Natural Gas Prices Pressured Amid Inventory Builds, Weather Modeling

Natural Gas Prices Pressured Amid Inventory Builds, Weather Modeling

Natural Gas Prices Resume Selloff on Monday as Warmer Weather Approaches

Natural gas futures were trading about 0.13 cents lower, or 6%, on Monday as traders digested updated weather models that see slightly warmer temperatures over the next eight to fourteen days, particularly in the Southeast United States.

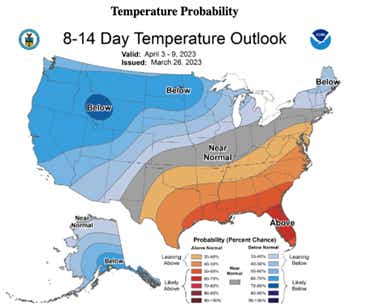

This puts U.S Henry Hub prices at a loss of nearly 25% for March, extending the selloff that preceded February’s price action when the commodity fell 35% and 40% in December and January. The chart below displays the NOAA’s 8–14-day temperature outlook.

Most of the demand will be driven by the Western U.S., where temps are expected to be cooler than average. That may keep prices from dropping much lower, but actual temperatures will dictate spot prices which heavily influence futures.

Traders Have Eyes on Upcoming EIA Report

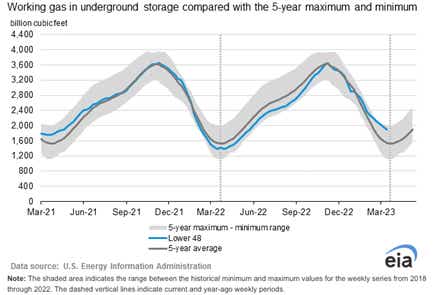

A warm winter in the U.S. allowed natural gas inventories to fall at a slower pace relative to historical averages, leading to a bearish trend in storage capacity over the winter withdrawal season. That also sets up prices for a bearish start to April, which marks the start of the 2023 injection season that runs through October. This is a period when injections outpace withdrawals, resulting in a net increase to stock levels.

According to the latest Weekly Natural Gas Storage Report from the Energy Information Administration (EIA), working gas in storage as of March 17 was 1,900 billion cubic feet (Bcf), which represents a 504 Bcf increase from the same period last year and 351 Bcf higher than the historical five-year average. The EIA’s next storage update for the week ending March 23 is due on Thursday. That report, combined with the April contract settling on Wednesday, brings the chance for additional volatility.

Chart Indicates Bears Remain in Control

The natural gas daily chart displays the bearish trading trend that has been in control since earlier this month when a rally was turned away by the falling 50-day Simple Moving Average (SMA). Now, prices are nearing the psychologically important $2 level, which may serve as a rallying point for bulls to stage another push higher.

However, given the broader weakness in prices, traders may opt to sell into strength. That said, those two levels may serve as decisive and telling points for traders to act. And with an implied volatility rank of above 50, there are also opportunities for premium sellers in the market.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.