Hot Takes: Natural gas Prices Rise Alongside Mercury Reading

Hot Takes: Natural gas Prices Rise Alongside Mercury Reading

Natural gas prices set to close out June with gains.

- Natural gas prices (/NG) reverse losses after EIA releases inventory figures.

- Warm weather patterns set up prices for another bullish month.

- Technical strength remains in /NG chart despite some obstacles.

U.S. natural gas futures (/NG) ended the day slightly higher on Thursday, with front-month prices—currently the July month—gaining 21 cents to $2.701 per million British thermal units (mmBtu).

Despite today’s price action, /NG prices are down about 1.5% this week as of Thursday afternoon. Unless we get a follow-up move Friday to finish the week, it will be the first weekly decline in U.S. natural gas since May.

But even with the weekly decline, /NG is on track to close June out with a gain of nearly 20%, which should mark the biggest monthly percentage increase since July 2022, when prices surged 51.7%

Why is natural gas rising?

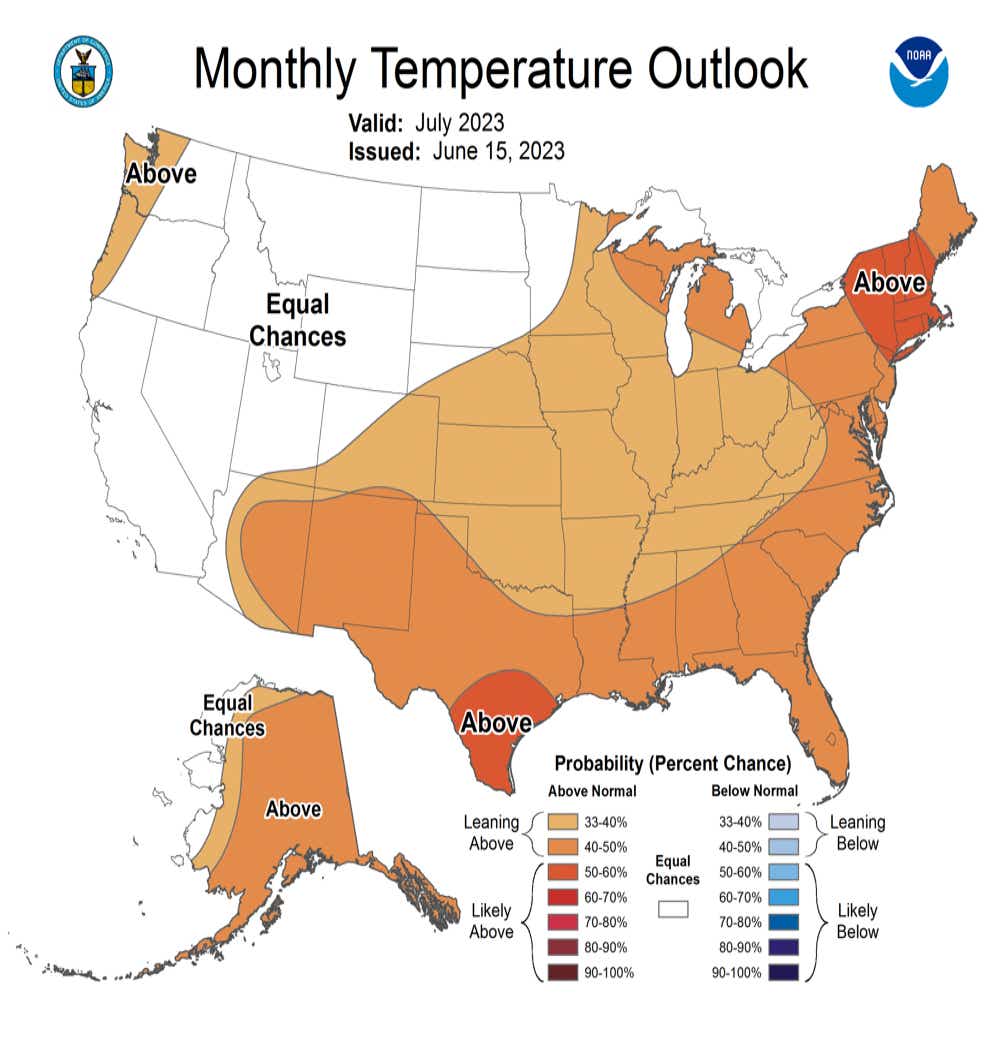

It’s been an extremely hot and dry June across much of the United States, which increases cooling demand days (i.e., higher energy demand) as people turn down their thermostats. The dryness also reduces hydroelectricity production, although better-than-average snowpacks from winter across the Rocky Mountains and the Sierra Nevada have countered much of that typical impact.

