Natural Gas Prices Dip as La Niña Sets the Stage for a Mild Winter

Natural Gas Prices Dip as La Niña Sets the Stage for a Mild Winter

Weather, not war, is once again driving price action in the natural gas market

- Despite the war in Eastern Europe, natural gas supplies have stabilized, making weather one of the factors that drives prices.

- La Niña could bring warmer temperatures to much of the U.S., which has weighed on prices.

- A sudden shift toward colder conditions could drive a rally, presenting potential opportunities for vigilant investors.

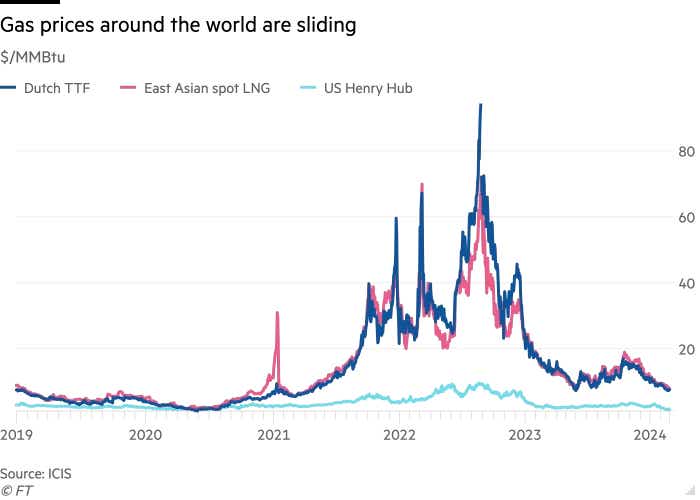

Back in 2022, the expansion of Russia's war in Ukraine sent shockwaves through global energy markets, causing natural gas prices to spike alongside many other commodities. For a time, the conflict seemed to dictate price movements across the sector. However, as countries have adapted and diversified their natural gas supplies, the direct influence of the war on global energy markets has lessened considerably.

Today, the natural gas market is much more attuned to domestic factors, with the upcoming 2024-2025 winter weather forecast now taking center stage. In the United States, natural gas is a critical energy source for both heating and cooling homes and businesses, meaning shifts in temperature can have a swift and substantial effect on prices.

Last winter was one of the warmest on record, which led to a sharp drop in demand for natural gas and, subsequently, lower prices. At one point, natural gas fell to $1.50/mmBtu, marking the lowest levels since the early days of the COVID-19 pandemic.

Prices did recover somewhat this summer as demand for cooling drove up natural gas use, bringing prices above $3.00/mmBtu by mid-June. However, as the winter weather outlook for 2024-2025 has crystallized, prices have once again moved lower.

As of mid-October, forecasters are predicting another mild winter, once again shaped by La Niña. In response, natural gas prices have dropped about 25% from their June peak, and currently trade around $2.35/mmBtu. The anticipated La Niña conditions are expected to usher in warmer, drier weather across much of the U.S., reducing the demand for natural gas, which could continue to weigh negatively on prices.

