The New Retail Trader: Bullish Tech Enthusiasts Navigating Market Uncertainty

The New Retail Trader: Bullish Tech Enthusiasts Navigating Market Uncertainty

By:Ed McKinley

Active investors recognize the possibility of bubbles—but remain invested

Today’s typical active retail trader—most likely a middle-income, middle-aged male—is fascinated with technology stocks and remains stubbornly optimistic despite recognizing potential market bubbles.

That’s the upshot from a comprehensive survey of this fairly diverse group conducted just a few days ago of by tastytrade and Nasdaq.

In terms of investable assets, the distribution of annual household income shows 38% of the survey's participants earning under $75,000, 34% between $75,000-$125,000 and 27% above $125,000.

Those figures show you don’t have to be rich to become an active investor. Nearly half (47%) of respondents have investable assets of less than $100,000, suggesting technological changes have democratized access to the markets.

Optimism despite political transitions

The survey, conducted in late January 2025 with 1,036 U.S. active retail traders, tapped into a rich vein of bullish sentiment. A solid 59% of respondents professed optimism about the markets’ performance over the next 12 months. About 10% categorized themselves as "very bullish" and 49% as "moderately bullish." Only 26% took a bearish stance, with a mere 2% identifying as "very bearish."

But the optimism appears much stronger among males than females. The guys traders, who represent 76% of respondents, displayed considerably more confidence (63% bullish) than their female counterparts (48% bullish). The 15-point gap suggests different risk assessments or varying levels of confidence in the economy.

Gender aside, the survey shows retail investing remains skewed toward older, more established investors, with 43% aged 35-54 and 36% over 55. However, the 21% of respondents in the 18-34 age bracket demonstrate markedly different investment patterns that may signal future trends.

Tech dominance and the Mag 7

Information technology stands as the undisputed favorite sector among retail traders, with 75% of them feeling good about it. Communication services (68%) and energy (67%) follow close behind, while real estate lags significantly, earning an optimistic rating from just 46% of respondents.

