Nasdaq 100 Dips on NVDA, AMD Tariff Charges; Gold Surges to All-Time High

Nasdaq 100 Dips on NVDA, AMD Tariff Charges; Gold Surges to All-Time High

Also, 10-year T-note, gold, natural gas and euro futures

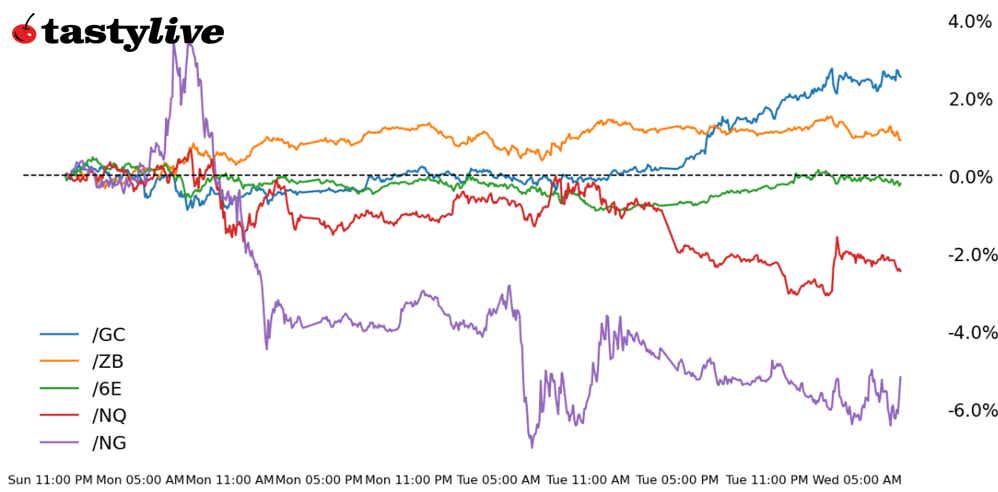

- Nasdaq 100 E-mini futures (/NQ): -1.84%

- 30-year T-note futures (/ZB): -0.19%

- Gold futures (/GC): +2.47%

- Natural gas futures (/NG): -1.68%

- Euro futures (/6E): +0.85%

Another round of dispiriting tariff news is hitting markets through the turn of the week. The Trump administration made another tweak to its China tariff policy overnight, fine tuning the nobs to raise tariff rates on some goods to 245%. While Chinese officials have outlined a series of demands for negotiations, there likewise has been no movement on any significant trade deals out of the White House. Keeping that in mind, a preliminary agreement with Japan might begin to trickle out as soon as today. Are you having trouble keeping up with the tariff twists and turns? You’re not the only one seeing the uncertainty; that’s why gold prices have screamed to fresh all-time highs.

Symbol: Equities | Daily Change |

/ESM5 | -1.03% |

/NQM5 | -1.84% |

/RTYM5 | -0.6% |

/YMM5 | -0.31% |

The Nasdaq 100 (/NQM5) is nearly 2% lower on the session as traders are digesting the reality of tariffs on some of the tech world’s biggest companies. As a result of semiconductor export curbs hitting its H20 AI chips, Nvidia (NVDA) announced it would take a $5.5 billion charge. Similarly, Advanced Micro Devices (AMD) said that it would take a $800 million hit. Both stocks are down meaningfully after the U.S. cash equity open, with the Semiconductor ETF (SMH) the loss leader early in the session. The spot VIX was last seen at 31.68.

Strategy: (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 16250 p Short 16500 p Short 20750 c Long 21000 c | 66% | +1015 | -3985 |

Short Strangle | Short 16500 p Short 20750 c | 71% | +6120 | x |

Short Put Vertical | Long 16250 p Short 16500 p | 83% | +645 | -4355 |

Symbol: Bonds | Daily Change |

/ZTM5 | +0.05% |

/ZFM5 | +0.02% |

/ZNM5 | -0.04% |

/ZBM5 | -0.19% |

/UBM5 | -0.26% |

As the U.S.-led trade war has intensified, traders seem more than willing to bet against the long-end of the curve. Even with U.S. equities selling off to the tune of nearly -2%, traders are not comfortable shuffling into 10s (/ZNM5) or 30s (/ZBM5) as long as U.S. fiscal policy remains on its current track. That said, the Trump administration has seemingly admitted to a pain point with a 10-year yield above 4.5% and a 30-year yield above 5%; swing lows established in the bond market last week may be viable levels of support to trade around.

Strategy (65DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 105 p Short 108 p Short 122 c Long 125 c | 62% | +625 | -2375 |

Short Strangle | Short 108 p Short 122 c | 68% | +1500 | x |

Short Put Vertical | Long 105 p Short 108 p | 81% | +359.38 | -2640.63 |

Symbol: Metals | Daily Change |

/GCM5 | +2.47% |

/SIK5 | +1.76% |

/HGK5 | -1.01% |

Gold (/GCM5) has been the primary beneficiary of the Trump trade war, up now by more than 26% year-to-date. Gold volatility has started to push higher amid the bullish breakout, a contemporaneous indicator that momentum is reinforcing itself to the upside. That said, the convexity in gold is two-way: if there is any sort of positive news related to tariffs that sparks a turnaround in stocks and bonds, precious metals could take a step backward.

Strategy (70DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 3000 p Short 3025 p Short 3625 c Long 3650 c | 64% | +650 | -1850 |

Short Strangle | Short 3025 p Short 3625 c | 72% | +5960 | x |

Short Put Vertical | Long 3000 p Short 3025 p | 85% | +280 | -2220 |

Symbol: Energy | Daily Change |

/CLK5 | +1.08% |

/HOK5 | +1% |

/NGK5 | -1.68% |

/RBK5 | +0.81% |

A weakening demand outlook, partly because of the pullback in global semiconductor supply, is pushing prices (/NGK5) lower this morning. Gas prices have weakened into the spring season, with weak cash prices now affecting the futures market. Bulls are defending the 3.2 level so far, but a drop below that would put the 3 handle in focus. A mild weather backdrop in the U.S. is offering little support for bids. Meanwhile, the pullback in geopolitical pressures offers another bearish factor into the mix.

Strategy (70DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2.5 p Short 2.65 p Short 4.25 c Long 4.4 c | 63% | +510 | -990 |

Short Strangle | Short 2.65 p Short 4.25 c | 73% | +2390 | x |

Short Put Vertical | Long 2.5 p Short 2.65 p | 86% | +200 | -1300 |

Symbol: FX | Daily Change |

/6AM5 | +0.27% |

/6BM5 | +0.32% |

/6CM5 | +0.34% |

/6EM5 | +0.85% |

/6JM5 | +0.35% |

Euro futures (/6EM5) surged back higher today, reversing losses from yesterday when the dollar gained some momentum amid positive risk sentiment in equity markets. This morning’s retail sales data didn’t do anything to subdue the selling in the dollar, with traders expecting that consumers front-loaded purchases ahead of tariffs. The trade war backdrop will likely hamper dollar gains over the short term, which should offer the Euro and non-U.S. currencies some support. The Euro is clearly benefiting from some safe-haven flight from the U.S., as traders struggle to understand the administration’s intent with tariffs.

Strategy (51DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.085 p Short 1.1 p Short 1.18 c Long 1.195 c | 65% | +437.50 | -1437.50 |

Short Strangle | Short 1.1 p Short 1.18 c | 71% | +1150 | x |

Short Put Vertical | Long 1.085 p Short 1.1 p | 86% | +200 | -1675 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. #@fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and #tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.