La Niña and the 2024-2025 Winter Forecast

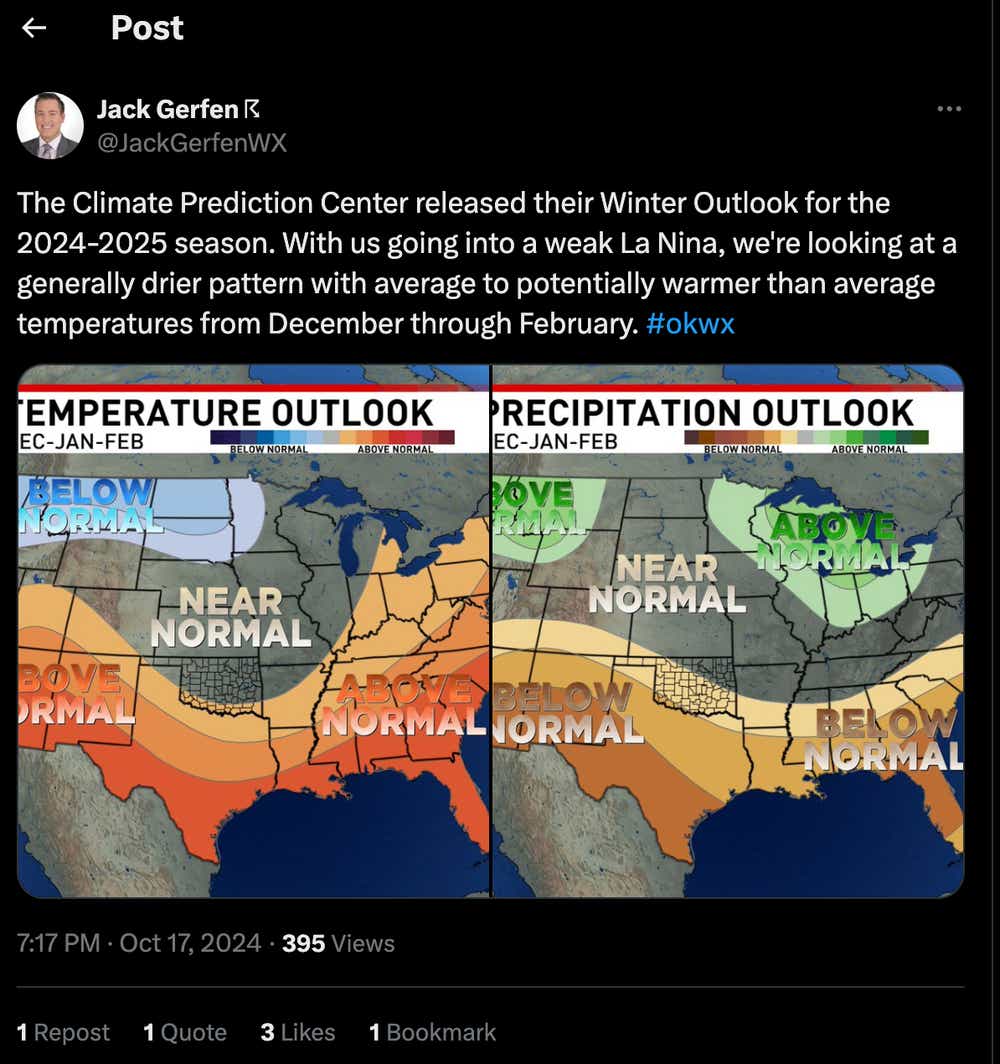

As winter 2024-2025 approaches, all eyes have shifted to the weather forecast, with La Niña once again poised to shape this season’s outlook. La Niña can significantly influence weather across North America by altering atmospheric circulation patterns.

Last winter, La Niña was a contributing factor to the historically warm winter in the United States, and was supported by other weather patterns, such as warmer-than-average water temperatures in the Pacific. This winter, the strength of La Niña is a bit harder to predict, which could allow for greater variability in what’s actually observed. At present, the National Oceanic and Atmospheric Administration (NOAA) forecast suggests another mild winter because of the continuing dominance of warmer waters in the Pacific.

That would suggest a continuation of last winter’s trend, with warmer-than-average temperatures likely dominating much of the southern and central United States (highlighted below). According to the NOAA report, “warmer-than-average temperatures are favored from the southern tier of the U.S. to the eastern Great Lakes, eastern seaboard, New England and northern Alaska.”. If this forecast holds, it could suppress natural gas demand because fewer households will need to run their heating systems at full capacity.

Despite the presence of La Niña, the northern regions of the U.S. may still experience bouts of cold air, especially as the season progresses into February, when the polar vortex could trigger cold snaps across the Midwest and Northeast.

For now, market sentiment seems to reflect expectations of a milder winter. U.S. natural gas prices have already seen downward pressure, slipping to around $2.35/mmBtu as of mid-October. Assuming the weather forecast holds, natural gas prices could trade in a tighter narrow range for the foreseeable future.

Takeaways

As the 2024-2025 winter season approaches, it’s clear La Niña is once again shaping the season’s outlook, suggesting another round of mild weather for much of the United States. This trend could translate to relatively modest demand for natural gas and thus limit bullish sentiment in the natural gas market.

However, a sudden chill, or a significant shift in the forecast, could rattle the current outlook. And under that scenario, long positions could benefit. Traditionally, investors access natural gas exposure using futures, stocks and exchange-traded funds (ETFs). The year-to-date performance in some of the best-known natural gas stocks is highlighted below:

- Kinder Morgan (KMI) +39%

- Antero Resources (AR) +21%

- Enbridge (ENB) +20%

- Cheniere Energy (LNG) +8%

- Chevron (CVX) +1%

- Range Resources (RRC) -3%

- EQT Corporation (EQT) -5%

- Coterra (CTRA) -6%

- ConocoPhillips (COP) -10%

- Devon (DVN) -11%

Besides those listed above, two well-known natural gas-focused ETFs include the United States Natural Gas Fund LP (UNG) and the United States 12-Month Natural Gas Fund LP (UNL), which are down 36% and 18%, respectively, in 2024.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor of Luckbox Magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.