Nasdaq 100 Gives Back FOMC Gains as Treasury Yields Plunge

Nasdaq 100 Gives Back FOMC Gains as Treasury Yields Plunge

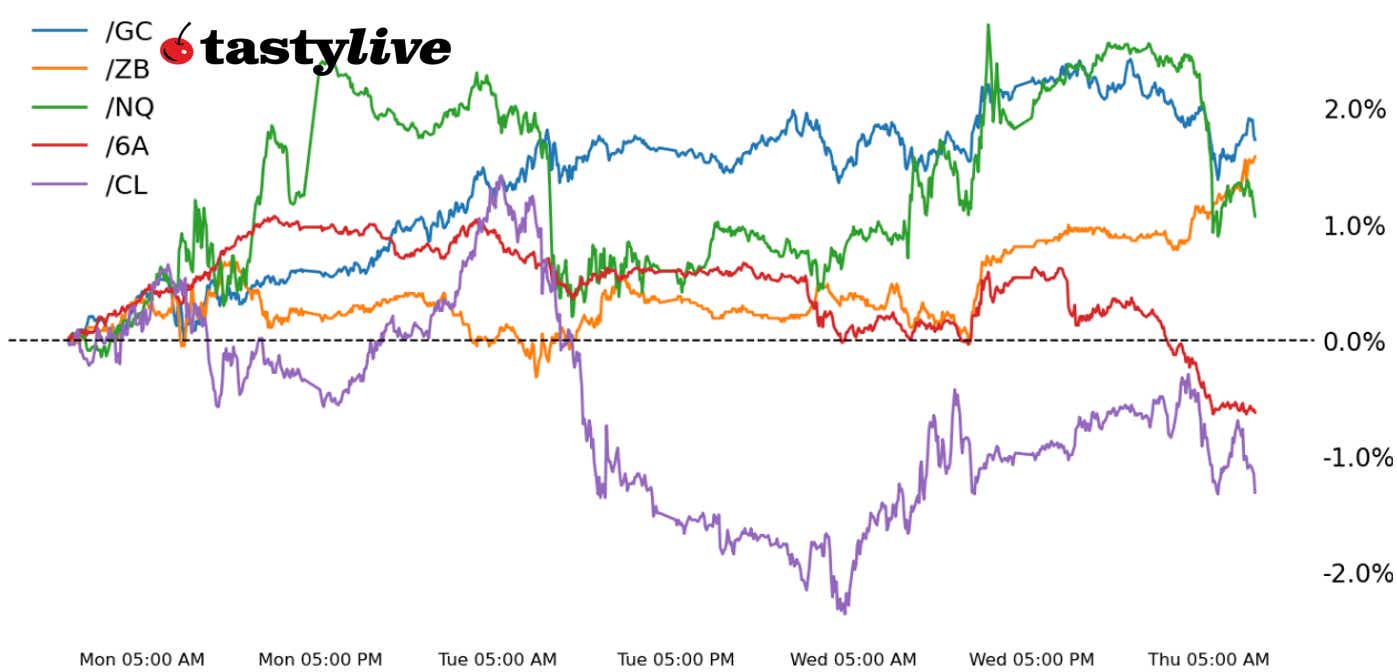

Also, 30-year T-bond, gold, crude oil and Australian dollar futures

- Nasdaq 100 E-mini futures (/NQ): -0.72%

- 30-year T-bond futures (/ZB): +0.98%

- Gold futures (/GC): -0.07%

- Crude oil futures (/CL): -0.03%

- Australian dollar futures (/6A): -1.27%

Markets were feeling hopeful in the wake of the March Federal Open Market Committee (FOMC) meeting but were shot down when European markets opened. A wave of risk aversion has swept across the globe since roughly 4 a.m. EDT, with equities losing all post-FOMC gains and Treasury yields plunging across the curve.

Federal Reserve Chair Jerome Powell’s insistence that policymakers remain in “wait-and-see” mode and that tariff inflation is “transitory” may raise the odds of the Fed following behind the curve. Traders seem to be taking a less growth-friendly approach to positioning today as well, with commodities underwater and the U.S. dollar rallying vs. all of its peers.

