Nasdaq 100 and Bonds Stage Relief Rally as Trump Tones Down Rhetoric

Nasdaq 100 and Bonds Stage Relief Rally as Trump Tones Down Rhetoric

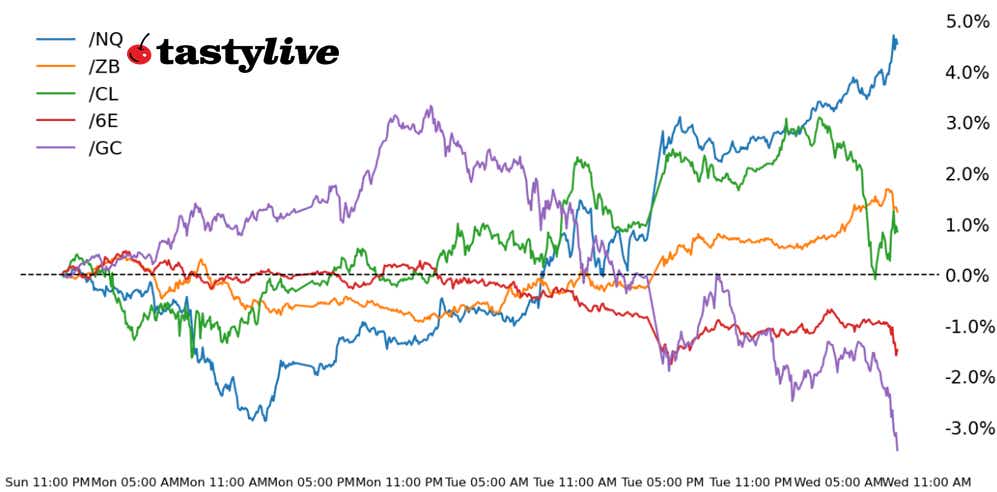

Also, 30-year T-note, gold, crude oil and euro futures

- Nasdaq 100 E-mini futures (/NQ): +3.65%

- 30-year T-note futures (/ZB): +1.21%

- Gold futures (/GC): -3.92%

- Crude oil futures (/CL): -2.12%

- Euro futures (/6E): -0.61%

Funny things can happen in the hour between trading sessions. One might say that’s what happened yesterday and today when President Donald Trump issued a stark about-face in rhetoric that has served as a springboard for a groundswell in risk appetite. In dismissing concern about Federal Reserve independence—the president noted he has “no intention” of firing Fed Chair Jerome Powell—and similarly signaling a softer stance toward the China tariffs, Trump has pulled financial markets away from the precipice (for now).

Symbol: Equities | Daily Change |

/ESM5 | +3.02% |

/NQM5 | +3.65% |

/RTYM5 | +3.9% |

/YMM5 | +2.8% |

U.S. equity markets are surging across the board today, with every S&P 500 sector in positive territory. The Nasdaq 100 (/NQM5) climbed closer to 4% during the session as this note was being written. Volatility is coming in, with the spot VIX dropping below 27.5; VIX futures remain in backwardation, but the curve is close to flattening, which signals the worst of the fear may be in the rearview mirror.

Strategy: (57DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 16500 p Short 16750 p Short 21500 c Long 21750 c | 66% | +950 | -4050 |

Short Strangle | Short 16750 p Short 21500 c | 70% | +5490 | x |

Short Put Vertical | Long 16500 p Short 16750 p | 84% | +555 | -4445 |

Symbol: Bonds | Daily Change |

/ZTM5 | -0.08% |

/ZFM5 | +0.03% |

/ZNM5 | +0.28% |

/ZBM5 | +1.21% |

/UBM5 | +1.71% |

The bond market was unhappy that Fed independence was being threatened. If Trump is true to his word, then it’s no longer under threat. In turn, a reduction in term premium at the long-end of the yield curve is helping the 10-year bonds (/ZNM5) and the 30-year bonds (/ZBM5) stage a turnaround through the middle of the week. While off their highs, both notes and bonds are behaving in a manner that 4.5% in the 10s and 5% in the 30s are pain-points for the administration (and one may trade around them accordingly).

Strategy (58DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 107 p Short 109 p Short 121 c Long 123 c | 62% | +515.63 | -1484.38 |

Short Strangle | Short 109 p Short 121 c | 69% | +1500 | x |

Short Put Vertical | Long 107 p Short 109 p | 81% | +296.88 | -1703.13 |

Symbol: Metals | Daily Change |

/GCM5 | -3.92% |

/SIK5 | +0.08% |

/HGK5 | -0.82% |

Gold prices (/GCM5) were hit hardest by the about-face in Trump’s tone, a clear sign that much of the rally in the safe haven was attached to concerns about the reliability of the U.S. dollar in the global financial system. Silver prices (/SIK5) on the other hand have weathered the storm, finding more favor as a “growth” metal (compared to its golden brethren) on a risk-on day. Volatility is rapidly contracting: gold IVR has dropped from 111.5 yesterday to 72.5 today.

Strategy (63DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2975 p Short 3000 p Short 3625 c Long 3650 c | 66% | +590 | -1910 |

Short Strangle | Short 3000 p Short 3625 c | 73% | +4990 | x |

Short Put Vertical | Long 2975 p Short 3000 p | 86% | +240 | -2260 |

Symbol: Energy | Daily Change |

/CLM5 | -2.12% |

/HOK5 | -1.92% |

/NGM5 | -0.13% |

/RBK5 | -1.89% |

Energy markets have turned the corner, but unlike for other asset classes, not in favor of good news. Indeed, chatter from OPEC+ that output should be hiked as soon as this summer are leading to speculation that markets may be entering a period of oversupply. To this end, if breakeven rates for existing U.S. production resides around 49-53 per barrel, a sustained bump in OPEC+ production could be a play to capture market share from America.

Strategy (54DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 53 p Short 54.5 p Short 72.5 c Long 74 c | 64% | +370 | -1130 |

Short Strangle | Short 54.5 p Short 72.5 c | 71% | +1920 | x |

Short Put Vertical | Long 53 p Short 54.5 p | 78% | +250 | -1250 |

Symbol: FX | Daily Change |

/6AM5 | +0.58% |

/6BM5 | -0.34% |

/6CM5 | -0.26% |

/6EM5 | -0.61% |

/6JM5 | -0.68% |

The anti-greenback trade is taking a breather today because it appears the Fed’s independence isn’t under imminent pressure. After all, Fed Chair Powell is set to depart in May 2026, so why bother to upset the apple cart with just a year remaining? Cooler heads prevailing gives traders a reason to back away from the “safety” of the euro (/6EM5) and the Japanese yen (/6JM5). A light macro calendar through the end of the week keeps focus on the latest twists and turns of the trade saga.

Strategy (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.09 p Short 1.1 p Short 1.17 c Long 1.18 c | 61% | +350 | -900 |

Short Strangle | Short 1.1 p Short 1.17 c | 68% | +1100 | x |

Short Put Vertical | Long 1.09 p Short 1.1 p | 87% | +137.50 | -1112.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.