Nasdaq 100 Turns Higher as Markets Await Outcome of Election Day 2024

Nasdaq 100 Turns Higher as Markets Await Outcome of Election Day 2024

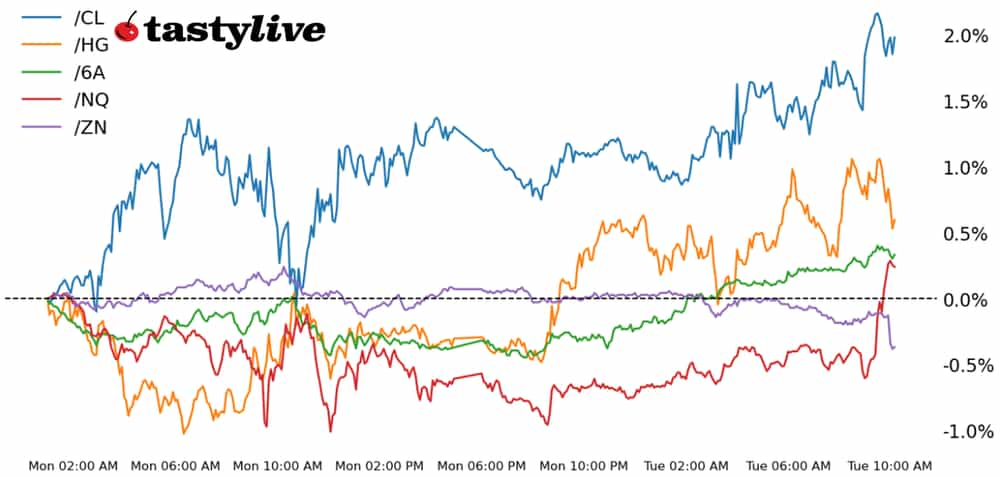

Also, 10-year T-note, copper, crude oil and Australian dollar futures

- Nasdaq 100 E-mini futures (/NQ): +0.96%

- 10-year T-note futures (/ZN): -0.33%

- Copper futures (/HG): +0.93%

- Crude Oil futures (/CL): +0.94%

- Australian dollar futures (/6A): +0.64%

U.S. equity markets rose at the start of trading today, extending gains from overnight in Asia and a mostly positive European session. China saw some upbeat economic data cross the wires, which prompted some risk taking in Asia. The dollar fell as U.S. election fears cascaded through the market, with the race being a coin flip by most measures. Crude oil continued to rise, as traders price in less supply in the market via OPEC+. After the election results, the focus will shift to the Federal Reserve decision on interest rates due on Thursday.

Symbol: Equities | Daily Change |

/ESZ4 | +0.78% |

/NQZ4 | +0.96% |

/RTYZ4 | +0.71% |

/YMZ4 | +0.60% |

Nasdaq futures (/NQZ4) rose after the New York session started, rising nearly 1%. It could be a volatile session as votes come in today. Some states won’t finish counting tonight, but the market should have a much clearer picture of who the next U.S. President will be by tonight. Palantir Technologies (PLTR) rose nearly 20% in pre-market trading after raising its revenue guidance. NXP Semiconductors (NXPI) fell about 8% ahead of the bell after offering softer-than-expected guidance.

Strategy: (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 19900 p Short 20000 p Short 20700 c Long 20750 c | 58% | +1150 | -850 |

Short Strangle | Short 20000 p Short 20700 c | 50% | +17620 | x |

Short Put Vertical | Long 19900 p Short 20000 p | 58% | +705 | -1295 |

Symbol: Bonds | Daily Change |

/ZTZ4 | -0.11% |

/ZFZ4 | -0.26% |

/ZNZ4 | -0.33% |

/ZBZ4 | -0.27% |

/UBZ4 | -0.20% |

Bond yields were slightly higher across the curve as voting gets underway in the United States. A split Congress and a Harris victory is seen as good for bonds, so the reactions in the Treasury market may reflect sentiment as votes are counted later today. 10-year T-note futures (/ZNZ4) were down 0.07% this morning ahead of the New York open.

Strategy (52DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 109 p Short 109.5 p Short 111.5 c Long 112 c | 29% | +343.75 | -156.25 |

Short Strangle | Short 109.5 p Short 111.5 c | 55% | +1781.25 | x |

Short Put Vertical | Long 109 p Short 109.5 p | 70% | +187.50 | -312.50 |

Symbol: Metals | Daily Change |

/GCZ4 | -0.01% |

/SIZ4 | +0.68% |

/HGZ4 | +0.93% |

Copper prices (/HGZ4) rose over 1% after holding overnight gains following upbeat data out of China. The country’s services sector expanded in October, brightening economic expectations for the Asian economic engine. Meanwhile, a weaker dollar is helping to clear some upside for the industrial metal.

Strategy (51DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4.42 p Short 4.43 p Short 4.64 c Long 4.65 c | 22% | +200 | -50 |

Short Strangle | Short 4.43 p Short 4.64 c | 59% | +5850 | x |

Short Put Vertical | Long 4.42 p Short 4.43 p | 60% | +125 | -125 |

Symbol: Energy | Daily Change |

/CLZ4 | +0.94% |

/HOZ4 | +0.94% |

/NGZ4 | -1.83% |

/RBZ4 | +1.55% |

Crude oil futures (/CLZ4) rose this morning, extending gains from yesterday. Prices are now near the highest levels since mid-October. News from OPEC+ earlier this week helped to fuel some bullish bets on the commodity. After the election, focus will shift to China and whatever stimulus measures they are willing to bring to the table.

Strategy (41DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 69.5 p Short 70 p Short 75 c Long 75.5 c | 25% | +380 | -120 |

Short Strangle | Short 70 p Short 75 c | 62% | +5610 | x |

Short Put Vertical | Long 69.5 p Short 70 p | 58% | +250 | -250 |

Symbol: FX | Daily Change |

/6AZ4 | +0.64% |

/6BZ4 | +0.30% |

/6CZ4 | +0.17% |

/6EZ4 | +0.16% |

/6JZ4 | +0.10% |

Australian dollar futures (/6AZ4) rose about 0.7% this morning. The Reserve Bank of Australia kept its benchmark interest rate steady at 4.35%, matching market expectations. Some broader weakness in the dollar and upbeat economic indicators out of China are helping to lift the currency. However, we could be in for a volatile FX session tonight, as election results cross the wires.

Strategy (31DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.65 p Short 0.655 p Short 0.67 c Long 0.675 c | 36% | +330 | -170 |

Short Strangle | Short 0.655 p Short 0.67 c | 61% | +1250 | x |

Short Put Vertical | Long 0.65 p Short 0.655 p | 71% | +150 | -350 |

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.