a record-shattering high near $92,000.n n

We covered crypto seasonality in last week's Cherry Picks. We discussed November crypto seasonality and showed how historically, that month can be extremely favorable for Crypto.

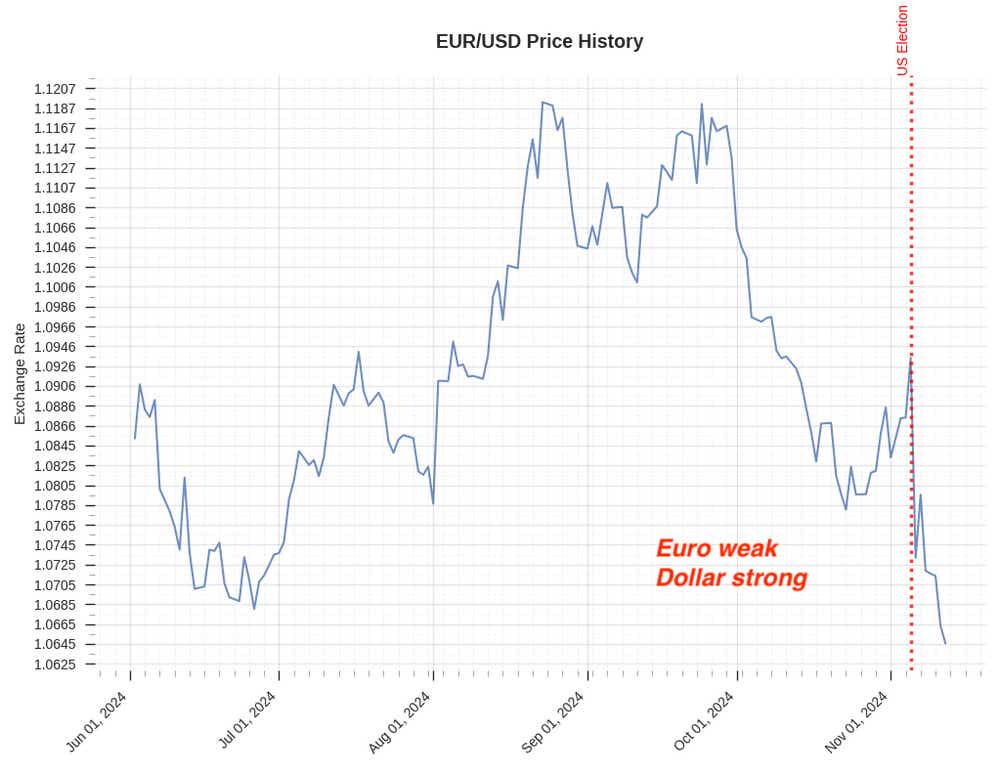

Meanwhile, the EUR/USD currency pair continued its decline, indicating a strengthening U.S. dollar relative to the euro.

