Nasdaq 100 Hits Fresh Lows as Oil Climbs, Inflation Fears Build

Nasdaq 100 Hits Fresh Lows as Oil Climbs, Inflation Fears Build

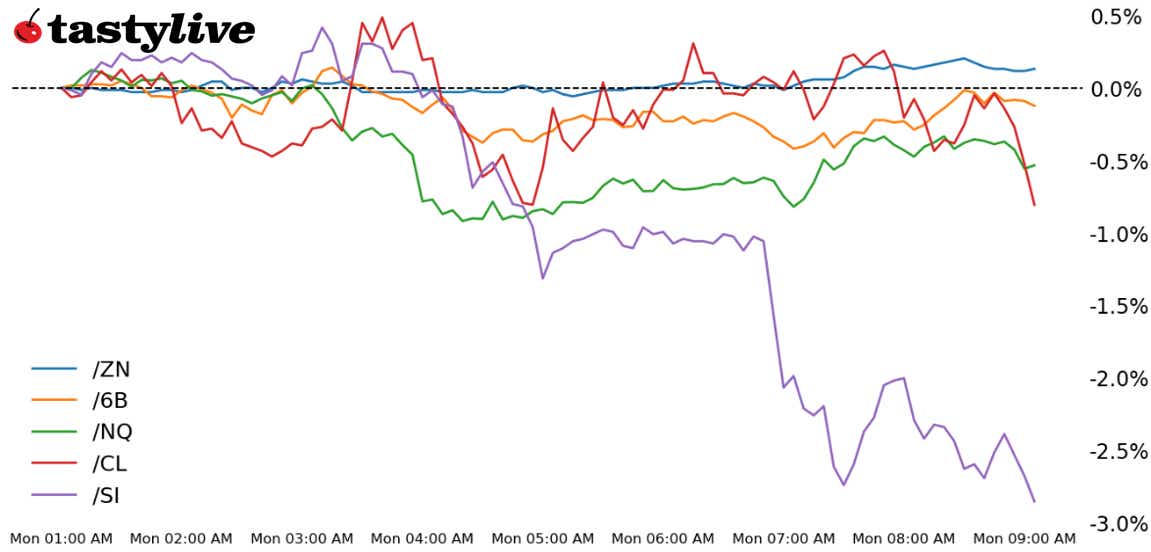

Also, 10-year T-note, silver, crude oil and British pound futures

- Nasdaq 100 E-mini futures (/NQ): -1.16%

- 10-year T-note futures (/ZN): 0%

- Silver futures (/SI): -3.21%

- Crude oil futures (/CL): +1.4%

- British pound futures (/6B): -0.58%

Better-than-expected U.S. jobs data on Friday, coupled with a bump in one-year-ahead inflation expectations in the Michigan Consumer Sentiment survey, have caused traders to adopt a risk-off posture unseen in long stretches since 2022. U.S. equity markets are down across the curve as energy prices continue to push higher, although the strong U.S. dollar and Japanese yen may be provoking a deleveraging in precious metals. While Treasury has a light auction schedule over the coming days, 4Q’24 earnings are starting in earnest: Banks and semiconductors start reporting later this week.

Symbol: Equities | Daily Change |

/ESH5 | -0.82% |

/NQH5 | -1.16% |

/RTYH5 | -1.19% |

/YMH5 | -0.11% |

Nasdaq futures (/NQH5) fell over 1% this morning to extend last week’s decline as fear of higher interest rates and geopolitical uncertainty weigh on market sentiment. Traders are looking ahead to earnings in the hope that good corporate numbers can arrest the slide in equity prices. As usual, the banks will kick off the season, with earnings reports this week from Goldman Sachs (GS), Morgan Stanley (MS), JPMorgan Chase (JPM) and Bank of America (BAC).

