Nasdaq 100 and Dollar Drop While Gold Soars as Trump Talks of Firing Powell

Nasdaq 100 and Dollar Drop While Gold Soars as Trump Talks of Firing Powell

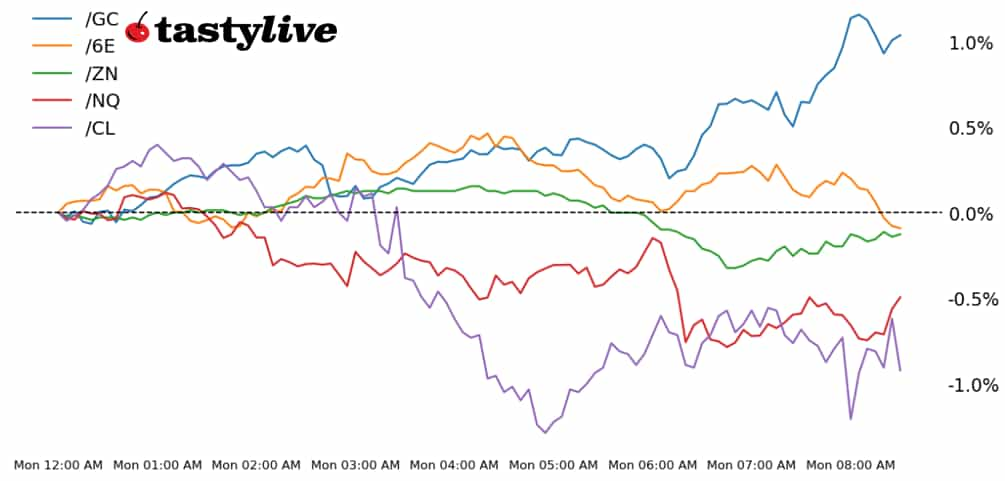

Also, 10-year T-note, gold, crude Oil and euro futures

- Nasdaq 100 E-mini futures (/NQ): -1.59%

- 10-year T-note futures (/ZN): -0.11%

- Gold futures (/GC): +3.17%

- Crude oil futures (/CL): -3.2%

- Euro futures (/6E): +1.3%

“Loose lips sink ships.” The same can be said of public chatter by President Donald Trump and his advisors that they’re looking into the feasibility of firing Federal Reserve Chair Jerome Powell. With a lack of progress in tariff trade talks—look no further than the Japanese delegations disparaging comments over the weekend—traders are back in the mindset of “sell America.” Gold has soared to another new all-time high above 3400, while stocks, bonds and the U.S. dollar are all weaker across the board.

Symbol: Equities | Daily Change |

/ESM5 | -1.15% |

/NQM5 | -1.59% |

/RTYM5 | -0.97% |

/YMM5 | -0.97% |

The U.S. equity market sell-off at the start of the week was deepening as this note was written. The Nasdaq 100 (/NQM5) remains the loss leader to the downside and in the context of broader cross-asset flows, foreigners are deleveraging their U.S. mega cap tech positions. To underscore this point: In 2024, half of all capital deployed by Europeans into equity markets went into the U.S.; in 2025 thus far, only about 3% of European capital is being allocated to U.S. stocks.

Strategy: (39DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 15500 p Short 15750 p Short 20000 c Long 20250 c | 69% | +1090 | -3910 |

Short Strangle | Short 15750 p Short 20000 c | 74% | +5655 | x |

Short Put Vertical | Long 15500 p Short 15750 p | 85% | +615 | -4385 |

Symbol: Bonds | Daily Change |

/ZTM5 | +0.06% |

/ZFM5 | -0.03% |

/ZNM5 | -0.11% |

/ZBM5 | -0.82% |

/UBM5 | -1.03% |

A lack of progress around trade talks has put U.S. Treasuries back in the hot seat at the start of the week. The Japanese trade delegation left the United States without any concept of what the Trump administration is trying to achieve through the negotiations, according to domestic Japanese news. The continued attack by the Oval Office on the independence of the Federal Reserve is likewise raising fears that Trump will try to replace Powell with an ally that will administer monetary policy according to POTUS’ whims.

Strategy (60DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 107 p Short 108 p Short 115 c Long 116 c | 66% | +250 | -750 |

Short Strangle | Short 108 p Short 115 c | 72% | +703.13 | x |

Short Put Vertical | Long 107 p Short 108 p | 86% | +140.63 | -859.38 |

Symbol: Metals | Daily Change |

/GCM5 | +3.17% |

/SIK5 | +1.4% |

/HGK5 | +1.2% |

It’s another strong start to the week for metals, which are finding appeal as alternative stores of value amid the generational repricing of USD-denominated risk. Gold prices (/GCM5) have surged by over 3% to another new all-time high above 3400, a clear sign the underpinnings of the U.S.-led global financial system is under increasing (and perhaps unsustainable) stress. Likewise, talk of firing Fed Chair Powell is proving helpful.

Strategy (65DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 3075 p Short 3125 p Short 3775 c Long 3825 c | 66% | +1270 | -3730 |

Short Strangle | Short 3125 p Short 3775 c | 74% | +6830 | x |

Short Put Vertical | Long 3075 p Short 3125 p | 86% | +550 | -4450 |

Symbol: Energy | Daily Change |

/CLM5 | -3.2% |

/HOK5 | -1.95% |

/NGM5 | -3.08% |

/RBK5 | -2.03% |

Trade data released in recent days coupled with disparaging news flow around trade talks have proven detrimental today for energy. The increasing probability of a sharp global recession gathering pace is becoming too difficult to ignore for crude oil prices (/CLM5). Likewise, positive steps toward a new U.S.-Iran nuclear deal following this weekend’s mediated talks in Rome may be helping to take some geopolitical risk premium out of the market.

Strategy (56DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 52.5 p | 63% | +360 | -1140 |

Short Strangle | Short 54 p | 70% | +1870 | x |

Short Put Vertical | Long 52.5 p | 78% | +240 | -1260 |

Symbol: FX | Daily Change |

/6AM5 | +0.48% |

/6BM5 | +0.9% |

/6CM5 | +0.22% |

/6EM5 | +1.3% |

/6JM5 | +1.03% |

Dedollarization remains a theme of FX markets, with the U.S. dollar (via DXY) dropping to its lowest level in three years. The euro (/6EM5) has jumped above 1.15, while the Japanese yen (/6JM5) has returned to its highest level since October 2024. The stunning lack of support for the greenback in the face of rising U.S. Treasury yields only points in one direction: increasing sovereign risk. That said, there is a bullwhip effect: a weaker dollar hurts other countries’ exports more than it hurts American exports; recession odds in Asia and Europe are increasing.

Strategy (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.1 p Short 1.11 p Short 1.2 c Long 1.21 c | 68% | +300 | -950 |

Short Strangle | Short 1.11 p Short 1.2 c | 74% | +1062.50 | x |

Short Put Vertical | Long 1.1 p Short 1.11 p | 86% | +150 | -1100 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.