Natural Gas Prices Rise Amidst Sweltering Heat Dome

Natural Gas Prices Rise Amidst Sweltering Heat Dome

Heat and storage figures support the bull case for energy prices

- U.S. natural gas prices rise amid extreme heat, inventory draw.

- European gas prices collapse after Australian workers strike deal.

- The technical outlook is unconvincing, but you should expect volatility to continue.

U.S. natural gas prices (/NG) surged higher on Thursday afternoon following the release of the Energy Information Administration's (EIA) weekly inventory figures for the week ending August 18. The report revealed an 18 billion cubic feet (bcf) build, significantly missing the 33 bcf consensus estimate and falling short of the previous week’s 35 bcf increase.

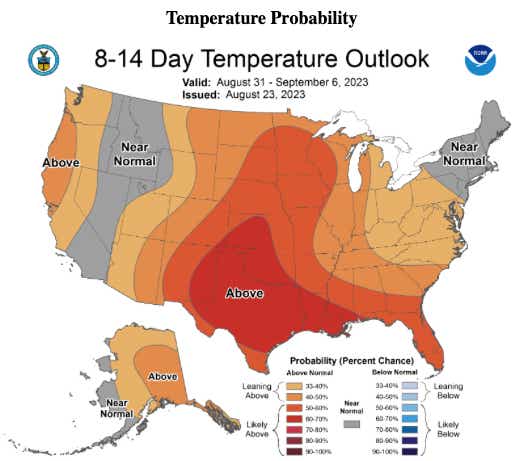

The market's reaction to the smaller-than-expected build is not surprising, even amidst falling equity and crude oil prices on Wall Street. A brutal heat dome is currently causing record and near-record temperatures across much of the Midwest and the South. Although some short-term relief is expected for the Midwest, the eight- to 14-day temperature outlook indicates high temperatures should return soon. This is likely to stave off bearish price action for the time being.

European prices collapse as Australian supply woes clear

European prices, as per Dutch Title Transfer Facility (TTF) futures, dipped nearly 14% overnight following the news that workers at Australia's largest liquified natural gas (LNG) facility have reached a preliminary agreement with Woodside Energy (WPL.AX) after a prolonged stretch of anxiety over a deal. This development is likely to prevent a significant supply shock. The union members have already cast their votes to finalize the deal, although the results have not been publicly disclosed yet.

Australia exports its LNG primarily to Japan and other Asian countries, with only a minimal number of cargoes destined for the U.S. A slowdown in Australian LNG exports due to a strike could have caused Japan to compete for U.S. cargoes, on which Europe has been heavily dependent. With the threat now eliminated, much of the risk premium has evaporated from the market. U.S. exports are expected to continue operating near capacity, while intense heat maintains domestic demand.

Natural gas technical outlook

/NG’s position has weakened over the past couple of weeks after falling below its 50- and 100-day Simple Moving Averages (SMAs). However, when looking at the chart, those SMAs haven’t stopped volatile price action from whipsawing around them.

Given that prices are near the lower end of the trading range seen over the past few months, traders may feel slightly inclined to take a long position at the current levels. Despite a low IV Rank (IVR) at 18.8%, there is still plenty of premium for those who would like to take the long side with a short put or short put vertical.

![[NG chart]](https://images.contentstack.io/v3/assets/blt40263f25ec36953f/bltd5829b992784cde1/64e7ae1daa596eedcb81a4cc/natgas_chart.png?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.