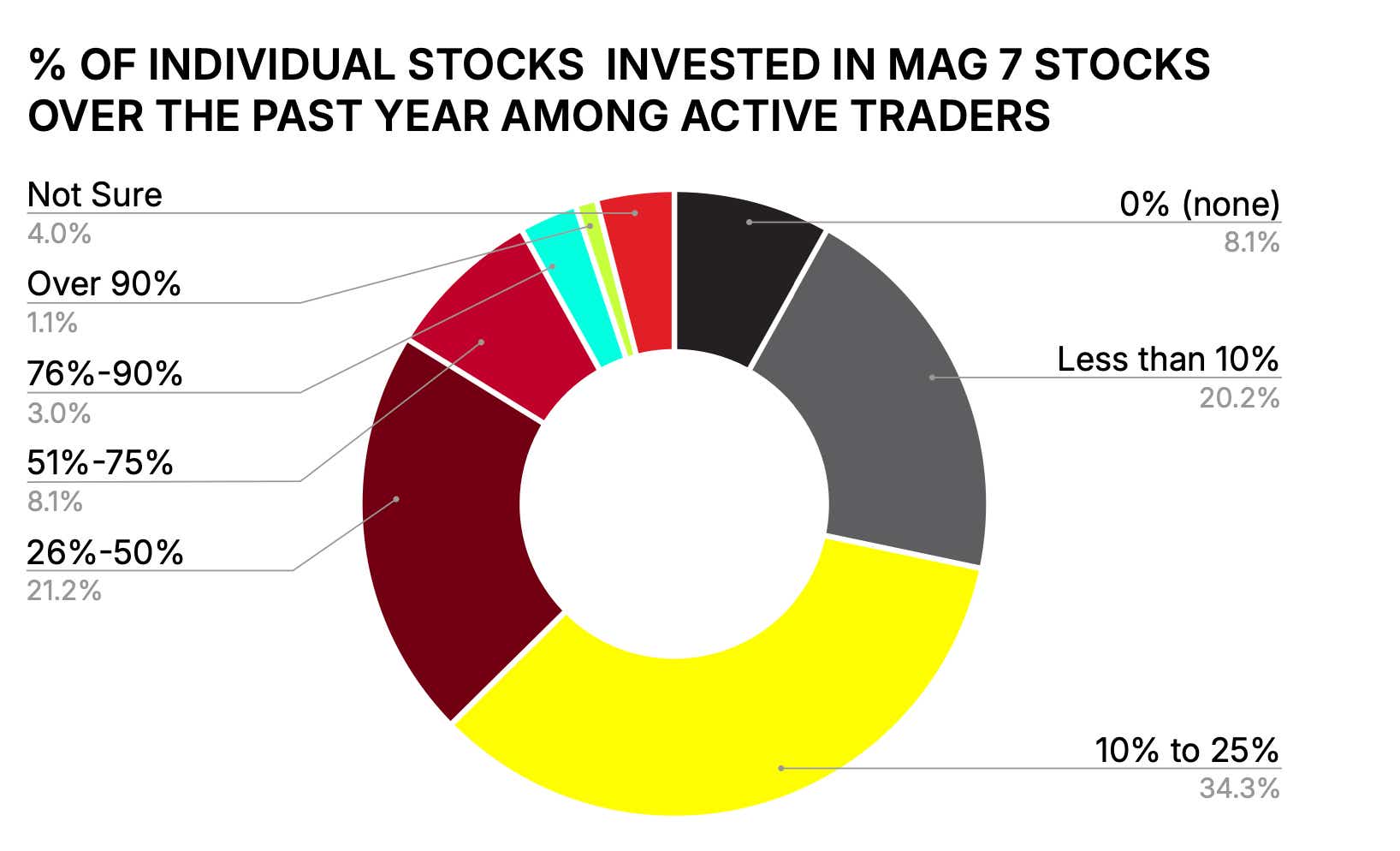

The survey highlights a continuing connection with the "Magnificent Seven" tech giants—Apple (AAPL), Microsoft (MSFT), Alphabet (GOOG), Amazon (AMZN), Nvidia (NVDA), Meta (META) and Tesla (TSLA). These companies represented 23% of the respondents’ stock investments over the past year. Traders aged 18-34 allocated nearly a third (32%) of their individual stock investments to these companies, compared to 27% for the 35-54 bracket and just 19% for those over 55.

Respondents had their own reasons for their interest in these tech behemoths. One trader mentioned Nvidia's promising outlook in AI and chips. Another cited Tesla's boundary-pushing approach to electric vehicles, acknowledging both the risk and "big upside potential." A third expressed concern about Apple's vulnerability to China-related tariffs despite its historical performance.

Youthful enthusiasm for cryptocurrency

The generational divide over cryptocurrency was striking. Among traders aged 18-34, a staggering 75% actively trade cryptocurrencies, with 93% having engaged with crypto at some point. That stands in sharp contrast to the over-55 demographic, where only 22% actively trade crypto and merely 38% have ever participated in the market.

The middle bracket (ages 35-54) appears to bridge this divide, with 51% actively trading crypto and 76% having some experience with it. These numbers illustrate a profound shift in investment approaches across generations, with younger traders embracing digital assets.

Respondents offered revealing commentary on their cryptocurrency involvement. One described seeing "an amazing opportunity where most people don't," while another characterized the appeal as "unlimited potential in a never-saturated market." A third admitted to routinely investing small amounts in newly launched cryptocurrencies, driven by "the thrill of seeing what is the next Bitcoin."

