Nasdaq 100 Remains Steady While Crude Oil Sinks Amid a Flurry of Trump Executive Orders

Nasdaq 100 Remains Steady While Crude Oil Sinks Amid a Flurry of Trump Executive Orders

Also, 10-year T-note, gold, crude oil and euro futures

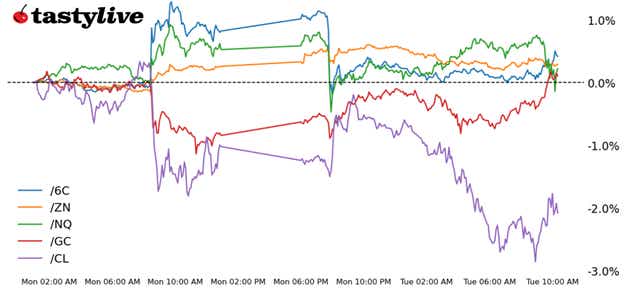

- Nasdaq 100 E-mini futures (/NQ): +0.14%

- 10-year T-note futures (/ZN): +0.22%

- Gold futures (/GC): +0.77%

- Crude oil futures (/CL): -1.93%

- Canadian dollar futures (/6C): +0.53%

Day One of the second Trump presidency is in the rearview mirror, and with it came a flurry of executive orders aimed at reshaping the U.S. economy. Directives to increase U.S. energy supply, reduce immigration and alter trade with Canada and Mexico have already been set forth. Perhaps what wasn’t ordered matters just as much: None of the executive orders related to crypto or tariffs on Chinese goods. In conjunction with the latter, the EO aimed at delaying enforcement of the TikTok ban is setting the stage for the administration to act less aggressively toward China than anticipated.

Symbol: Equities | Daily Change |

/ESH5 | +0.39% |

/NQH5 | +0.14% |

/RTYH5 | +1.23% |

/YMH5 | +0.64% |

U.S. stock futures rose this morning as traders brushed aside the potential impact of tariffs and focused instead on the potential economic benefits from increased fiscal spending, deregulation and tax cuts. Nasdaq futures (/NQH5) rose 0.6% ahead of the opening bell. 3M (MMM) rose nearly 5% after the industrial company reported better-than-expected corporate earnings results. Netflix (NFLX) will report after the bell.

Strategy: (38DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 21300 p Short 21400 p Short 21900 c Long 22000 c | 18% | +1575 | -425 |

Short Strangle | Short 21400 p Short 21900 c | 51% | +14725 | x |

Short Put Vertical | Long 21300 p Short 21400 p | 59% | +680 | -1315 |

Symbol: Bonds | Daily Change |

/ZTH5 | 0% |

/ZFH5 | +0.08% |

/ZNH5 | +0.22% |

/ZBH5 | +0.53% |

/UBH5 | +0.82% |

Treasury futures rose across the curve, with traders pricing in a softer-than-expected path on tariffs. The 10-year T-note futures (/ZNH5) rose 0.3% in morning trading. President Trump appears reluctant to place tariffs on China immediately, but it is still the early days of the administration. If the news flow on tariffs remains positive, it could help to push yields lower in the coming weeks. The Treasury will auction off 52-week bills today.

Strategy (31DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 107.5 p Short 108 p Short 109.5 c Long 110 c | 36% | +312.50 | -187.50 |

Short Strangle | Short 108 p Short 109.5 c | 55% | +968.75 | x |

Short Put Vertical | Long 107.5 p Short 108 p | 73% | +156.25 | -343.75 |

Symbol: Metals | Daily Change |

/GCG5 | +0.08% |

/SIH5 | +0.77% |

/HGH5 | -0.89% |

Gold prices (/GCG5) were lower this morning despite weaker Treasury yields and a softer U.S. dollar. Traders are instead pushing capital into equity markets amid positive news on tariffs and trade. It’s a typical risk-on atmosphere going into the New York session, which should keep gold prices suppressed for the time being.

Strategy (35DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2735 p Short 2740 p Short 2780 c Long 2785 c | 14% | +430 | -70 |

Short Strangle | Short 2740 p Short 2780 c | 55% | +8440 | X |

Short Put Vertical | Long 2735 p Short 2740 p | 64% | +200 | -300 |

Symbol: Energy | Daily Change |

/CLG5 | -1.93% |

/HOG5 | -2.98% |

/NGG5 | -3.7% |

/RBG5 | -0.61% |

Crude oil prices (/CLH5) fell over 2% this morning as traders assessed how delayed tariffs on Canadian imports would affect the U.S. oil complex. Geopolitical risks also receded after Houthis said they would stop attacking commercial ships not linked to Israel. Inventory data from the American Petroleum Institute (API) is due later today.

Strategy (29DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 73.5 p Short 73.75 p Short 77 c Long 77.25 c | 20% | +200 | -50 |

Short Strangle | Short 73.75 p Short 77 c | 54% | +3760 | X |

Short Put Vertical | Long 73.5 p Short 73.75 p | 57% | +110 | -140 |

Symbol: FX | Daily Change |

/6AH5 | +0.91% |

/6BH5 | +1.06% |

/6CH5 | +0.53% |

/6EH5 | +1.16% |

/6JH5 | +0.38% |

Canadian dollar futures (/6CH5) rose this morning after it was revealed Trump wouldn’t levy tariffs on Canada until February instead of immediately. The move sent the Canadian currency to the highest levels since December, but much of the gains were quickly trimmed as trading in New York kicked off. For now, the Canadian dollar remains in a technically vulnerable position with prices trading near the low end of a range carved out since mid-December.

Strategy (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.685 p Short 0.69 p Short 0.705 c Long 0.71 c | 40% | +280 | -220 |

Short Strangle | Short 0.69 p Short 0.705 c | 57% | +810 | x |

Short Put Vertical | Long 0.685 p Short 0.69 p | 73% | +140 | -360 |

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.