Nasdaq and the S&P 500 Hit New Monthly Lows

Nasdaq and the S&P 500 Hit New Monthly Lows

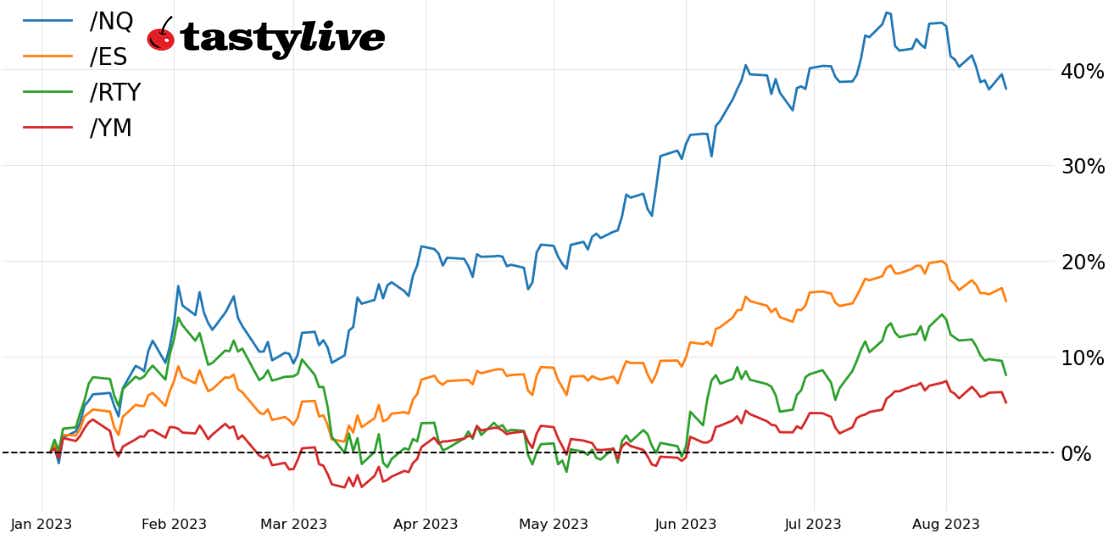

Nasdaq 100 down 4.68% month-to-date

- All four major U.S. indexes were down around 1% on Tuesday.

- Volatility metrics jumped, sticking to the historical script of vol expansion in August.

- Despite being down more than 5% from the /NQ highs in July, a deeper setback is still possible across the board.

As the calendar turns to the second half of the month, U.S. equity index futures are signaling more pain to come.

All four more indexes are in the red month-to-date, led lower by the Russell 2000 Index (/RTY), down by 5.44%. E-mini Nasdaq-100 futures (/NQ) are now down more than 5% from its yearly high. These developments have been underscored by a sustained rise in volatility that usually happens around this time of the year. As we scan the horizon, the near-term bearish impulse is accelerating amid technical support buckling across the board.

/ES S&P 500 price technical analysis: daily chart (August 2022 to August 2023)

Last week we noted that “a near-term top may be forming in S&P 500 futures contracts (/ES). Former highs from June and July around 4480/4500 have provided support thus far during the August downswing … the measured move off the highs, assuming support around 4480/4500 breaks, suggests a move closer to 4360 over the coming weeks.”

It appears that 4480/4500 has decisively given way, with the price action on Tuesday. Momentum remains bearish, with /ES trading below its daily 5-, 13-, and 21-EMA envelope (which is in bearish sequential order. MACD is trending lower and on the cusp of a move through its signal line, while slow stochastics remain mired in oversold territory.

It maintains the case the latter’s behavior is uncharacteristic of how momentum indicators were behaving during short-term pullbacks over the past two and a half months, which confirms that “this time is different.” Focus now shifts to the immediate downside around 4400 (rising trendline from the October 2022 and March 2023 lows) and the measured move at 4360 in the coming sessions.

/NQ Nasdaq 100 price technical analysis: daily chart (August 2022 to August 2023)

/NQ has been in trouble for the entire month, as we observed last week that it “may have the most bearish setup in the short-term … former highs in June and July, which had turned support, have now been broken.” The situation has not improved since then, and despite the bullish outside engulfing bar on Monday—a veritable bottoming signal–no such follow-through was found on Tuesday. The lack of immediate response to a potential technical sign portends a lack of desire by bulls to step back in.

The momentum profile remains bearish. MACD is sliding lower, having just issue a bearish sell signal, while slow stochastics remain in oversold territory. It thus remains: “The path of least resistance appears to be lower in the near-term, setting up a window for a healthy correction (which can be a function of both price and time). A return to the late-June swing low at 14853.50 can’t be ruled out before the uptrend reasserts itself.”

/RTY Russell 2000 price technical analysis: daily chart (August 2022 to August 2023)

The breakdown in /RTY may have taken longer than in /NQ, but it assuredly crossed the Rubicon on Tuesday in textbook fashion: “the June high at 1929.1 may draw in some longs. Failure here would suggest that a return to 1900 – former triangle resistance–may be on the docket over the next few weeks.” The break today has hastened the return to triangle support, which comes in closer to 1885/90 this week. Below there, support doesn’t come into play until 1825/35, the swing highs from April and May as well as the late-June and early-July swing lows.

The behavior of the technical indicators suggest accelerating bearish momentum, to wit. The daily EMA envelope is now in bearish sequential order for the first time since June 1. MACD is close to crossing below its signal line while trending lower since March 7. Slow stochastics are digging deeper into oversold territory. None of these developments appeared during the June/July rally, which underscores the fact that this is no longer a “buy the dip” environment in the short term.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.