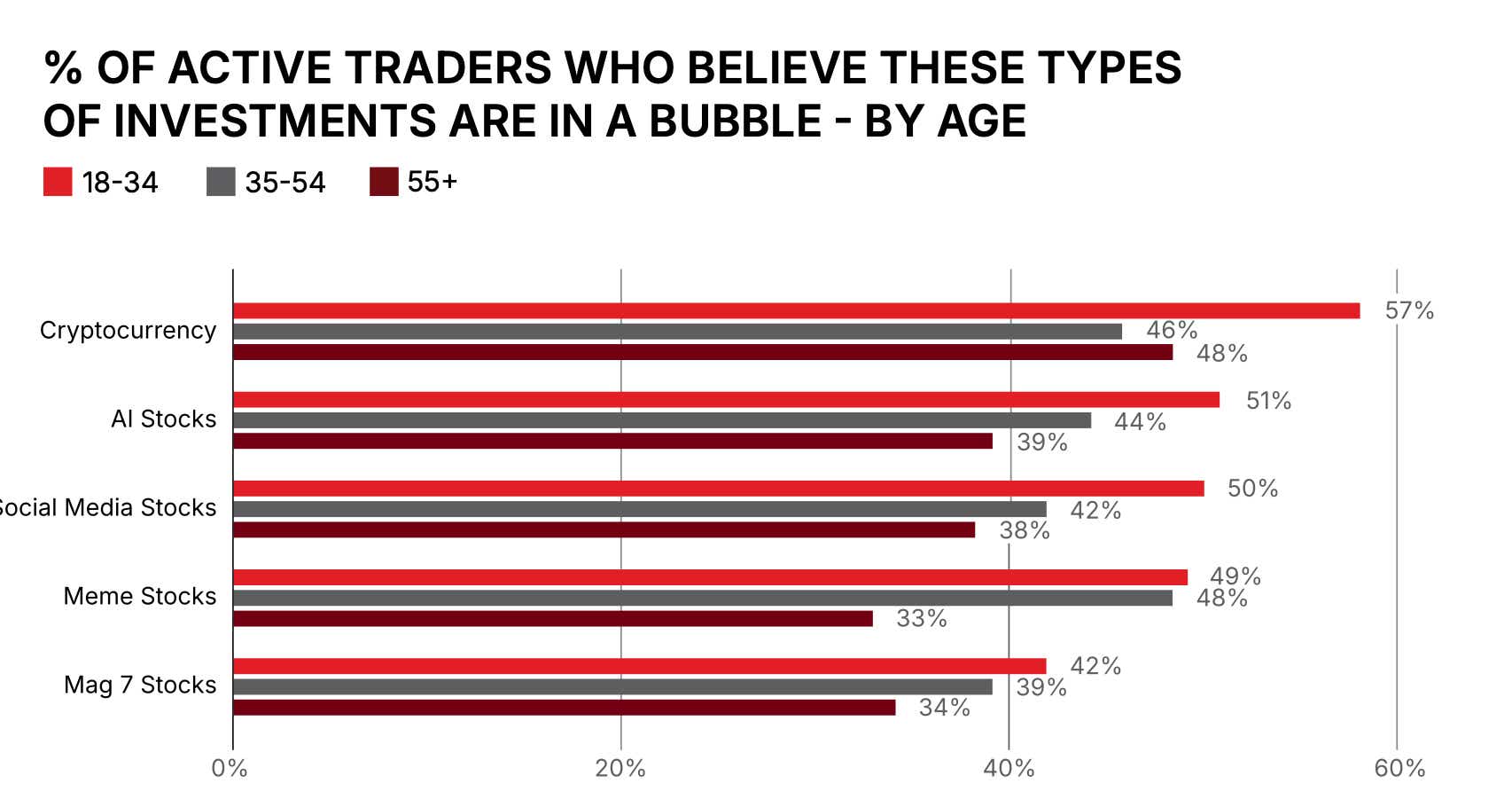

Yet paradoxically, these same young traders who most eagerly embrace cryptocurrency are also the most likely to believe it exists in a bubble. Over half of traders aged 18-34 consider cryptocurrency, AI stocks and social media stocks to be in bubble territory—significantly higher percentages than among older investors. Traders under 55 are also much more likely than their elders to view meme stocks as overvalued.

This cognitive dissonance—investing heavily in assets one believes may be fundamentally overvalued—suggests complex motivation beyond traditional value investing. One respondent noted cryptocurrency "can be booming one second and then drop the next," while another bluntly described it as "very speculative."

Product preferences vary by age

The survey reveals stocks and equities remain the most exciting financial products for all age groups (86% overall), but significant differences emerge in enthusiasm for other investment vehicles. Cryptocurrency ranks as the second-most exciting product for investors aged 18-54, with substantially higher interest among younger traders.

Traders under 55 show significantly greater interest than older investors in options, indices, futures, Forex and exchange-traded funds (ETFs). Interest in fixed-income products remains relatively consistent across age groups at 21%, suggesting traditional, lower-risk investments hold similar appeal regardless of age.

The modern retail trader

A nuanced portrait of the American retail trader in 2025 emerges from the survey. They’re predominantly male, cautiously optimistic about markets despite political transitions and heavily focused on technology stocks. Younger traders drive interest in alternative investments, particularly cryptocurrency, despite harboring concern about potential overvaluation.

These traders appear to blend traditional approaches to investing with more speculative strategies. One respondent described meme stocks as "fun to look at all the while they are decently priced," suggesting an awareness of both entertainment value and underlying fundamentals.

The survey reveals a base of market participant who recognize potential bubbles but nonetheless remain engaged. This suggests modern retail traders may combine long-term investing, short-term speculation and even entertainment value—a complex mixture of motivation that defies simple characterization.

Implications for market dynamics

The high bullishness among retail traders may contribute to continued market resilience in 2025, especially in technology. The concentration in Magnificent Seven stocks suggests these companies may continue receiving outsized retail support, potentially maintaining their market dominance.

Cryptocurrency's strong popularity among younger investors shows it has become a permanent fixture in investing, despite considerable volatility. As younger traders inherit and accumulate more wealth, their comfort with digital assets may shift broader market allocations.

The significant number of investors who recognize potential market bubbles while remaining invested suggests a "ride the wave" mentality that could amplify both upswings and eventual corrections. That challenges the stability of the markets because participants may be poised to exit positions quickly if they themselves already recognize them as potentially overvalued.

A market in transition

This tastytrade and Nasdaq survey captures a retail investment community in transition. Traditional demographics and investment focuses blend with emerging trends driven by younger participants with differing priorities and risk assessments.

Despite a new presidential administration, retail investors remain confident in their prospects for 2025. They continue to gravitate toward technology investments while showing awareness of potential overvaluation. Cryptocurrency has established itself as a mainstream asset class among younger investors, despite—or perhaps because of—its volatility.

As these trends evolve, markets may experience the stabilizing effects of broad-based optimism and the potential volatility that comes from concentration in assets widely recognized as possibly overvalued. The modern retail trader appears to be navigating this contradiction with a blend of enthusiasm, caution and a distinctly contemporary approach to risk that differs markedly from previous generations.

Ed McKinley is Luckbox editor-in-chief.

About the survey: Nasdaq and tastytrade surveyed active retail investors to understand their investment outlook for 2025. This is the first in a series of studies. Researchers polled 1,036 U.S. active retail traders from Jan. 27 to 28, 2025, in conjunction with Dr. Michele Madansky. Active retail traders are defined as adults 18+ who trade stocks or equities every three months or more frequently, and have over $1,000 in investable assets.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.