Nasdaq 100 Rebound Slows After Disappointing Jobless Claims, Retail Sales

Nasdaq 100 Rebound Slows After Disappointing Jobless Claims, Retail Sales

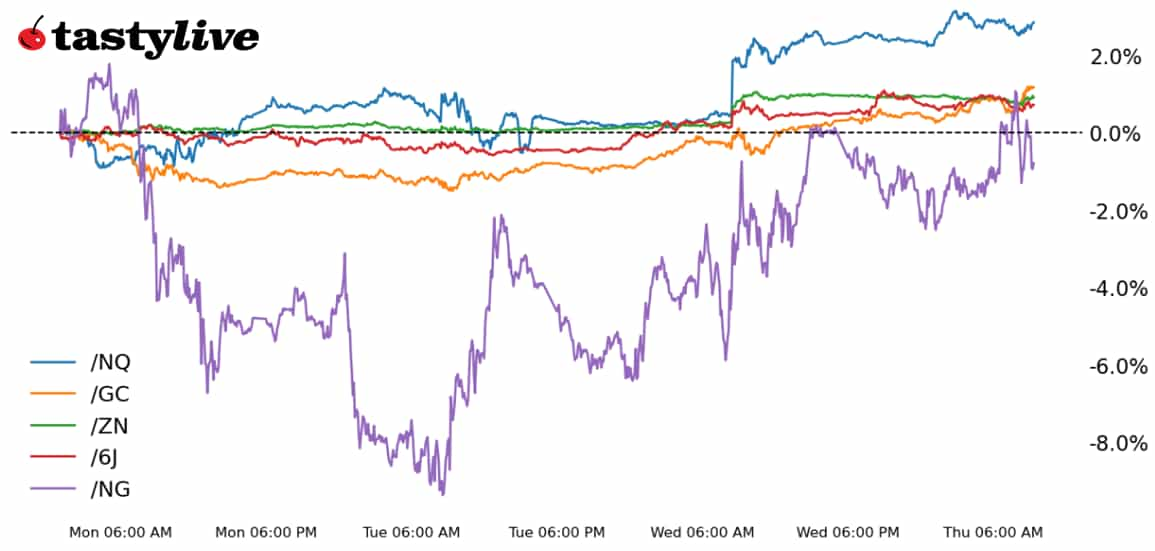

Also, 10-year T-note, gold, natural gas and Japanese yen futures

- Nasdaq 100 E-mini futures (/NQ): +0.1%

- 10-year T-note futures (/ZN): -0.1%

- Gold futures (/GC): +1.09%

- Natural gas futures (/NG): +1.1%

- Japanese Yen futures (/6J): +0.21%

Yesterday’s jubilation across stocks and bonds has been met with more cautious trading today. Disappointing December U.S. retail sales—up 0.4% month-over-month (m/m) vs. the expected 0.6%, alongside an unexpected increase in weekly jobless claims of 217,000 vs. the expected 210,000 undercut improved sentiment overnight, with U.S. equity markets returning close to unchanged on the day at the time of writing. Even as Treasury yields bounce back, precious metals appear to be breaking out.

Symbol: Equities | Daily Change |

/ESH5 | +0.1% |

/NQH5 | +0.1% |

/RTYH5 | +0.1% |

/YMH5 | +0.3% |

Nasdaq futures trimmed earlier gains after jobless claims data cooled risk sentiment. Bank of America (BAC) reported earnings this morning, pushing the stock slightly higher in early trading. The impressive results were in line with other big banks that began reporting earlier this week. Taiwan Semiconductor (TSM) rose 5% in the first hour of trading after the Asian chip manufacturer and Apple (AAPL) supplier reported strong quarterly results and raised guidance for the next quarter.