Strategy: (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 20300 p Short 20400 p Short 21200 c Long 21250 c | 60% | +1095 | -905 |

Short Strangle | Short 20400 p Short 21200 c | 52% | +18185 | x |

Short Put Vertical | Long 20300 p Short 20400 p | 60% | +645 | -1355 |

Symbol: Bonds | Daily Change |

/ZTH5 | +0.01% |

/ZFH5 | 0% |

/ZNH5 | 0% |

/ZBH5 | +0.06% |

/UBH5 | +0.14% |

After trimming earlier losses this morning, the 10-year T-note futures contract (/ZNH5) managed to enter green territory, rising about 0.04% just ahead of the opening bell. Traders are still assessing Friday’s jobs report that showed a better-than-expected headline number, which discouraged bets on Fed rate cuts in the market. The higher yields sent shockwaves across financial markets. The Treasury will auction 13- and 26-week bills today.

Strategy (39DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 106 p Short 106.5 p Short 108 c Long 108.5 c | 31% | +312.50 | -187.50 |

Short Strangle | Short 106.5 p Short 108 c | 53% | +1187.50 | x |

Short Put Vertical | Long 106 p Short 106.5 p | 73% | +156.25 | -343.75 |

Symbol: Metals | Daily Change |

/GCG5 | -1.13% |

/SIH5 | -3.21% |

/HGH5 | -0.07% |

Silver prices dropped over 3% this morning, marking the biggest daily percentage drop since Dec. 19. A stronger dollar is working against the case for precious metals as Friday’s jobs report continues to shift the outlook for rate cuts. The December swing low at 29.145 will shift into focus if prices continue to drop this week. A break below that level would mark a severe degradation in the metal’s technical structure.

Strategy (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 29.5 p Short 29.75 p Short 31.25 c Long 31.5 c | 25% | +935 | -315 |

Short Strangle | Short 29.75 p Short 31.25 c | 56% | +7800 | x |

Short Put Vertical | Long 29.5 p Short 29.75 p | 59% | +560 | -690 |

Symbol: Energy | Daily Change |

/CLG5 | +1.4% |

/HOG5 | +1.46% |

/NGG5 | -0.1% |

/RBG5 | +1.23% |

Crude oil futures (/CLG5) rose over 1% to start the week. Traders see the latest U.S. sanctions on Russian oil forcing China to source more oil from the Middle East and elsewhere. Meanwhile, the prompt spread—the difference between the current and next month’s contract prices—rose above $1.00, the highest since mid-September. That signals a tight physical market. Inventories dropped last week, according to the Energy Information Administration. And rising expectations for stimulus in China is also underpinning the market. A move up to $80 per barrel seems to be in the cards.

Strategy (32DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 74.5 p Short 75 p Short 79 c Long 79.5 c | 24% | +360 | -140 |

Short Strangle | Short 75 p Short 79 c | 55% | +3830 | x |

Short Put Vertical | Long 74.5 p Short 75 p | 59% | +210 | -290 |

Symbol: FX | Daily Change |

/6AH5 | -0.05% |

/6BH5 | -0.58% |

/6CH5 | +0.11% |

/6EH5 | -0.35% |

/6JH5 | +0.45% |

British Pound futures (/6BH5) are trading at 14-month lows as prices continue to drop amid concern about government policies on taxes and the jobs market. Lobbying groups are raising alarms on the government’s tax plans and employment laws and maintaining that the market is losing confidence in the legislature. The market reaction echoes what happened during Liz Truss’s short tenure as prime minister, which caused havoc in the United Kingdom’s bond market. Meanwhile, concern about the incoming U.S. administration's trade policies are boosting the dollar.

Strategy (53DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.195 p Short 1.2 p Short 1.225 c Long 1.23 c | 28% | +237.50 | -75 |

Short Strangle | Short 1.2 p Short 1.225 c | 63% | +1781.25 | x |

Short Put Vertical | Long 1.195 p Short 1.2 p | 70% | +106.25 | -206.25 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.