Nasdaq Futures Hold Week-Long Range as Bonds Recover

Nasdaq Futures Hold Week-Long Range as Bonds Recover

Also, 10-year T-note, silver, natural gas and Japanese yen futures

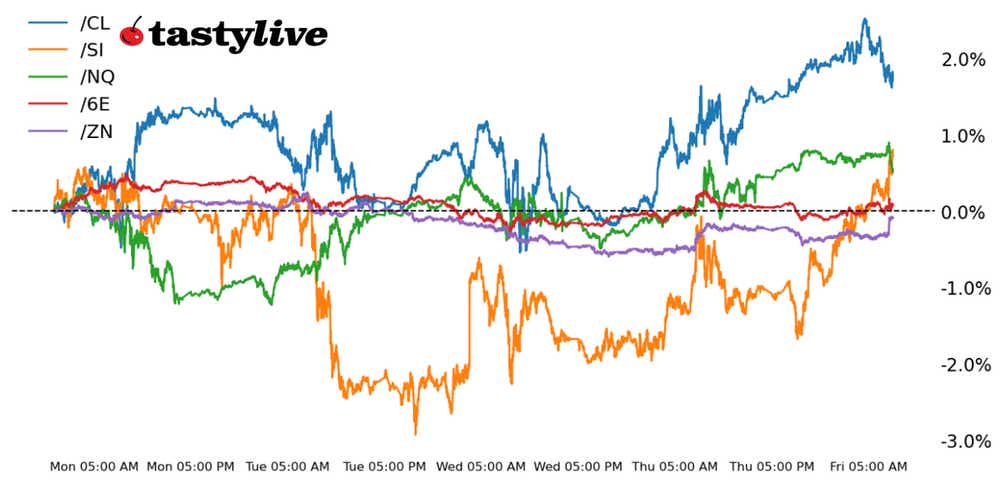

Nasdaq 100 E-mini futures (/NQ): -0.5%

10-year T-note futures (/ZN): +0.24%

Silver futures (/SI): -0.2%

Natural gas futures (/NG): -1.25%

Japanese yen futures (/6J): -0.05%

Jerome Powell’s comments weighed on Treasury yields this morning after the Federal Reserve chair said he sees a disinflation trend, referencing recent economic data that supports that view. That helped equities climb early in the session, with the Nasdaq erasing a 0.5% loss. If this morning’s job openings and labor turnover survey (JOLTS) data supports a softer view of the labor market, it would likely reinforce the case for interest rate cuts happening sooner rather than later.

Symbol: Equities | Daily Change |

/ESU4 | -0.4% |

/NQU4 | -0.5% |

/RTYU4 | -0.21% |

/YMU4 | -0.29% |

Nasdaq contracts (/NQU4) fell this morning, trimming gains from yesterday as traders stand by for commentary from Fed Chair Powell. Tesla (TSLA) rose nearly 5% in early morning trading after the electric vehicle company reported stronger-than-expected deliveries for Q2. Chewy (CHWY) is extending losses despite Keith Gill taking a position in the stock.

Strategy: (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 18750 p Short 19000 p Short 21000 c Long 21250 c | 61% | +1365 | -3635 |

Short Strangle | Short 19000 p Short 21000 c | 68% | +4650 | x |

Short Put Vertical | Long 18750 p Short 19000 p | 82% | +730 | -4270 |

Symbol: Bonds | Daily Change |

/ZTU4 | +0.05% |

/ZFU4 | +0.16% |

/ZNU4 | +0.24% |

/ZBU4 | +0.51% |

/UBU4 | +0.61% |

Bond yields are down across the curve as traders eye JOLTS data due out this morning. 10-year T-note futures (/ZNU4) rose 0.24%, partially retracing yesterday’s losses, which drove prices to the lowest since early June following the U.S. Presidential debate. No auctions from the Treasury are scheduled for today, but the week has plenty of economic data ahead.

Strategy (52DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 106.5 p Short 107 p Short 112 c Long 112.5 c | 63% | +140.63 | -359.38 |

Short Strangle | Short 107 p Short 112 c | 70% | +531.25 | x |

Short Put Vertical | Long 106.5 p Short 107 p | 89% | +62.50 | -437.50 |

Symbol: Metals | Daily Change |

/GCQ4 | -0.35% |

/SIU4 | -0.2% |

/HGU4 | +0.6% |

Nothing has changed for either gold (/GCQ4) or silver prices (/SIU4): The former remains rangebound above 2300, while the latter continues to hold 29 as support. Until these levels break, bears are tilting at windmills. Contracting volatility and heightened political risk in the Western world (to say nothing of increasing debts and deficits) may be helping keep precious metals attractive despite the uptick in U.S. yields and a stronger U.S. dollar.

Strategy (56DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 26.5 p Short 27 p Short 32.5 c Long 33 c | 63% | +700 | -1800 |

Short Strangle | Short 27 p Short 32.5 c | 70% | +3180 | x |

Short Put Vertical | Long 26.5 p Short 27 p | 82% | +345 | -2155 |

Symbol: Energy | Daily Change |

/CLQ4 | +0.95% |

/HOQ4 | +1.39% |

/NGQ4 | -1.25% |

/RBQ4 | +1.23% |

Natural gas prices (/NGQ4) have continued their losing streak, extending it to six in a row amid what has been more than a 20% plunge over the past three weeks. Technical problems are cropping up: Not only has the late-May swing low broken, so too has the uptrend from the February and May swing lows. Volatility has not yet expanded, making fading the move a still-difficult endeavor.

Strategy (56DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.85 p Short 1.9 p Short 2.95 c Long 3 c | 64% | +150 | -350 |

Short Strangle | Short 1.9 p Short 2.95 c | 72% | +1120 | x |

Short Put Vertical | Long 1.85 p Short 1.9 p | 84% | +70 | -430 |

Symbol: FX | Daily Change |

/6AU4 | +0.14% |

/6BU4 | +0.17% |

/6CU4 | +0.16% |

/6EU4 | +0.02% |

/6JU4 | -0.05% |

The recent push higher by U.S. Treasury yields and crude oil prices may be part of the reason why the Japanese yen (/6JU4) continues to fall. The USD/JPY spot rate remains near its highest level since December 1986. Intervention risks run abound, given recent commentary from Japanese policy officials—something to keep in mind as we approach the illiquid, holiday portion of the week.

Strategy (38DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.006 p Short 0.00605 p Short 0.00645 c Long 0.0065 c | 65% | +150 | -475 |

Short Strangle | Short 0.00605 p Short 0.00645 c | 72% | +512.50 | x |

Short Put Vertical | Long 0.006 p Short 0.00605 p | 87% | +62.50 | -562.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.