Is any respite from hot mercury readings in sight? Don’t bet on it. According to the National Weather Service (NWS), July is the hottest U.S. month on average for a large portion of the country. That means more energy consumption is in the forecast.

Natural gas inventory reflects higher demand from weather

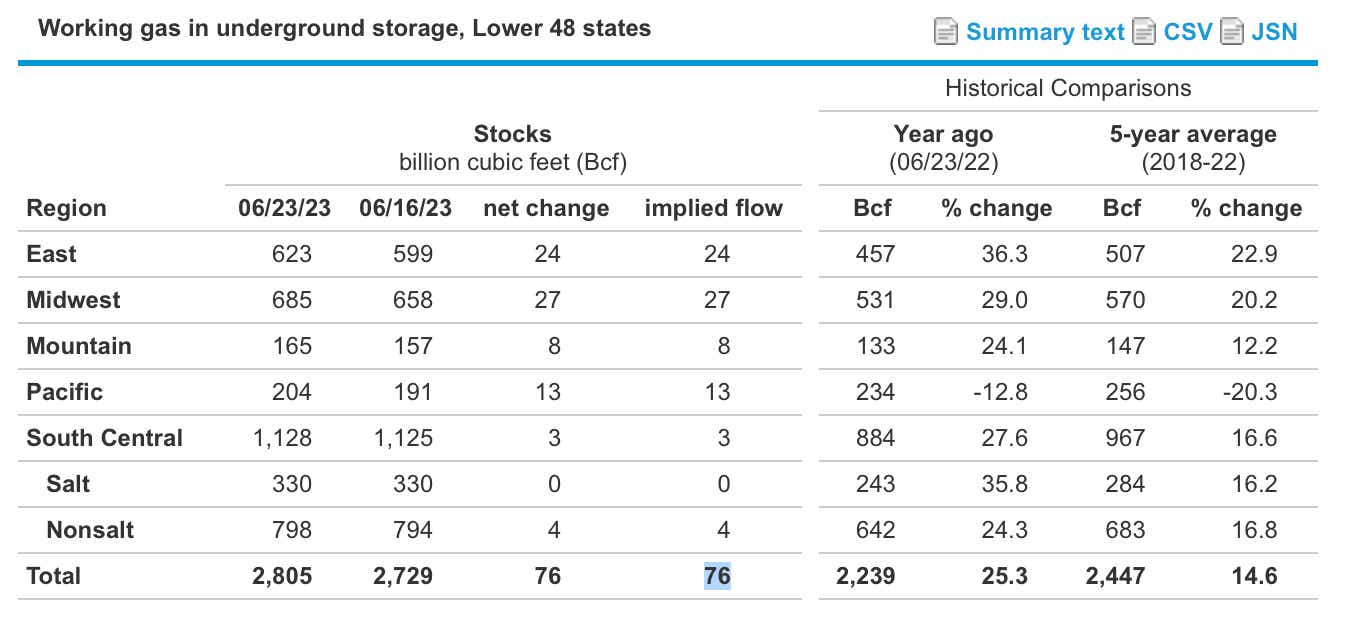

The Energy Information Administration (EIA) released its weekly natural gas report Thursday morning, which includes inventory figures. The report stated that working gas in storage rose by 76 billion cubic feet (Bcf) from the week prior, bringing the level to 2,805 Bfc.

Analysts expected a build of 82 Bcf following the prior week’s 95 Bcf increase. /NG prices were slightly negative before the report and then rose subsequently as energy traders digested the data.

While U.S. stockpiles remain well above the five-year historical range (2,447 Bcf), which should provide plenty of cushion ahead of the winter withdrawal season to quell a bullish move, the situation in Ukraine and Europe’s need for natural gas may exhaust inventories faster than normal this winter.

That said, if hotter-than-average temperatures persist throughout the rest of the summer in the U.S., it could set bulls up for a speculative run in the coming weeks and months. It is key for energy traders to keep a close eye—more so than usual—on weather and inventory reports.

Natural gas technical outlook

Despite the recent upside, /NG prices have only managed to retrace 38.2% of the move from the March high to the May low. The 100-day Simple Moving Average (SMA) and the pseudo 50% Fibonacci retracement level, as well as the 38.2% Fib, appear to have tempered bullish sentiment several times over the last week.

Still, June’s uptrend wouldn’t be exhausted until bears pushed prices below the 23.6% Fib, where some support was offered during mid-June. A clean break (daily close) above the 50% Fib could inspire additional upside on a technical basis.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.