Nasdaq 100 Treads Water as Microsoft Earnings and FOMC Meeting Loom

Nasdaq 100 Treads Water as Microsoft Earnings and FOMC Meeting Loom

Also, 30-year T-bond, silver, crude oil and Japanese yen futures

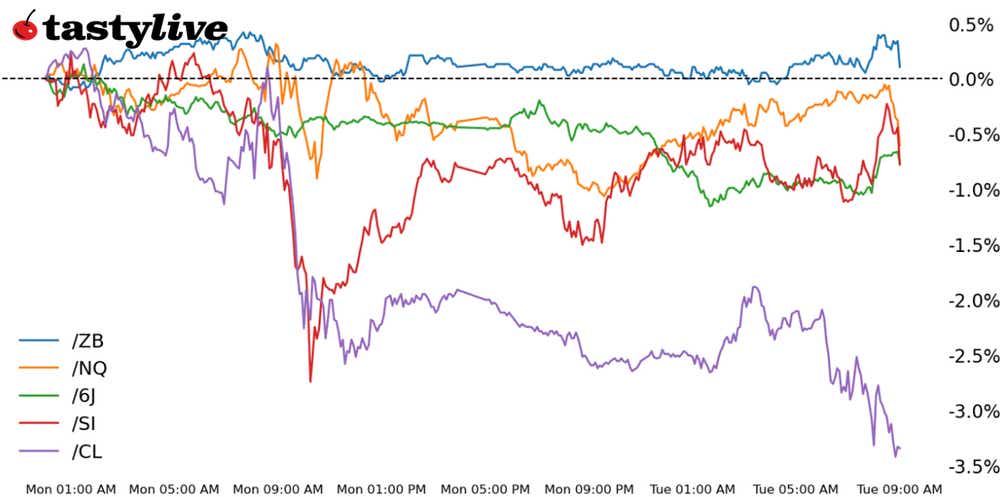

Nasdaq 100 E-mini futures (/NQ): +0.31%

30-year T-bond futures (/ZB): +0.26%

Silver futures (/SI): +0.62%

Crude oil futures (/CL): -1.28%

Japanese yen futures (/6J): -0.41%

The most important week of the summer is facing the most critical 72-hour period on the immediate horizon. The Federal Reserve July rate decision tomorrow typically breeds quieter trading conditions ahead of time, putting less focus on the macro calendar and more focus on earnings.

Microsoft (MSFT) earnings kick things off after hours today, the first of four Magnificent Seven companies to report this week. Elsewhere, even with a stronger U.S. dollar, precious metals are finding some relief after their sharp selloff last week. However, commodities are not uniformly positive: growth-sensitive copper and crude oil continue to struggle.

Symbol: Equities | Daily Change |

/ESU4 | +0.10 |

/NQU4 | +0.31% |

/RTYU4 | +0.20% |

/YMU4 | +0.25% |

Nasdaq futures (/NQU4) rose this morning as the Fed kicks off its July interest rate meeting. Traders expect the central bank to hold steady on rates before cutting in September, but traders will be dialed into Fed Chair Jerome Powell’s press conference. Microsoft (MSFT) and Advanced Micro Devices (AMD) are due to report earnings today after the bell.

Strategy: (31DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 18800 p Short 18900 p Short 19500 c Long 19600 c | 23% | +1545 | -460 |

Short Strangle | Short 18900 p Short 19500 c | 56% | +14430 | x |

Short Put Vertical | Long 18800 p Short 18900 p | 61% | +705 | -1305 |

Symbol: Bonds | Daily Change |

/ZTU4 | +0.00 |

/ZFU4 | -0.01% |

/ZNU4 | +0.01% |

/ZBU4 | +0.26% |

/UBU4 | +0.20% |

Treasury yields are down across the curve as active investors wait for the Fed to announce its interest rate decision. The 30-year T-bond futures contract (/ZBU4) rose 0.26% to outpace gains along the curve. Overnight index swaps are pricing in a September rate cut and the possibility for two more rate cuts by next year. Friday’s job data could pose a big risk event for the bond market if labor forces accelerate.

Strategy (52DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 117 p Short 118 p Short 121 c Long 122 c | 29% | +687.50 | -312.50 |

Short Strangle | Short 118 p Short 121 c | 55% | +2890 | x |

Short Put Vertical | Long 117 p Short 118 p | 70% | +328.13 | -671.88 |

Symbol: Metals | Daily Change |

/GCZ4 | +0.42% |

/SIU4 | +0.62% |

/HGU4 | -1.26% |

Silver prices (/SIU4) rose this morning despite a stronger dollar. The metal carved out a potential bottom this week after prices failed to extend lower after prices closed above last week’s swing low. Silver has failed to keep pace with gold prices, reflected in the gold-silver ratio, which rose as high as 86.76 just yesterday. A challenging outlook in China has weighed on the industrial demand side of silver as gold has benefited from geopolitical risks and volatility in the equity markets.

Strategy (57DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 27.5 p Short 27.75 p Short 29.5 c Long 29.75 c | 24% | +900 | -350 |

Short Strangle | Short 27.75 p Short 29.5 c | 55% | +8415 | x |

Short Put Vertical | Long 27.5 p Short 27.75 p | 60% | +560 | -690 |

Symbol: Energy | Daily Change |

/CLU4 | -1.28% |

/HOU4 | -1.08% |

/NGU4 | +0.44% |

/RBU4 | -0.97% |

Crude oil prices broke below 75 for the first time since early June as prices continued to fall today, extending a selloff from the previous two trading sessions. Demand concerns from China are weighing on the commodity’s fundamental backdrop. Later this week OPEC and its allies, OPEC+, will meet to review proposed plans to undo some output cuts starting in October.

Strategy (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 72.5 p Short 73 p Short 76 c Long 76.5 c | 19% | +400 | -100 |

Short Strangle | Short 73 p Short 76 c | 52% | +4250 | x |

Short Put Vertical | Long 72.5 p Short 73 p | 58% | +200 | -300 |

Symbol: FX | Daily Change |

/6AU4 | -0.24% |

/6BU4 | 0.34% |

/6CU4 | -0.06% |

/6EU4 | -0.21% |

/6JU4 | -0.41% |

Japanese yen futures (/6JU4) fell today as active investors lost optimism ahead of the Bank of Japan (BOJ) rate decision tomorrow. Markets are pricing in a nearly 50% chance the BOJ will hike its interest rate by 10 basis points. If the BOJ holds, it would likely create a strong headwind for the yen as the U.S. prepares to cut interest rates.

Strategy (38DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0064 p Short 0.00645 p Short 0.0066 c Long 0.00665 c | 34% | +375 | -250 |

Short Strangle | Short 0.00645 p Short 0.0066 c | 56% | +1400 | x |

Short Put Vertical | Long 0.0064 p Short 0.00645 p | 69% | +225 | -400 |

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.