Nasdaq 100 Crashes and Bonds Surge as Yen Carry Trade Implodes

Nasdaq 100 Crashes and Bonds Surge as Yen Carry Trade Implodes

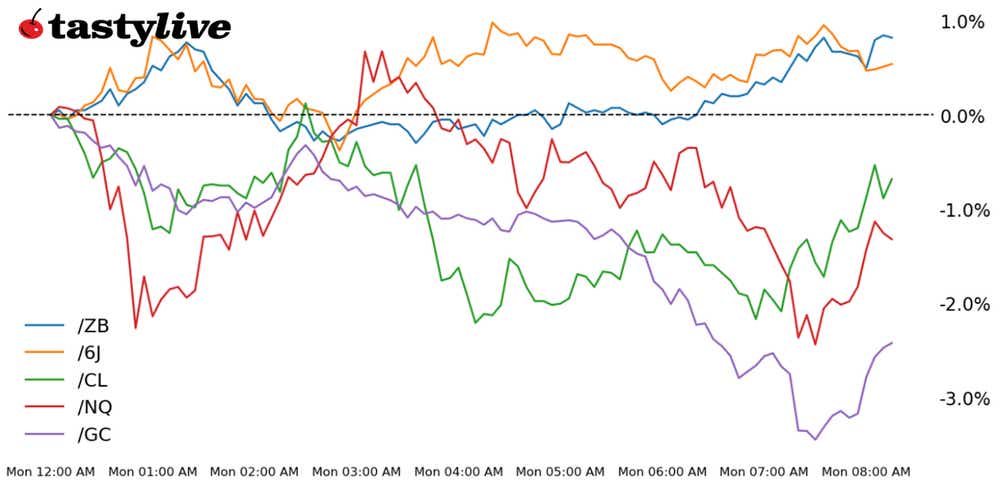

Also, 30-year T-bond, gold, crude oil and Japanese yen futures

Nasdaq 100 E-mini futures (/NQ): -5.07%

30-year T-bond futures (/ZB): +1.17%

Gold futures (/GC): -1.41%

Crude oil futures (/CL): -1.41%

Japanese yen futures (/6J): +0.77%

Welcome to the “Correlation 1” event, brought to you by the Bank of Japan (BOJ). Last week’s BOJ rate hike, sandwiched between the deflation consumer price index (CPI) print on July 11, the Federal Reserve’s decision to keep rates on hold on July 31 and the July U.S. jobs report on Aug. 2, may have been the straw that broke the camel’s back. The yen carry trade that has been built up since the pandemic, roughly $4 trillion notionally, is being unwound. Outside of bonds, everything is red as investors are raising cash; not even precious metals are proving to be a safe haven.

Traders would be wise to remember that the past is the past; hemming and hawing about what should have been done last week does nothing to inform traders of how they should proceed moving forward. Measures of volatility have spiked to multi-year highs; the spot VIX has only been higher twice before—in 2008 and in 2020. In volatility environments like these, mechanically deploying capital in directionally neutral strategies has proved efficacious.

Symbol: Equities | Daily Change |

/ESU4 | -3.76% |

/NQU4 | -5.07% |

/RTYU4 | -5.01% |

/YMU4 | -2.73% |

Nasdaq futures (/NQU4) fell over 5% this morning as recession-driven fears accelerated the selling seen over the past two weeks. The plunge puts the Nasdaq on track to record its biggest daily percentage decline since September 2022. Meanwhile, calls for the Federal Reserve to conduct an emergency rate cut are growing. Apple (AAPL) is down over 7% this morning after Warren Buffett’s Berkshire Hathaway dumped about half of its position in the second quarter.

Strategy: (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 14500 p Short 15000 p Short 20500 c Long 21500 c | 56% | +1080 | -8920 |

Short Strangle | Short 15000 p Short 20500 c | 60% | +5315 | x |

Short Put Vertical | Long 14500 p Short 15000 p | 79% | +755 | -9245 |

Symbol: Bonds | Daily Change |

/ZTU4 | +0.23% |

/ZFU4 | +0.45% |

/ZNU4 | +0.60% |

/ZBU4 | +1.17% |

/UBU4 | +1.52% |

Long-term Treasury futures surged this morning as recession fears expanded rapidly amid a surge in market volatility, which is pushing investors into the safe-haven assets. 30-year T-bond futures (/ZBU4) rose over 1% to trade at the highest level since July 2023. The Treasury is set to auction off 13- and 26-week bills today.

Strategy (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 119 p Short 120 p Short 132 c Long 133 c | 57% | +281.25 | -718.75 |

Short Strangle | Short 120 p Short 132 c | 65% | +1500 | x |

Short Put Vertical | Long 119 p Short 120 p | 81% | +140.63 | -859.38 |

Symbol: Metals | Daily Change |

/GCZ4 | -1.41% |

/SIU4 | -4.64% |

/HGU4 | -3.86% |

Gold isn’t immune to today’s selloff despite lower yields and a weaker dollar, with the metal seeing little support from safe haven flows as investors flood into Treasuries. The move is slightly counterintuitive as gold has typically performed well recently when the dollar and yields drop but the market volatility appears to be too much for investors to handle at the moment.

Strategy (51DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2375 p Short 2380 p Short 2460 c Long 2465 c | 22% | +390 | -110 |

Short Strangle | Short 2380 p Short 2460 c | 59% | +9230 | x |

Short Put Vertical | Long 2375 p Short 2380 p | 62% | +220 | -280 |

Symbol: Energy | Daily Change |

/CLU4 | -1.41% |

/HOU4 | -1.96% |

/NGU4 | -0.92% |

/RBU4 | -1.64% |

Crude oil prices (/ESU4) extended losses to start the week as recession fear in the market pushed the commodity lower despite a mostly supportive fundamental picture. Even geopolitical tensions are offering little help to oil after negotiations between Israel and Hamas fell through over the weekend. Eyes are on China, where diesel demand has collapsed, signaling a pullback in industrial activity. Inventory numbers from the American Petroleum Institute (API) due out tomorrow offers the best chance for crude oil to turn around if the data shows inventory draws beyond expectations.

Strategy (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 70 p Short 70.5 p Short 75 c Long 75.5 c | 22% | +390 | -110 |

Short Strangle | Short 70.5 p Short 75 c | 57% | +5350 | x |

Short Put Vertical | Long 70 p Short 70.5 p | 57% | +190 | -310 |

Symbol: FX | Daily Change |

/6AU4 | -0.77% |

/6BU4 | -0.74% |

/6CU4 | -0.19% |

/6EU4 | +0.19% |

/6JU4 | +0.77% |

Japanese yen futures (/6JU4) rose over 2% to trade at the highest level since early January, nearly retracing all its losses this year. Markets are blaming the unwinding of the carry trade in the yen for causing the selloff in risk assets, with traders believing that the low-interest currency was funding risky trades.

Strategy (32DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0069 p Short 0.00695 p Short 0.0071 c Long 0.00715 c | 32% | +450 | -175 |

Short Strangle | Short 0.00695 p Short 0.0071 c | 69% | +2450 | x |

Short Put Vertical | Long 0.0069 p Short 0.00695 p | 67% | +287.50 | -337.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.