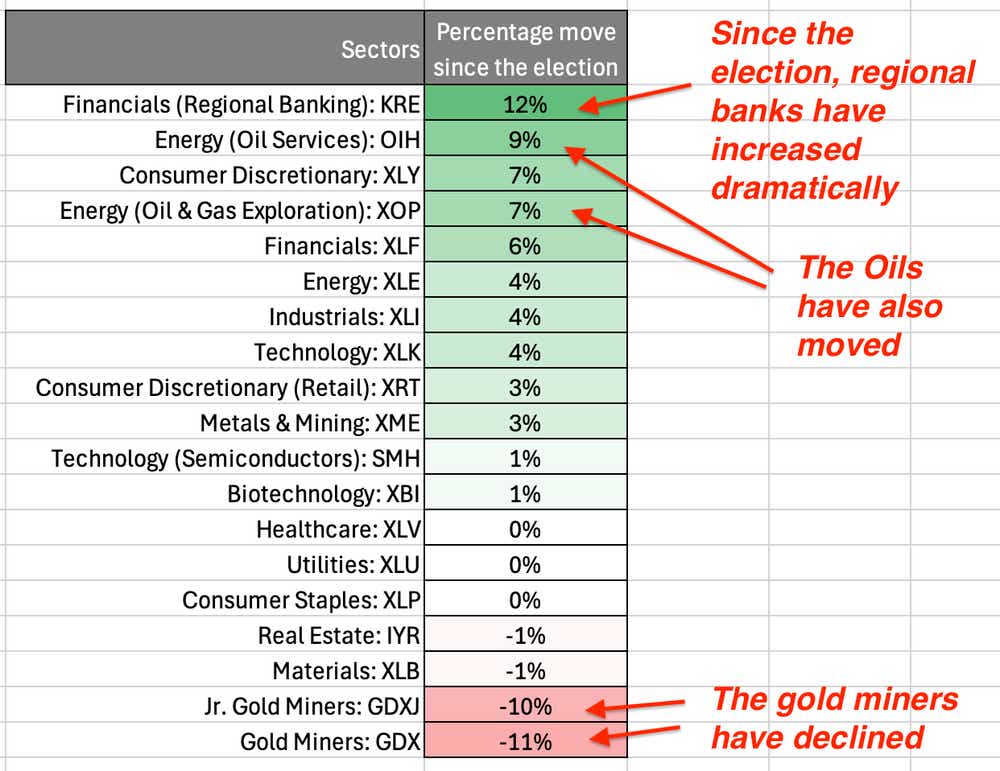

The stock Sectors that have moved the most since the election:

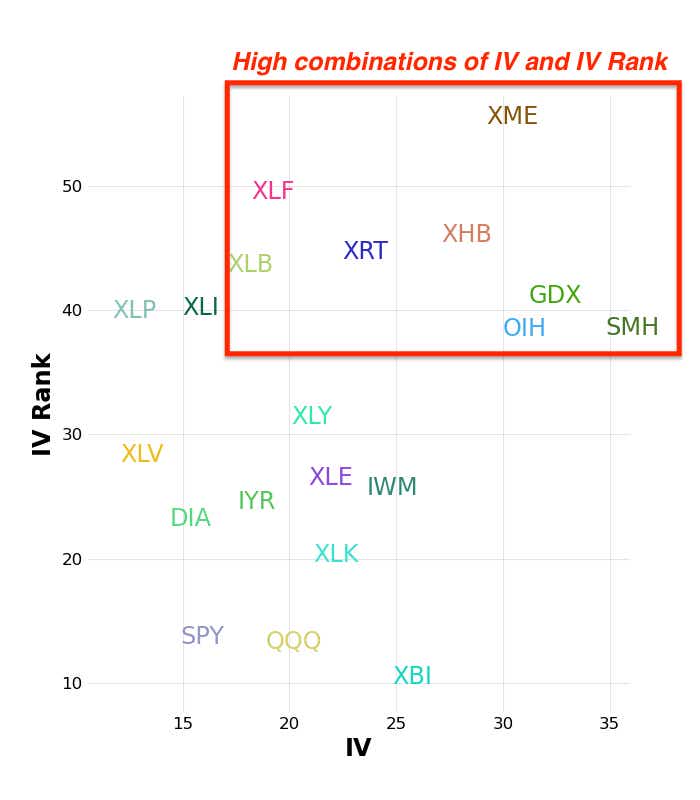

Where's the Volatility?

The following exchange-traded funds (ETFs) currently have relatively high volatilities. Below we've listed the ETFs from most volatile (SMH) to least (XLB).

