Nasdaq 100 Rebound Stalls as Bonds and Yen Bounce Back

Nasdaq 100 Rebound Stalls as Bonds and Yen Bounce Back

Also, 30-year T-note, gold, crude oil and Japanese yen futures

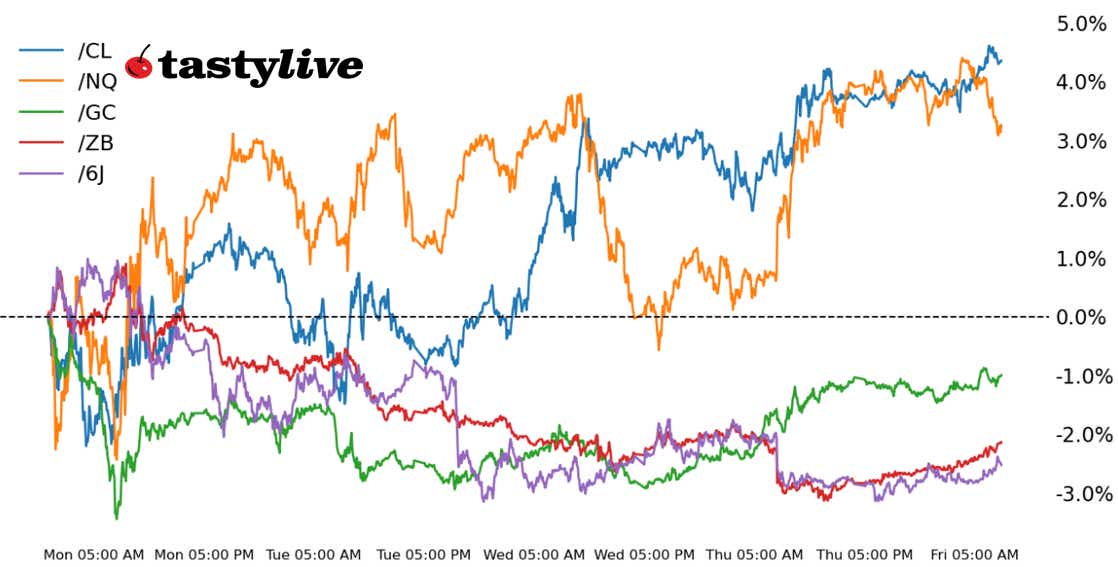

Nasdaq 100 E-mini futures (/NQ): +0.03%

30-year T-note futures (/ZB): -0.38%

Gold futures (/GC): +0.40%

Crude oil futures (/CL): +0.28%

Japanese yen futures (/6J): -0.99%

A week that started with a VIX over 60 and U.S. equity markets down nearly 5% is getting ready to wrap up with barely any damage: both the S&P 500 and Nasdaq 100 are each down by less than 1% since their respective closes last Friday. Derisking ahead of the weekend may be taking place, with the Japanese yen emerging as the top performing currency as U.S. Treasury yields fall across the curve. Meanwhile, all eyes remain on simmering tensions between Israel and Iran, even as public reporting suggests the odds of an Iranian retaliation are dropping.

Symbol: Equities | Daily Change |

/ESU4 | -0.23% |

/NQU4 | -0.42% |

/RTYU4 | +0.13% |

/YMU4 | -0.13% |

Nasdaq futures (/NQU4) fell this morning, trimming 0.5% ahead of the opening bell, after posting the best day since March yesterday. Take Two Interactive (TTWO) rose over 6% in pre-market trading after the game developer said it expects net bookings growth over the next two fiscal years with Grand Theft Auto VI’s launch next year. Paramount Global (PARA) rose 5% ahead of the bell after the media empire reported rosy subscriber growth numbers this morning.