Symbol: Equities | Daily Change |

/ESM5 | -0.58% |

/NQM5 | -0.72% |

/RTYM5 | -0.92% |

/YMM5 | -0.48% |

U.S. equity markets continue to see bouts of intraday volatility, oscillating between gains and losses rapidly; to this end, while writing, stocks were rallying back and shaking off their overnight losses. The Nasdaq 100 (/NQM5) remains the most interesting of the four equity indexes, given the continued poor performance of Magnificent Seven tech names since mid-February. Volatility is continuing to retrace, with the spot VIX below 20. Vixpiration and quad witching are likely to produce elevated trading volume through the end of the week.

Strategy: (41DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 18250 p Short 18500 p Short 21500 c Long 22000 c | 65% | +1160 | -3840 |

Short Strangle | Short 18500 p Short 21500 c | 71% | +5020 | x |

Short Put Vertical | Long 18250 p Short 18500 p | 82% | +750 | -4250 |

Symbol: Bonds | Daily Change |

/ZTM5 | +0.11% |

/ZFM5 | +0.29% |

/ZNM5 | +0.46% |

/ZBM5 | +0.98% |

/UBM5 | +1.24% |

Is the Fed running behind the curve to address concern about growth? Is tariff inflation transitory? The bond market may be thinking the answer could be “yes” in both regards, which in turn increases the appeal of the long-end of the curve. Earlier in the session, 30-year bonds (/ZBM5) touched the highest level since March 4, although gains were trailing off amid the equity market rebound. A 10-year TIPS auction is scheduled for today.

Strategy (64DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 112 p Short 114 p Short 123 c Long 125 c | 62% | +593.75 | -1406.25 |

Short Strangle | Short 114 p Short 123 c | 69% | +1390.63 | x |

Short Put Vertical | Long 112 p Short 114 p | 84% | +296.88 | -1703.13 |

Symbol: Metals | Daily Change |

/GCJ5 | -0.07% |

/SIK5 | -1.04% |

/HGK5 | -0.71% |

Metals traded up to fresh yearly highs overnight before a round of profit taking clipped their wings. Gold prices (/GCJ5) set a new all-time high at 3065.20, although a situation similar to mid-February may be setting up: Despite the rally, gold volatility has been trending lower. The drop off in gold vol in mid-February amid the push to new highs preceded a sharp pullback in prices as February came to a close.

Strategy (68DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2630 p Short 2845 p Short 3260 c Long 3275 c | 65% | +430 | -1070 |

Short Strangle | Short 2845 p Short 3260 c | 72% | +4030 | x |

Short Put Vertical | Long 2630 p Short 2845 p | 87% | +170 | -1330 |

Symbol: Energy | Daily Change |

/CLK5 | -0.03% |

/HOJ5 | -0.02% |

/NGJ5 | -2.75% |

/RBJ5 | -0.59% |

Crude oil prices (/CLK5) have been in a holding pattern for most of the month, closing between 65.50 and 67.50 in every session since March 5. Geopolitical headlines are ramping up again, but unlike prior flareups in 2024, there has been no corresponding expansion in volatility; dare we say, it’s all priced in? After a surge yesterday, natural gas prices (/NGK5) are working on an inside day, retracing its one-month exponential moving average (EMA).

Strategy (56DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 58.5 p Short 60 p Short 74 p Long 75.5 c | 62% | +390 | -1110 |

Short Strangle | Short 60 p Short 74 p | 70% | +1590 | x |

Short Put Vertical | Long 58.5 p Short 60 p | 80% | +230 | -1270 |

Symbol: FX | Daily Change |

/6AM5 | -1.27% |

/6BM5 | -0.49% |

/6CM5 | -0.6% |

/6EM5 | -0.76% |

/6JM5 | +0.13% |

The commodity and equities crush during the European session spilled over into FX markets, where traders have been quick to abandon their U.S. dollar short positions. Likewise, the drop in bond yields is helping to insulate the Japanese yen (/6JM5) from steeper losses. The biggest loser on the day remains the Australian dollar (/6AM5), down over 1% while losing the technical breakout condition that developed earlier in the week.

Strategy (50DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.595 p Short 0.61 p Short 0.645 c Long 0.66 c | 61% | +390 | -1110 |

Short Strangle | Short 0.61 p Short 0.645 c | 65% | +580 | x |

Short Put Vertical | Long 0.595 p Short 0.61 p | 83% | +190 | -1310 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.