Nasdaq 100 Leads as Trump Tariff Talk Boosts Yields, U.S. Dollar

Nasdaq 100 Leads as Trump Tariff Talk Boosts Yields, U.S. Dollar

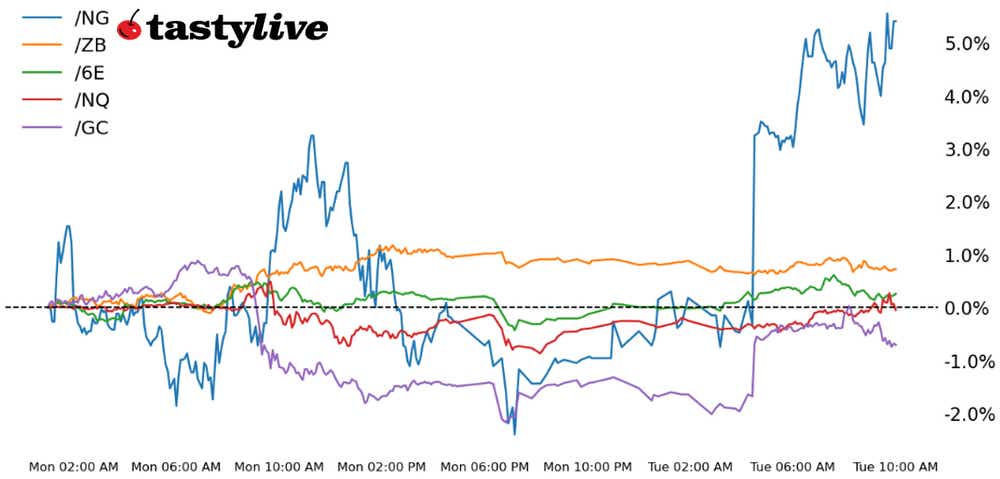

Also 30-year T-bond, gold, natural gas, and euro futures

- Nasdaq 100 E-mini futures (/NQ): +0.42%

- 30-year T-Bond futures (/ZB): -0.48%

- Gold futures (/GC): +0.38%

- Natural Gas futures (/NG): +1.54%

- Euro futures (/6E): -0.25%

President-elect Donald Trump’s tariff announcement last night has proven to be the defining story for markets today. U.S. equity markets are mostly unbothered as Trump’s rhetoric is nothing new. Bonds, on the other hand, are facing a bit more pressure after yesterday’s Bessent bounce. Yesterday’s blood letting in precious metals is finding some reprieve, although action in gold and silver prices hardly speaks of a bottom being formed. Elsewhere, with the tariff talk, the U.S. dollar is up against most of its peers.

Symbol: Equities | Daily Change |

/ESZ4 | +0.36% |

/NQZ4 | +0.42% |

/RTYZ4 | -0.55% |

/YMZ4 | -0.24% |

Stocks are sloshing around today as traders grapple with the implications of Trump’s tariff announcement. Trading volumes are markedly lower than they were this time yesterday as well as below the one-week average in both the S&P 500 (/ESZ4) and Nasdaq 100 (/NQZ4). Volatility continues to contract, with both /ESZ4 and /NQZ4 seeing their IVRs drop below 10.

Strategy: (52DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 19500 p Short 19750 p Short 22500 c Long 22750 c | 65% | +990 | -4010 |

Short Strangle | Short 19750 p Short 22500 c | 70% | +4240 | x |

Short Put Vertical | Long 19500 p Short 19750 p | 86% | +515 | -4485 |

Symbol: Bonds | Daily Change |

/ZTH5 | -0.05% |

/ZFH5 | -0.18% |

/ZNH5 | -0.27% |

/ZBH5 | -0.48% |

/UBH5 | -0.67% |

Notes and bonds are down today as the inflation premium embedded at the long-end of the yield curve has ticked higher in the wake of the Trump tariff announcement. Similar to equity futures, trading volumes are depressed in bond futures. December rate cut odds are ticking higher after the release of the November FOMC meeting minutes. A quartet of data releases at 8:30am ET/7:30am CT tomorrow (durable goods orders, PCE index, GDP, and personal income/spending) represents the last bout of scheduled risk for bonds for the remainder of the week.

Strategy (59DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 112 p Short 114 p Short 123 c Long 125 c | 63% | +562.50 | -1437.50 |

Short Strangle | Short 114 p Short 123 c | 69% | +1203.13 | x |

Short Put Vertical | Long 112 p Short 114 p | 83% | +328.13 | -1671.88 |

Symbol: Metals | Daily Change |

/GCG5 | +0.38% |

/SIH5 | +0.95% |

/HGH5 | -0.83% |

The bloodletting in gold (/GCG5) and silver (/SIH5) may be taking a pause today. Yesterday’s loss by gold prices was the worst single-day performance since June 17, 2021. While gold prices stabilized for a few days, the lows were not found until July 2021. Technical weakness in both /GCG5 and /SIH5 is beginning to round into topping patterns.

Strategy (63DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2475 p Short 2500 p Short 2825 c Long 2850 c | 66% | +670 | -1830 |

Short Strangle | Short 2500 p Short 2825 c | 72% | +3120 | x |

Short Put Vertical | Long 2475 p Short 2500 p | 84% | +350 | -2150 |

Symbol: Energy | Daily Change |

/CLF5 | -0.06% |

/HOF5 | +0.28% |

/NGF5 | +1.54% |

/RBF5 | +0.1% |

Energy markets are in flux as traders contend with the tariff talk, but likewise deflating geopolitical risk premia as it appears that Israel and Hezbollah/Lebanon are moving ever closer to a ceasefire agreement. Natural gas prices (/NGF5) continue to whip around for unrelated reasons, and shifting two-week ahead temperature forecasts are underpinning speculation around short-term demand.

Strategy (63DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2.5 p Short 2.6 p Short 4.7 c Long 4.8 c | 63% | +330 | -670 |

Short Strangle | Short 2.6 p Short 4.7 c | 72% | +2150 | x |

Short Put Vertical | Long 2.5 p Short 2.6 p | 73% | +250 | -750 |

Symbol: FX | Daily Change |

/6AZ4 | -0.71% |

/6BZ4 | -0.23% |

/6CZ4 | -0.64% |

/6EZ4 | -0.25% |

/6JZ4 | +0.42% |

Tariff talk is good news for the U.S. dollar, which is up against most of its major counterparts. Moreover, those currencies directly (Canadian dollar (/6CZ4) and Mexican peso (/6MZ4)) and indirectly (Australian dollar (/6AZ4) via China) impacted by tariffs are struggling the most. Tariffs could raise U.S. real interest rates while deterring U.S. capital from circulating outside of American borders, leaving the greenback uniquely positioned among its peers through the end of 2024.

Strategy (38DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.01 p Short 1.02 p Short 1.07 c Long 1.08 c | 63% | +362.50 | -887.50 |

Short Strangle | Short 1.02 p Short 1.07 c | 68% | +750 | x |

Short Put Vertical | Long 1.01 p Short 1.02 p | 92% | +112.50 | -1137.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.