Nasdaq 100 Rebounds as Tech Stocks Shake Off the DeepSeek Shock

Nasdaq 100 Rebounds as Tech Stocks Shake Off the DeepSeek Shock

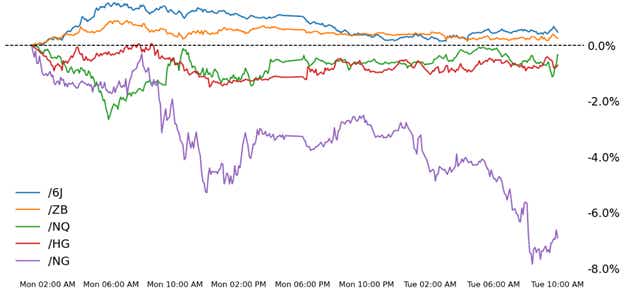

Also 10-year T-note, copper, natural gas and Japanese yen futures

- Nasdaq 100 E-mini futures (/NQ): +0.68%

- 30-year T-bond futures (/ZB): -0.52%

- Copper futures (/HG): +0.58%

- Natural gas futures (/CL): -4.11%

- Japanese yen futures (/6J): -0.68%

A brutal start to the week for tech stocks is finding some relief today as traders digest the implications of DeepSeek-R1 on AI capex while looking ahead to the January Federal Open Market Committee (FOMC) meeting tomorrow. Seemingly overlooked, the Federal Reserve’s meetings typically lead to a period of quiet trading conditions in the 24-hour leadup to the decision. That’s to say the inside day action happening in U.S. equity indexes may be more of markets moving into “the eye of the storm” instead of the storm having already passed.

Symbol: Equities | Daily Change |

/ESH5 | +0.39% |

/NQH5 | +0.68% |

/RTYH5 | +0.04% |

/YMH5 | +0.36% |

U.S. markets recovered today following yesterday’s down day when technology stocks led losses after news of DeepSeek injected uncertainty into the demand outlook of chip stocks. Nvidia (NVDA) extended losses at first but then turned into positive territory after the bell. The broader market saw gains through trading early this morning. Boeing (BA) rose 5.5% in early trading after the airline manufacturer reported mixed results. Investors are turning their attention to other big earnings announcements scheduled this week, including Apple (AAPL) and Tesla (TSLA).

Strategy: (31DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 21100 p Short 21200 p Short 21750 c Long 21800 c | 60% | +1100 | -900 |

Short Strangle | Short 21200 p Short 21750 c | 50% | +13870 | x |

Short Put Vertical | Long 21100 p Short 21200 p | 59% | +650 | -1350 |

Symbol: Bonds | Daily Change |

/ZTH5 | -0.04% |

/ZFH5 | -0.15% |

/ZNH5 | -0.27% |

/ZBH5 | -0.52% |

/UBH5 | -0.65% |

Bonds fell across the curve today, reversing some of Monday’s rally that sent yields significantly lower. The selling in Treasuries comes after President Trump announced tariff measures on semiconductors and metals, which is seen as potentially inflationary to the market. The evolution in the new administration's trade policy will likely remain a wild card for traders in the coming weeks and months. The 30-year T-bond futures fell 0.46% today’s early trading.

Strategy (52DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 111 p Short 112 p Short 115 c Long 116 c | 32% | +656.25 | -343.75 |

Short Strangle | Short 112 p Short 115 c | 57% | +2609 | x |

Short Put Vertical | Long 111 p Short 112 p | 69% | +328.13 | -671.88 |

Symbol: Metals | Daily Change |

/GCG5 | +0.83% |

/SIH5 | +1.19% |

/HGH5 | +0.58% |

Copper prices (/HGH5) rose after President Trump threatened to place tariffs on the metal, which could result in higher prices for U.S. consumers along the supply chain. The U.S. lacks sustainable investment in the downstream industry, and smelters in the U.S. have closed several shops over the last decade. The U.S. imports much of its copper and the tariffs will likely be passed down to consumers, particularly in the auto industry where copper needs are high.

Strategy (57DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4.23 p Short 4.24 p Short 4.41 c Long 4.42 c | 19% | +200 | -50 |

Short Strangle | Short 4.24 p Short 4.41 c | 53% | +4787.50 | x |

Short Put Vertical | Long 4.23 p Short 4.24 p | 59% | +125 | -125 |

Symbol: Energy | Daily Change |

/CLH5 | +0.15% |

/HOH5 | -0.48% |

/NGH5 | -4.11% |

/RBH5 | +0.51% |

Natural gas futures (/NGH5) fell for a fourth day today, driving prices to the lowest level since early January. Weather models have shifted to the bearish side for February, with much of the United States expected to see above or near-normal temperatures through the month. That could help to keep inventories elevated as we exit the winter season when stocks are typically drawn from inventory. However, there is some technical support near current levels, which could help to suspend the selling in the short term. The move comes despite higher expectations for a rate hike from the Bank of Japan, with market-based bets expecting another hike by July.

Strategy (57DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 3.05 p Short 3.1 p Short 3.4 c Long 3.45 c | 21% | +390 | -110 |

Short Strangle | Short 3.1 p Short 3.4 c | 53% | +3480 | x |

Short Put Vertical | Long 3.05 p Short 3.1 p | 53% | +250 | -250 |

Symbol: FX | Daily Change |

/6AH5 | -0.56% |

/6BH5 | -0.41% |

/6CH5 | -0.06% |

/6EH5 | -0.59% |

/6JH5 | -0.68% |

The upside in U.S. yields is putting pressure on currencies outside of the United States as traders expect the trade moves to bolster inflation expectations and potentially cut into the Federal Reserve’s rate-cutting forecast. Japanese yen futures (/6JH5) fell about 0.68% through early trading today, reversing almost all of yesterday’s upside.

Strategy (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.00635 pShort 0.0064 p Short 0.0065 c Long 0.00655 c | 30% | +200 | -189.76 |

Short Strangle | Short 0.0064 p Short 0.0065 c

| 54% | +1437.50 | x |

Short Put Vertical | Long 0.00635 p Short 0.0064 p | 69% | +225 | -400 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.