A New Look at Crude Oil

A New Look at Crude Oil

Crude prices are poised for gains as supply/demand imbalances surface as OPEC cuts production

- WTI crude oil (/CL) fell about 1% on Thursday.

- Supply/demand signals suggest more upside.

- U.S. supply gains tempered by OPEC production.

- The technical outlook shows likely profit taking.

WTI crude oil futures (/CL) are trading about 2% lower through Thursday midday U.S. trading after traders analyzed data from the Organization of the Petroleum Exporting Countries (OPEC) that showed a significant decrease in the cartel's output.

OPEC and its de facto leader, Saudi Arabia, previously announced production cuts that would extend into September, but there was skepticism that those cuts would not be fully delivered.

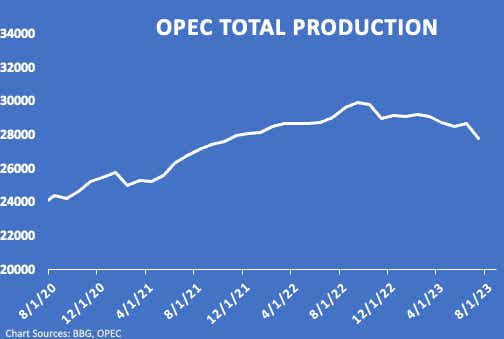

According to the OPEC Monthly Oil Market Report, released on Thursday, OPEC is acting. Total oil production dropped in July by 836 thousand barrels per day (tb/d) from June, averaging 27.31 million barrels per day (mb/d). Riyadh played a significant role in driving this decrease.

This supply drop is concerning, considering the globally resilient economy. Despite China starting to show some cracks, there is an expectation that oil demand will surpass supply. OPEC predicts demand for its oil to reach 29.3 mb/d through 2023 and 30.1 mb/d in 2024.This leaves a market deficit and if we follow the simple law of supply and demand, we can expect prices to rise—assuming we avoid a global recession.

Will the United States Save the day?

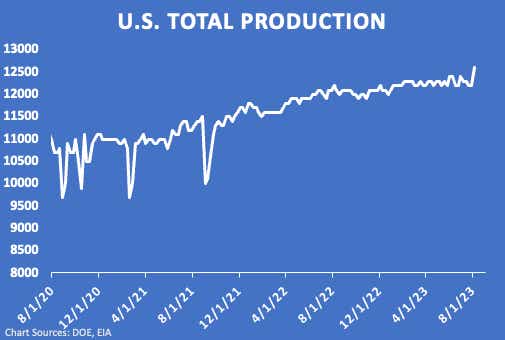

U.S. oil production surged to 12.6 million barrels per day (mb/d) for the week ending August 4, according to data from the Energy Information Administration (EIA). This marked the largest weekly increase in domestic crude production since September 2021, with a gain of 400,000 barrels per day (bpd).

It is expected that these production gains will continue. The EIA anticipates a further rise of 160,000 bpd in U.S. production, reaching a new record high of 12.76 mb/d. By 2024, the EIA projects production to reach 13.09 mb/d. Considering the law of supply and demand, these trends suggest that prices should increase.

Despite the recent increase in production capacity in the U.S., domestic stockpiles have come under significant pressure. While the U.S. added approximately 5.8 million barrels to its stocks for the most recent week, last week's record-breaking draw of 17 million barrels shocked the markets.

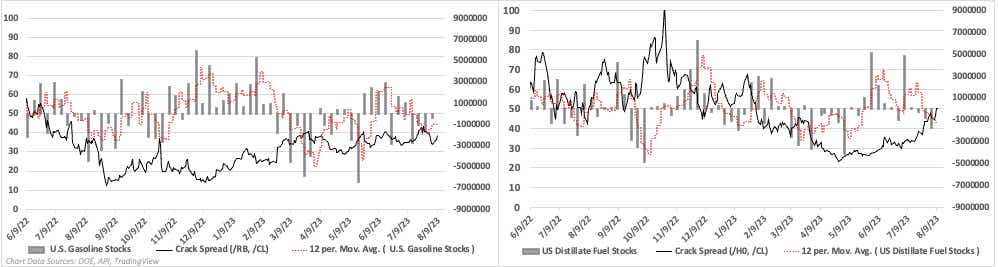

Furthermore, fuel inventories continue to be strained. On August 4, gasoline and distillate stocks fell by 2.6 million barrels and 1.7 million barrels, respectively. Despite some healthy builds earlier this summer, fuel inventories have been declining on average. This can be observed in the charts below.

Crack spreads between crude oil and gasoline and distillates have increased, leading to higher crack spreads. These spreads represent the theoretical profit made by a refiner in the process of buying oil and converting it into fuel for sale to end users. This has recently sparked a rally in the S&P 500 energy sector (XLE), as well as in single-name refiners, as evidenced by the rise in the CRAK ETF.

That said, investors who are bullish on oil markets have numerous opportunities to participate in the market at present, whether through futures, single-name stocks, or exchange-traded funds.

WTI crude oil technical outlook

Prices cleared the April swing high this week, breaking into fresh highs for 2023. That said, it’s reasonable to assume that today’s weakness is being driven by some profit taking rather than a fundamentally driven selloff.

Other technical signals, such as the recent crossover between the 50- and 100-day Simple Moving Averages bode well for bulls. The next levels of potential resistance could present at the 78.6% Fibonacci retracement from the November 2022 to May 2023 range. Beyond that, bulls would look to dispatch the 90 psychological level.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.