Nasdaq 100 Chop Persists; Rising Yields Lift Dollar to Fresh Highs

Nasdaq 100 Chop Persists; Rising Yields Lift Dollar to Fresh Highs

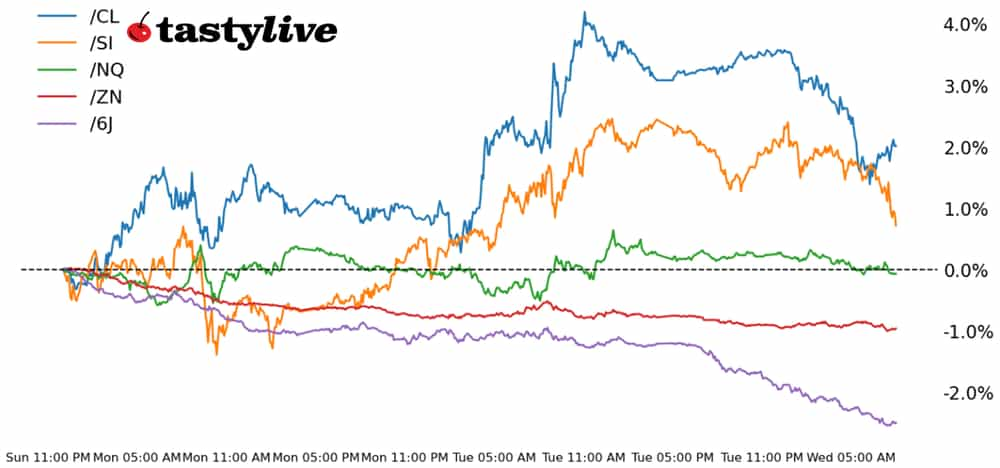

Also, 10-year T-note, silver, crude oil and Japanese yen futures

- Nasdaq 100 E-mini futures (/NQ): -0.42%

- 10-year T-note futures (/ZN): -0.21%

- Silver futures (/SI): -1.73%

- Crude oil futures (/CL): -0.54%

- Japanese yen futures (/6J): -1.31%

Debate over the Federal Reserve's rate cut path is driving yields higher, as traders move away from risk assets. A disappointing set of corporate results also injected some volatility into equity markets. Meanwhile, the push higher in yields is coming alongside dollar strength, weakening the commodity markets. All eyes are on Tesla (TSLA) earnings due out after the bell today.

Symbol: Equities | Daily Change |

/ESZ4 | -0.34% |

/NQZ4 | -0.42% |

/RTYZ4 | -0.54% |

/YMZ4 | -0.57% |

Nasdaq futures (/NQZ4) were tracking lower this morning, threatening to end a five-day win streak. McDonald’s (MCD) fell nearly 7% in pre-market trading after an E. coli outbreak resulted in multiple hospitalizations and one death. Coca-Cola (KO) fell 2.5% ahead of the bell despite beating expectations in its quarterly results. The cola producer is being dragged by McDonalds, which is one of its biggest customers. Boeing (BA) edged lower after losses rose above the $6 billion mark. Spirit Airlines (SAVE) surged after the Wall Street Journal reported Frontier Airlines (ULCC) is considering another bid for the airline operator. Texas Instruments (TXN) gained about 3% after a solid third-quarter report.

Strategy: (37DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 20200 p Short 20250 p Short 20750 c Long 20800 c | 15% | +825 | -175 |

Short Strangle | Short 20250 p Short 20750 c | 50% | +15560 | x |

Short Put Vertical | Long 20200 p Short 20250 p | 57% | +355 | -645 |

Symbol: Bonds | Daily Change |

/ZTZ4 | -0.05% |

/ZFZ4 | -0.14% |

/ZNZ4 | -0.21% |

/ZBZ4 | -0.34% |

/UBZ4 | -0.5% |

The 10-year T-Note futures (/ZNZ4) shed 0.21% ahead of the New York open, as resilient economic data and the looming threat of more deficit spending from a new U.S. administration ahead of the November election. The rise in yields comes despite expectations that the Federal Reserve will cut interest rates again later this year. If the trend in bonds continues, it could start to put pressure on the risk appetite in equity markets.

Strategy (30DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 109.5 p Short 110 p Short 111.5 c Long 112 c | 29% | +359.38 | -140.63 |

Short Strangle | Short 110 p Short 111.5 c | 55% | +1500 | x |

Short Put Vertical | Long 109.5 p Short 110 p | 71% | +156.25 | -343.75 |

Symbol: Metals | Daily Change |

/GCZ4 | -0.19% |

/SIZ4 | -1.73% |

/HGZ4 | -1.21% |

Silver futures (/SIZ4) fell amid rising yields and a stronger dollar. Today’s nearly 2% drop leaves the metal’s gains intact for the week but threatens to inject some further profit taking. However, if the rise in yields moderates over the short term, silver prices are likely to continue higher, especially if global economic indicators remain supportive of growth.

Strategy (33DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 33 p Short 33.25 p Short 35 c Long 35.25 c | 21% | +975 | -265 |

Short Strangle | Short 33.25 p Short 35 c | 56% | +11085 | x |

Short Put Vertical | Long 33 p Short 33.25 p | 57% | +590 | -660 |

Symbol: Energy | Daily Change |

/CLZ4 | -0.54% |

/HOZ4 | -1.02% |

/NGZ4 | +0.52% |

/RBZ4 | -1.48% |

Crude prices (/CLZ4) eased this morning, dropping by about 0.54%, although weekly gains remain following solid gains Monday and yesterday. Crude stocks fell more than expected last week, according to yesterday’s report from the American Petroleum Institute (API). However, a stronger dollar is taking some wind out of the commodity’s sails. Data from the Energy Information Administration (EIA) is due out later today.

Strategy (26DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 69.25 p Short 69.5 p Short 73.25 c Long 73.5 c | 13% | +180 | -70 |

Short Strangle | Short 69.5 p Short 73.25 c | 44% | +5360 | x |

Short Put Vertical | Long 69.25 p Short 69.5 p

| 52% | +130 | -120 |

Symbol: FX | Daily Change |

/6AZ4 | -0.65% |

/6BZ4 | -0.18% |

/6CZ4 | -0.17% |

/6EZ4 | -0.24% |

/6JZ4 | -1.31% |

Japanese yen (/6JZ4) volatility is on the rise as prices fall against a stronger U.S. dollar and rising yields. The yen remains one of the most sensitive currencies to changes in Treasury yields, as the differential between the two countries’ yields drive price action. The upcoming general election will also likely keep the currency’s volatility elevated.

Strategy (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.00645 p Short 0.0065 p Short 0.00665 c Long 0.0067 c | 28% | +450 | -175 |

Short Strangle | Short 0.0065 p Short 0.00665 c

| 56% | +2037.50 | x |

Short Put Vertical | Long 0.00645 p Short 0.0065 p | 67% | +237.50 | -387.50 |

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts #Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.