The Moment of Truth for Stock Markets

The Moment of Truth for Stock Markets

By:Ilya Spivak

How stocks respond to economic data is in flux just as U.S. jobs data looms

- June’s U.S. employment data is in the spotlight as markets weigh Fed outlook.

- If recent patterns hold, stocks may cheer upbeat data or wilt on weakness.

- However, the data night yet bring back “good=bad” price action patterns.

A sense of occasion accompanies the release of June’s U.S. employment statistics.

The monthly publication already commands considerable attention from financial markets, pivotal as it is for gauging the health of the most singularly impactful consumer market for global economic growth. This time, it will also mark the first bit of truly top-tier economic data after an almost month-long deluge of hawkish posturing from the Federal Reserve.

Fed Chair Jerome Powell took the lead, trying to appear stern even as he announced that the U.S. central bank opted to hold fire at the Federal Open Market Committee (FOMC) meeting held mid-June after consecutive rate hikes at the preceding 10 gatherings. The message remained forceful as Powell sat for semi-annual testimony in Congress the very next week. He was at it again the following week, this time at the annual European Central Bank (ECB) Forum on Central Banking in Sintra, Portugal.

Minutes from June’s conclave released this week summarize policymakers’ disposition nicely. While “almost all” officials saw pausing the tightening cycle as “appropriate or acceptable,” “some” favored a hike but agreed to go along with a wait-and-see approach. A commanding majority of the group remained keenly focused on reducing still-too-high inflation and expected more rate hikes in 2023.

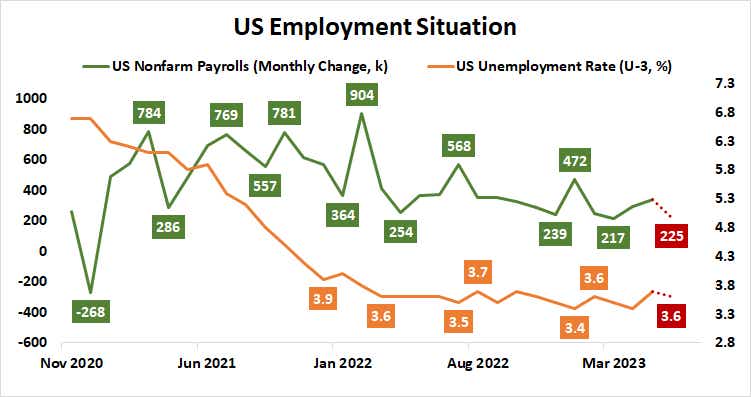

Against this backdrop, June’s labor-market data drop is expected to show a 225,000 rise in non-farm payrolls, the smallest increase in three months. Nevertheless, the jobless rate is seen ticking lower from 3.7% to 3.6%. Average hourly earnings—a measure of wage inflation—is seen easing back from 4.3% to 4.2% year-on-year. Absent a wild surprise on one of these key metrics, the results seem unlikely to meaningfully alter the Fed’s tune.

Stocks have shrugged off four months of hawkish Fed repricing

With this in mind, price action after the numbers cross the wires may prove telling.

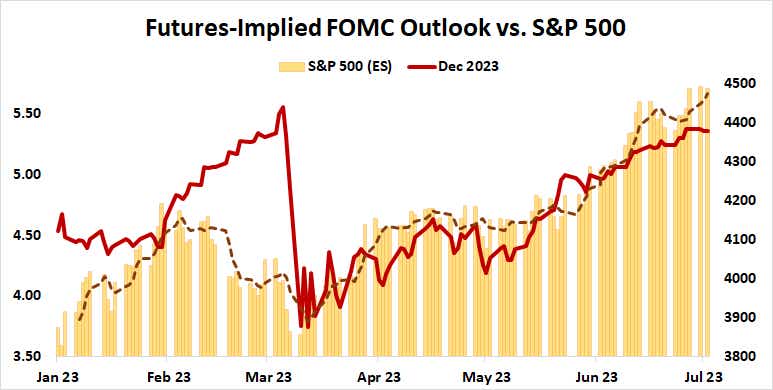

Stocks have managed to rally alongside a steady hawkish shift in the priced-on Fed policy outlook since mid-March. That has amounted to the near-total unwinding of the panicked dovish lurch suffered amid the SVB-led banking crisis. What’s more, measures of credit stress dropped to the lowest yet this year, even as late-2023 rate cut hopes evaporated.

If these dynamics hold, a solid set of jobs figures might be welcomed on Wall Street even as yields rise. Alternatively, a soggy outing might spur worries about flagging economic growth at a time when the Fed has all-but promised more tightening, stoking recession fears.

Resetting market reaction expectations after SVB banking crisis, U.S. debt ceiling mess

An alternate framework for interpreting the numbers might suggest price action over the past four months has amounted to little more than a kind of reset.

With the banking crisis pushed off to the background and the U.S. debt ceiling standoff paused until after the 2024 election cycle, the priced-in policy outlook has recovered the ground it lost when panic peaked. It has not made new ground. The year-end rate implied in Fed Funds futures remains below the March high, even if only slightly so.

Upbeat jobs data that translates to a truly higher high on 2023 Fed Funds expectations may bring back over-tightening fears, much as it did in February. That might see stocks decline on seemingly supportive figures. On the other hand, soft outcomes might be welcomed in that they might limit the Fed to the added action that is already priced in. Markets see the rate hike cycle topping after one more 25-basis-point increase no later than September.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.