U.S. Exports Likely to Support Higher Natural Gas Prices in 2025

U.S. Exports Likely to Support Higher Natural Gas Prices in 2025

Uncertain weather and tight global supplies set the stage for a volatile year

- Natural gas prices for February are rising 20% into the new year as the weather forecast prompts a buying frenzy.

- Increased export pressure on U.S. natural gas is expected to increase in 2025.

- The global energy complex remains fragile amid the ongoing Russia/Ukraine war.

Natural gas futures (/NGG5) for February delivery rose 20% yesterday, marking the largest increase for the commodity future since October and one of the largest since 1990, when the contract started trading.

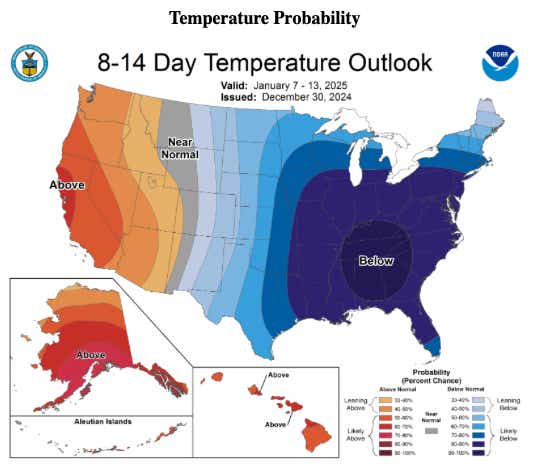

Investors piled into the futures market with long bets after weather forecasts shifted to show a brutally cold January across much of the eastern United States. The frigid temperatures will boost gas demand, especially on the energy-hungry East Coast.

The surge came on the second-to-last trading day of the year, providing a bullish backdrop as traders head into the new year.

Will 2025 be a bullish for natural gas?

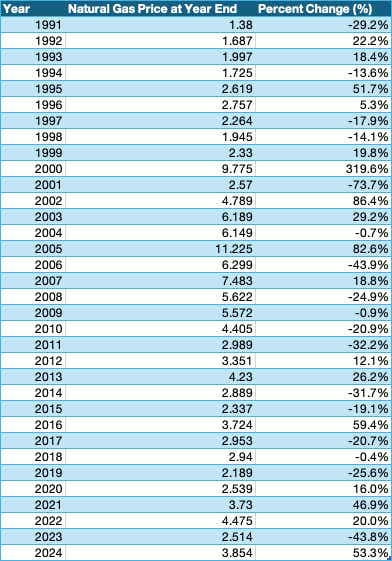

Natural gas prices were on track for a 55% gain for the year as of yesterday on a continuous contract basis.

That would mark the largest annual increase since 2016, when prices rose nearly 60% for the year, and the second highest since 2005’s 83% gain.

Given the movement in December—up over 15%—it looks as though 2025 could be shaping up as a very bullish year.

Export pressures add to demand side

The United States became the leading natural gas exporter in 2022 and has held that position since. This was an expected development, but the Ukraine/Russia war helped the U.S.become leader of leading exporter sooner that it would have otherwise.

The trend in export strength is expected to continue in 2025. The Energy Information Administration (EIA) forecasts U.S. exports will increase by 15% from about 12 million billion cubic feet per day (Bcf/d) to nearly 14 Bcf/d. The added capacity will likely come via the Plaquemines LNG and Corpus Christi LNG Stage 3, with both export facilities expected to be operating in the new year.

While those export facilities may not capture the full benefit immediately, they should lead to maximum utilization toward the end of 2025, as Europe will likely look to bolster inventories to full capacity ahead of next year’s winter season.

Volatility likely to continue

With natural gas prices influenced most in the short term weather, mainly temperatures, considerable volatility is likely in the product, continuing the trend from 2024.

The price surge seen in the last week of December trading may have already run its course, but profit taking will likely open a window for renewed buying on the next bullish catalyst.

While U.S. supply remained slightly above trend heading into 2025, a continuation of January’s expected cold snap could lead to an inventory deficit relative to last year and the five-year average.

Traders who were bold enough to buy the dips and sell the rips in 2024 were mostly rewarded. That strategy could prove rewarding again in 2025, but managing trades through sharp price swings will require a diligent eye.

Key Points going into 2025:

- A shift in U.S. weather forecasts is bolstering prices into the New Year.

- Export pressure on the U.S. appears likely to lift prices, especially in late 2025.

- Don’t expect volatility to calm down substantially.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.