Nasdaq 100 Eases Back Ahead of Microsoft, Google Earnings

Nasdaq 100 Eases Back Ahead of Microsoft, Google Earnings

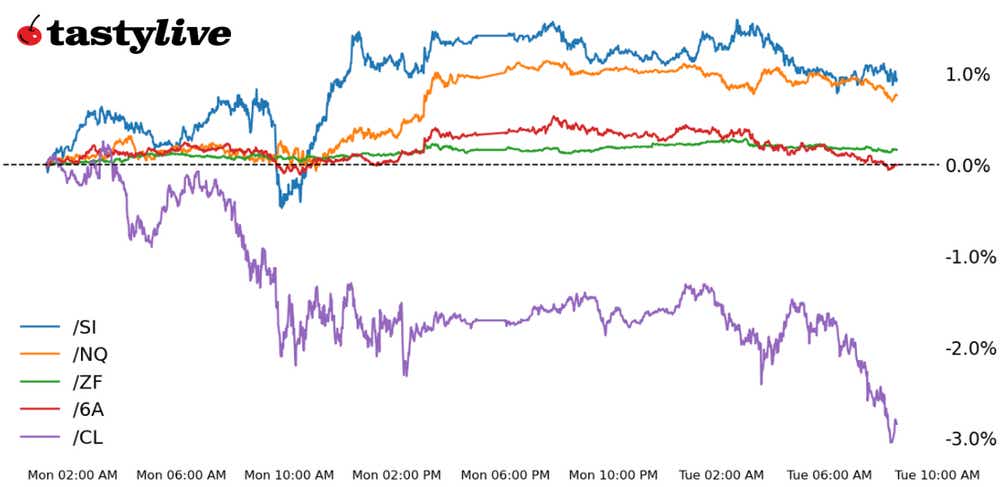

Also, five-year T-note, silver, crude oil, and Australian dollar futures

- Nasdaq 100 E-mini futures (/NQ): -0.20%

- Five-year T-note futures (/ZF): +0.02%

- Silver futures (/SI): -0.26%

- Crude oil futures (/CL): -1.03%

- Australian dollar futures (/6A): -0.17%

Can the Magnificent 7 (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms and Tesla) keep U.S. equity markets pointed higher? Will the Federal Reserve signal openness for a March rate cut? Is the U.S. labor market still growing?

These are questions whose answers will be revealed in the coming days. Ahead of the deluge of earnings and economic data, traders are taking some profit off the table in stocks. Meanwhile, following the first part of the Treasury’s quarterly refunding announcement (QRA) yesterday, bonds are higher across the curve.

Note that for all of the jarring geopolitical headlines in recent days, neither energy nor metals are discounting a high probability of direct conflict between the United States and Iran.

Symbol: Equities | Daily Change |

/ESH4 | -0.20% |

/NQH4 | -0.24% |

/RTYH4 | -0.49% |

/YMH4 | -0.21% |

U.S. equity indexes are cooling off this morning following the smashing run into the close yesterday. Event risk accelerates in the coming days, with Microsoft (MSFT), Alphabet’s Google (GOOG/GOOGL) and Advanced Micro Devices (AMD) earnings after hours today—not to mention the litany of earnings reports due on the other side of tomorrow’s Federal Open Market Committee (FOMC) meeting. The Nasdaq 100 (/NQH4) options chain is pricing in a +/-1.62% move through the end of the week.

Strategy: (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 17300 p Short 17400 p Short 18400 c Long 18500 c | 40% | +1100 | -900 |

Short Strangle | Short 17400 p Short 18400 c | 62% | +8375 | x |

Short Put Vertical | Long 17300 p Short 17400 p | 72% | +515 | -1485 |

Symbol: Bonds | Daily Change |

/ZTH4 | +0.01% |

/ZFH4 | +0.02% |

/ZNH4 | +0.10% |

/ZBH4 | +0.39% |

/UBH4 | +0.64% |

The bond market is looking on approvingly following the release of the Treasury’s QRA, which showed the U.S. government will be borrowing less money moving forward than previously anticipated. Less borrowing means less issuance, which means less supply; less supply means less pressure on yields. While the long-end (30s (/ZBH4) and ultras (/UBH4)) is proving most sensitive to the supply/demand shift, the belly of the curve (5s (/ZFH4)) are decidedly muted by comparison. For traders in 2s (/ZTH4) and 5s, the January FOMC meeting results tomorrow may help wake up the front-end of the curve.

Strategy (52DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 107 p Short 107.25 p Short 109.75 c Long 110 c | 46% | +117.19 | -132.81 |

Short Strangle | Short 107.25 p Short 109.75 c | 61% | +671.88 | x |

Short Put Vertical | Long 107 p Short 107.25 p | 83% | +70.31 | -179.69 |

Symbol: Metals | Daily Change |

/GCJ4 | +0.45% |

/SIH4 | -0.26% |

/HGH4 | -0.35% |

Metals are mixed this morning despite the weakness of U.S. dollar and lower U.S. Treasury yields—both of which one would assume would help prop up gold (/GCJ4) and silver prices (/SIH4). Nevertheless, technically not much has changed: /GCH4 remains in a sideways consolidation; and /SIH4 has maintained the break of the downtrend from the December 2023 intra-month swing highs. Volatility is relatively muted, with both /GCH4 and /SIH4 retaining IVRs below 20.

Strategy (55DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 22.5 p Short 22.75 p Short 24 c Long 24.25 c | 28% | +845 | -405 |

Short Strangle | Short 22.75 p Short 24 c | 55% | +5290 | x |

Short Put Vertical | Long 22.5 p Short 22.75 p | 65% | +455 | -795 |

Symbol: Energy | Daily Change |

/CLH4 | -1.03% |

/HOH4 | -1.93% |

/NGH4 | +1.41% |

/RBH4 | -2.12% |

Crude oil prices (/CLH4) dropped this morning as traders wait for the United States to respond to a deadly attack on U.S. forces last week in Jordan. President Biden has reportedly been briefed on several strike options, which range from attacking proxy forces to a more direct set of options that include striking targets inside of Iran. Unrelated, Saudi Arabia announced that Aramco would drop plans to expand oil production. Elsewhere, month-ahead forecasts for warm weather continue to weigh on natural gas prices (/NGH4), which are barely off of its yearly low.

Strategy (55DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.7 p Short 1.8 p Short 2.4 c Long 2.5 c | 46% | +450 | -550 |

Short Strangle | Short 1.8 p Short 2.4 c | 59% | +1620 | x |

Short Put Vertical | Long 1.7 p Short 1.8 p | 70% | +220 | -780 |

Symbol: FX | Daily Change |

/6AH4 | -0.17% |

/6BH4 | -0.17% |

/6CH4 | -0.01% |

/6EH4 | +0.20% |

/6JH4 | +0.08% |

Australian dollar futures (/6AH4) pulled back ahead of inflation data due tonight that may alter rate bets for the Reserve Bank of Australia (RBA). The year-over-year inflation rate for the fourth quarter is seen dropping to 4.3% from 5.4%. Markets see the RBA cutting later this year, but those bets appear fragile and subject to change on data points such as tonight’s inflation print.

Strategy (38DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.63 p Short 0.635 p Short 0.685 c Long 0.69 c | 77% | +80 | -420 |

Short Strangle | Short 0.635 p Short 0.685 c | 80% | +230 | x |

Short Put Vertical | Long 0.63 p Short 0.635 p | 92% | +40 | -460 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.