Strategy: (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 19750 p Short 20000 p Short 22750 c Long 23000 c | 65% | +1150 | -3850 |

Short Strangle | Short 20000 p Short 22750 c | 70% | +4680 | x |

Short Put Vertical | Long 19750 p Short 20000 p | 84% | +635 | -4365 |

Symbol: Bonds | Daily Change |

/ZTH5 | -0.05% |

/ZFH5 | -0.09% |

/ZNH5 | -0.1% |

/ZBH5 | -0.14% |

/UBH5 | -0.16% |

Treasuries trimmed gains early in trading today, following a sharply higher day yesterday because of the inflation figures. Traders have a rate cut by July back on the table, according to market-based bets. Ten-year T-note futures (/ZNH5) fell 0.10% as the New York trading session kicked off. The Treasury will auction off four- and eight-week bills today. President-elect Trump’s Treasury Secretary pick will appear before the U.S. Senate today. Traders will be watching for clues on how fiscal policy and tariffs will play out over the next four years.

Strategy (36DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 105 p Short 106 p Short 110 c Long 111 c | 64% | +218.75 | -781.25 |

Short Strangle | Short 106 p Short 110 c | 68% | +453.13 | x |

Short Put Vertical | Long 105 p Short 106 p | 88% | +93.75 | -906.25 |

Symbol: Metals | Daily Change |

/GCG5 | +1.09% |

/SIH5 | +0.73% |

/HGH5 | +0.36% |

Gold prices (/GCG5) rose over 1% to hit a one-month high this morning. Traders are still expecting the Federal Reserve to cut interest rates later this year, which is a positive for the metal. Meanwhile, uncertainty in the stock market is helping to drive some investors into the metal as a safe-haven bet. If prices can breach above the December swing high at 2,761.30, then the all-time high from October will shift into focus.

Strategy (39DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2620 p Short 2635 p Short 2865 c Long 2880 c | 61% | +510 | -990 |

Short Strangle | Short 2635 p Short 2865 c | 72% | +3610 | x |

Short Put Vertical | Long 2620 p Short 2635 p | 87% | +200 | -1300 |

Symbol: Energy | Daily Change |

/CLG5 | -2.09% |

/HOG5 | +0.21% |

/NGG5 | +1.1% |

/RBG5 | -1.17% |

After hitting the highest levels since April, crude oil prices (/CLH5) pulled back this morning. Traders couldn’t hit the $80 per barrel level, but prices remain on track for the best month since July. Yesterday, the Energy Information Administration (EIA) revealed that oil stocks fell to the lowest level since early 2022. For now, the case for crude oil remains bullish, but the market may pause on the buying until President-elect Trump is sworn in next week.

Strategy (40DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2.7 p Short 2.85 p Short 4.4 c Long 4.55 c | 65% | +360 | -1140 |

Short Strangle | Short 2.85 p Short 4.4 c | 73% | +1730 | x |

Short Put Vertical | Long 2.7 p Short 2.85 p | 80% | +180 | -1320 |

Symbol: FX | Daily Change |

/6AH5 | -0.39% |

/6BH5 | -0.39% |

/6CH5 | -0.42% |

/6EH5 | -0.23% |

/6JH5 | +0.21% |

The small shift higher in U.S. Treasury yields is hurting all major currencies vs. the U.S. dollar but for one: the Japanese yen (/6JH5). Reports from Japan suggest the Bank of Japan (BOJ) is preparing to hike rates next week, a decision driven in part by the Federal Reserve’s inability to continue its rate cut cycle; the BOJ does not want rate differentials blowing out in a manner that lead to another yen-driven cycle of overleveraging and deleveraging. Rates markets are discounting north of an 85% chance of a 25-basis-point (bps) rate hike to bring the BOJ’s main rate to 0.5%.

Strategy (50DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0061 p Short 0.0062 p Short 0.0067 c Long 0.0068 c | 68% | +262.50 | -987.50 |

Short Strangle | Short 0.0062 p Short 0.0067 c | 72% | +575 | x |

Short Put Vertical | Long 0.0061 p Short 0.0062 p | 87% | +125 | -1125 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.