SMH - Semiconductor ETF

GDX - Gold Miners ETF

OIH - Oil Services ETF

XME - Metals & Mining ETF

XHB - Homebuilders ETF

XRT - Retail ETF

XLF - Financial Select Sector SPDR Fund

XLB - Materials Select Sector SPDR Fund

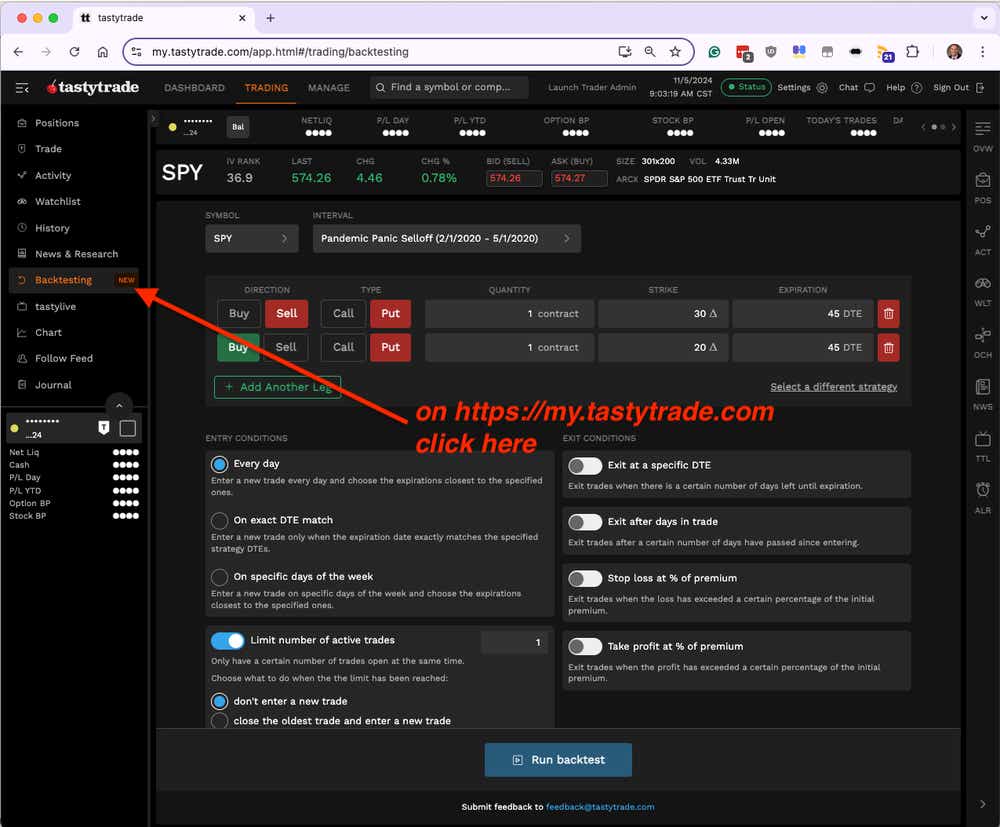

Baby Got Back(test)

The tutorial can be found here.

Two Trade Ideas

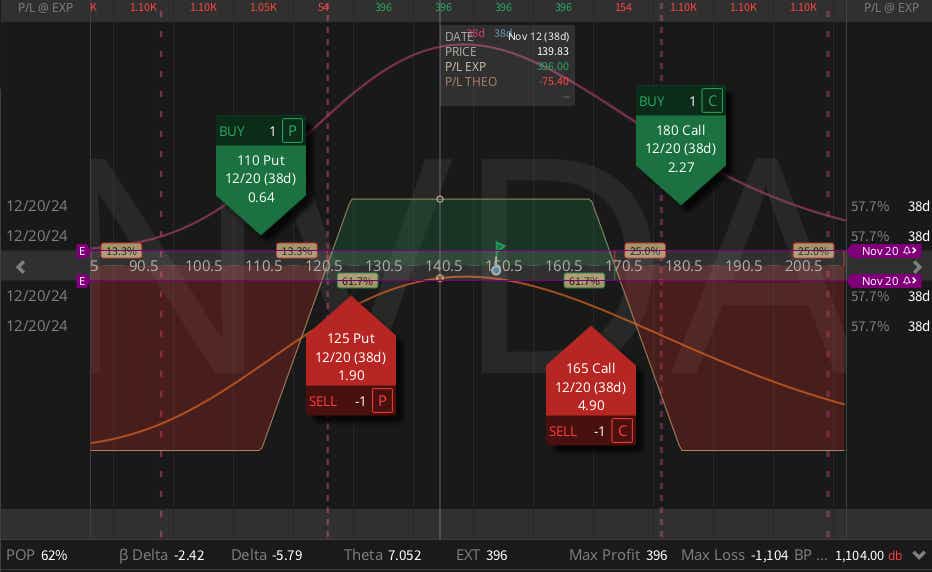

NVDA ($149) iron condor (DEC) $3.96 Credit

NVDA is the last of the Mag 7 stocks to report earnings, coming on Nov. 20 after the close. The stock is at all-time highs and vol has continued to expand. If you think it might be a bit overdone here, or at least maybe time for some chop, try an iron condor in DEC. Short the 125/110 put spread and the 165/185 call spread trades at around $3.96 with a 62% probability of profit.

UVXY ($20) ZEBRA (NOV29) $3.26 Debit

Volatility has come down to near lows, with the VIX sitting below 15. We've gotten the election out of the way, monitored rate cuts, and analyzed most of the earnings reports. With Santa on the way, what could possibly go wrong? If you think maybe there is some mean reversion in volatility in the near term, a ZEBRA trade is a cheap synthetic stock position. In this case, go long 2x the 19s and short 1x the 21 in the 17 DTE to capitalize on a little bit of volatility into the end of the month.

Sharing is caring. Forward this email to your friends so they can subscribe to our newsletters, too! Get weekly data-driven trade ideas with Cherry Picks and daily pre-market insights and trade ideas with Cherry Bomb.

Michael Rechenthin, Ph.D., (aka “Dr. Data”), managing director of research and development, has 25 years of trading and markets experience. He’s best known for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex and macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.