Strategy: (38DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4900 p Short 4950 p Short 5700 c Short 5750 c | 65% | +402.50 | -2097.50 |

Short Strangle | Short 4950 p Short 5700 c | 70% | +2262.50 | x |

Short Put Vertical | Long 4900 p Short 4950 p | 85% | +250 | -2250 |

Symbol: Bonds | Daily Change |

/ZTU4 | +0.02% |

/ZFU4 | +0.18% |

/ZNU4 | +0.33% |

/ZBU4 | +0.74% |

/UBU4 | +1.06% |

30-year T-Bond futures (/ZBU4) rose after three days of losses as investors reassessed the economic outlook. Calls for the Federal Reserve to conduct an emergency rate cut have faded this week, although markets are pricing in a more aggressive path than before last week’s jobs data. Yesterday’s 30-year bond auction was met with poor demand, with a bid-to-cover ratio of 2.31 and a 3.1 basis point tail. The tepid demand comes after a weak 10-year auction.

Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 117 p Short 118 p Short 128 c Long 129 c | 63% | +250 | -750 |

Short Strangle | Short 118 p Short 128 c | 70% | +1062.50 | x |

Short Put Vertical | Long 117 p Short 118 p | 86% | +109.38 | -890.63 |

Symbol: Metals | Daily Change |

/GCZ4 | +0.21% |

/SIN4 | -0.18% |

/HGN4 | +0.53% |

Gold prices (/GCZ4) are in a better technical position after yesterday’s move, which sent prices above its 9-, 12- and 21-day exponential moving averages (EMAs). The move higher in bonds is helping to lift gold prices as investors wait for a possible escalation in the Middle East. Data released earlier this week showed China didn’t buy gold in July, marking the third straight month it hasn’t purchased any after a streak of buying earlier in the year. High prices are likely to blame for the lull in appetite, but if prices drop it could encourage China to resume purchases, as the country looks to diversify its reserves.

Strategy (47DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2300 p Short 2325 p Short 2600 c Long 2625 c | 65% | +670 | -1830 |

Short Strangle | Short 2325 p Short 2600 c | 72% | +2770 | x |

Short Put Vertical | Long 2300 p Short 2325 p | 86% | +380 | -2120 |

Symbol: Energy | Daily Change |

/CLU4 | +0.29% |

/HOU4 | +0.11% |

/NGU4 | +1.88% |

/RBU4 | -0.2% |

Crude oil prices (/CLU4) are on track to break a four-week losing streak as prices rise about 0.5% this morning, putting the commodity on track for a nearly 4% gain for the week. A larger-than-expected inventory draw in oil stocks as reported by the Energy Information Administration helped to lift sentiment as geopolitical tensions in the Middle East remained elevated. An Iranian response to last week’s assassinations of high-ranking Hamas and Hezbollah commanders may not even occur, according to the latest intelligence. Sources have suggested Iran is hesitant to engage in military actions that could drag it into a war with Israel and the United States. Meanwhile, Hezbollah may decide to move forward with its own response without direct support from Iran. Today will bring rig count figures from Baker Hughes.

Strategy (39DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 67 p Short 68 p Short 84 c Long 85 c | 67% | +220 | -780 |

Short Strangle | Short 68 p Short 84 c | 74% | +1370 | x |

Short Put Vertical | Long 67 p Short 68 p | 85% | +140 | -860 |

Symbol: FX | Daily Change |

/6AU4 | -0.31% |

/6BU4 | -0.12% |

/6CU4 | -0.03% |

/6EU4 | -0.05% |

/6JU4 | +0.34% |

Japanese yen futures (/6JU4) rose this morning as the currency tracks toward a nearly unchanged week following last week’s massive surge that caused an unwind of carry trades, which some are blaming as the cause of market volatility that engulfed markets over the past several weeks. The Bank of Japan (BOJ) has assured the world that it would be cautious of policy changes and how they affect the market, but traders are unsure how the BOJ will move to hike rates again. For now, the yen is holding above its 9-day EMA.

Strategy (28DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.00675 p Short 0.0068 p Short 0.00695 c Long 0.007 c | 29% | +425 | -200 |

Short Strangle | Short 0.0068 p Short 0.00695 c | 55% | +1837.50 | X |

Short Put Vertical | Long 0.00675 p Short 0.0068 p | 63% | +262.50 | -362.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday andLet Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater,a tastylive financial writer and analyst, has eight years of markets and trading experience.@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.