Natural Gas Traders Brace for Volatility

Natural Gas Traders Brace for Volatility

Natural gas prices rise as labor disputes cause frenzy over supply

- Natural gas prices rose amid a volatile week of trading.

- Warmer U.S. weather and Australian labor disputes are in focus.

- The technical outlook remains tilted to the upside.

U.S. natural gas (/NG) rose about 1% through mid-day trading as an ongoing labor dispute in Australia lingers over the liquified natural gas market. So far, there is no official strike among workers at key LNG terminals throughout Australia, but the threat of such walk-offs has caused hoarding behavior among importers and mid-stream companies.

The market should gain more clarity over the coming weeks, with talks between labor leaders and Woodside taking place on Aug. 23. The following day, workers for Chevron’s (CVX) Gorgon and Wheatstone facilities will face a ballot deadline, which, if approved, would authorize a strike that threatens to severely limit exports from those facilities. Those flows usually go to Japan, but without them, Tokyo would start competing more with Europe, which could bolster prices there.

Another action, on Sept. 8, marks the last date that workers could act at Woodside Energy's (WDS) North West Shelf project. These actions potentially threaten up to 10% of global LNG exports. Until then, we can expect volatility in the market to continue due to hoarding behaviors and overall uncertainty.

U.S. weather outlook worsens at a bad time

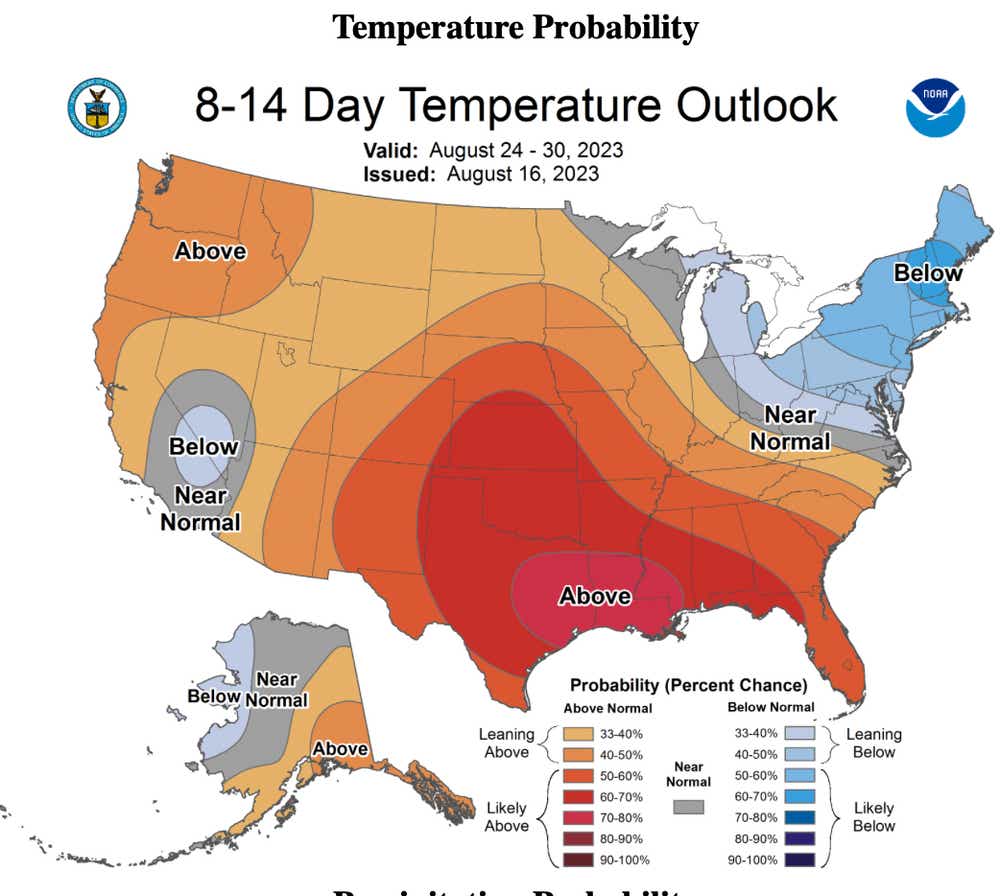

The U.S. weather outlook shows that hotter-than-average temperatures should blanket much of the continental U.S., except the Northeast, which is a welcome reprieve for the densely populated area. This outlook would come after an already-hotter summer.

On Thursday, the Energy Information Administration (EIA) published weekly storage figures on natural gas stockpiles, showing that gas in underground storage increased by 35 billion cubic feet (Bcf). That was slightly less than the 34 Bcf consensus forecast and 6 Bcf above last week’s build.

While an above-consensus print is welcome for bears, it was hardly enough to have a notable impact on price action. However, European storage is well on pace to hit the bloc’s 90% storage target, and gas is being injected into Ukrainian caverns, further easing supply concerns. If Australian labor disputes fade, we may see a decent drop in prices for European gas, which would also drag U.S. gas prices lower.

Natural gas technical outlook

Natural gas prices are tracking above the 50-day and 100-day Simple Moving Averages, which just recently completed a bullish crossover. Volatility, as expressed by the average true range (ATR), shows an elevation from levels seen earlier this month.

For now, with prices above those moving averages, the technical bias is toward the bullish side, but traders should remain cautious and opt toward trading strategies that capitalize on volatility.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.