Natural Gas Bears Feel the Heat as Prices Rise

.png?format=pjpg&quality=50&width=387&disable=upscale&auto=webp)

Natural Gas Bears Feel the Heat as Prices Rise

Prices on pace for more gains

- Natural gas price (/NG) pace higher amid continued heat.

- Europe faces supply disruptions as it faces similar weather.

- Speculators added to long positions, according to COT data.

Traders are pushing U.S. natural gas prices (/NG) up about 17 cents on Thursday afternoon to $2.751 per million British thermal units (mmBtu) as they contemplate the uncertainty caused by higher-than-average temperatures across the United States, as well as a volatile supply situation in Europe where hotter temperatures are also increasing demand.

Extreme temperatures remain the primary tailwind to gas prices

The summer has been hot not only in the United States but also around the globe. According to NASA's global temperature analysis, June recorded the highest temperatures on record. The demand for natural gas increases during the summer due to above-average mercury readings as people use air conditioning.

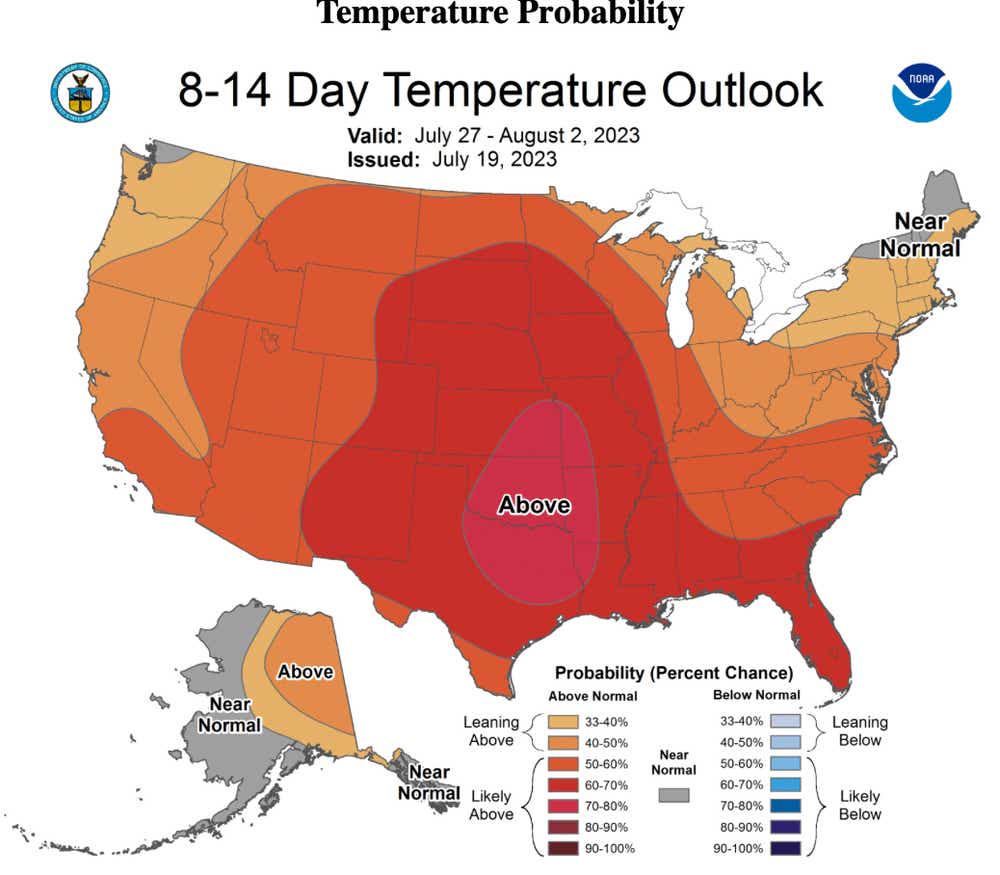

The National Oceanic and Atmospheric Administration's 8-14 Day Temperature Outlook predicts that these hot temperatures will persist until early August. The forecast, shown in the chart below, covers almost the entire U.S. with "likely above" and "leaning above" probabilities for above-normal temperatures during the 8-14-day period. This forecast should support bullish sentiment for the commodity.

Supply Concerns in Europe Add Fuel to Bull Case

While Moscow's incursion into Ukraine and the resulting consequences, including severely limited gas supply from Russia, have likely spared Europe from a catastrophic energy situation, the situation remains delicate. Europe continues to face intense heat similar to that across the Atlantic, leading to increased cooling demand at a particularly bad time. However, this has been partially countered by a decline in industrial activity due to the European Central Bank's rate-tightening cycle.

The importation of liquified natural gas (LNG), primarily from the U.S., has contributed to a moderation in Dutch natural gas prices, which have fallen over 50% since January 1st, although they remain high compared to pre-war levels. Norway's oil fields, the primary domestic source of European gas, have also aided in lowering prices.

Even so, several Norwegian gas fields are scheduled for maintenance in the upcoming weeks, which could limit further selling as Europe's reliance on U.S. LNG flows supports demand during this already unusually high period in the states. Traders should anticipate continued volatility in the sector.

Money Managers Add to Net Long Position

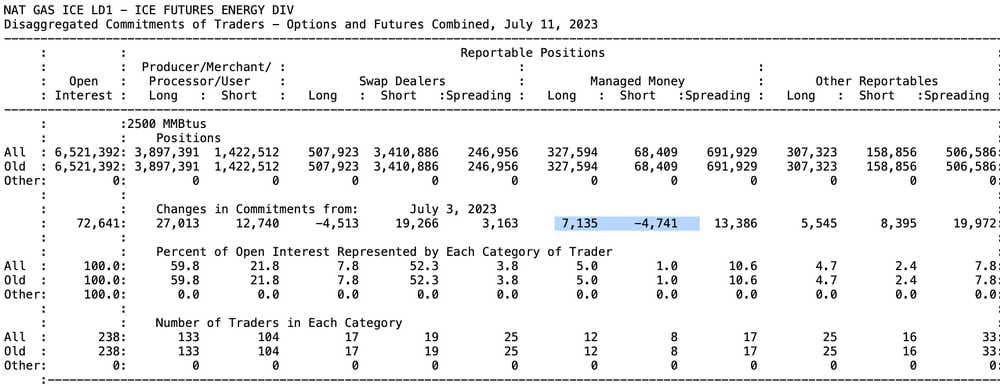

The latest Commitments of Traders report (COT) from the Commodities Futures Trading Commission (CFTC) shows that money managers, who are naturally speculative in nature, added to their long positions for the week ending July 11. The net long position rose 7,135 contracts to a total of 327,594. That compares to a net short position of 68,409 after those funds trimmed 4,741 contracts.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.