Nasdaq 100 Leads and Russell 200 Lags as Gold Attempts Breakout

Nasdaq 100 Leads and Russell 200 Lags as Gold Attempts Breakout

Also, 30-year T-bond, gold, natural gas and Australian dollar futures

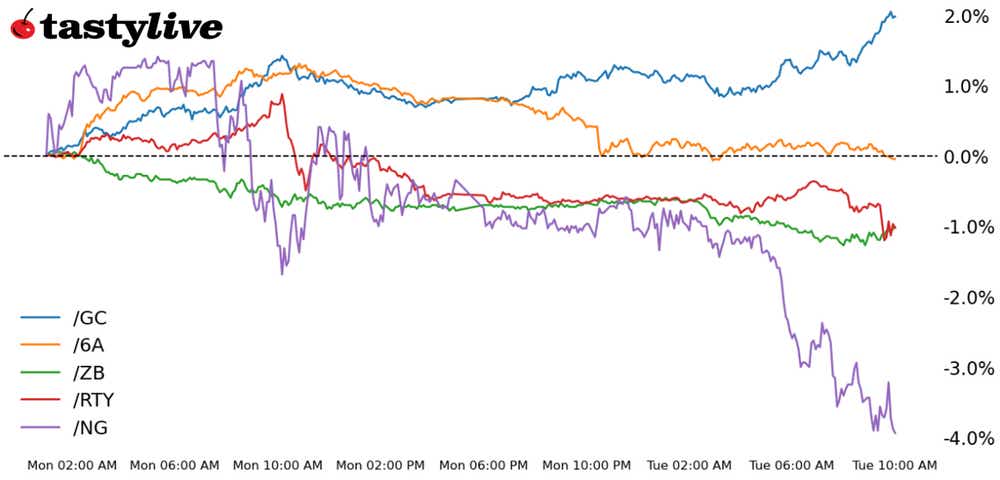

- Russell 2000 E-mini futures (/RTY): -0.42%

- 30-year T-Bond futures (/ZB): -0.31%

- Gold futures (/GC): +1.08%

- Natural Gas futures (/NG): -3.21%

- Australian Dollar futures (/6A): -0.44%

Low trading volume was persisting through early trading today, though U.S. equity markets are showing discouraging signs of rotation internally. Weakening breadth may be attributed to the continued push higher by Treasury yields, which have reversed the entirety of their post-NFP moves. Higher yields are helping prop up the U.S. dollar, which is up across the board. Notably, however, gold prices are attempting to break their multi-week downtrend despite this backdrop.

Symbol: Equities | Daily Change |

/ESZ4 | +0.08% |

/NQZ4 | +0.46% |

/RTYZ4 | -0.42% |

/YMZ4 | -0.17% |

Breadth is deteriorating in U.S. equity markets, with the number of stocks trading above their one-month moving average dropping as traders are rotating back into mega cap tech at the expense of everything else. The Nasdaq 100 (/NQZ4) is back on top of the leaderboard with a near 0.5% gain while the Russell 2000 (/RTYZ4) is a mirror image to the downside. Volatility in equity indexes continues to trend lower, with IVRs in /NQZ4 and the S&P 500 (/ESZ4) below 10 since Nov. 26.

Strategy: (52DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2150 p Short 2225 p Short 2575 c Long 2650 c | 63% | +900 | -2850 |

Short Strangle | Short 2225 p Short 2575 c | 68% | +2030 | x |

Short Put Vertical | Long 2150 p Short 2225 p | 84% | +395 | -3355 |

Symbol: Bonds | Daily Change |

/ZTH5 | -0.05% |

/ZFH5 | -0.12% |

/ZNH5 | -0.2% |

/ZBH5 | -0.31% |

/UBH5 | -0.32% |

Treasuries continue to struggle across the curve on the other side of the weekend. The long-end remains the leader to the downside, although volatility is effectively absent (IVRs at or below 20 in both 10s (/ZNH5) and 30s (/ZBH5)). There is a three-year note auction later today that might jostle 2s (/ZTH5) and 5s (/ZFH5).

Strategy (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 113 p Short 115 p Short 123 c Long 125 c | 66% | +484.38 | -1515.63 |

Short Strangle | Short 115 p Short 123 c | 70% | +875 | x |

Short Put Vertical | Long 113 p Short 115 p | 86% | +250 | -1750 |

Symbol: Metals | Daily Change |

/GCG5 | +1.08% |

/SIH5 | +0.4% |

/HGH5 | -0.48% |

The news that China has resumed its gold buying spree seems to be helping metals weather the headwinds of a stronger dollar and higher yields. Gold prices (/GCG5) have traded to their highest level since Nov. 26, and in turn have started to break the downtrend from the October and November swing highs. Likewise, volatility is starting to expand in the metals, typically a good sign for bulls.

Strategy (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2570 p Short 2585 p Short 2845 c Long 2860 c | 61% | +480 | -1020 |

Short Strangle | Short 2585 p Short 2845 c | 70% | +3200 | x |

Short Put Vertical | Long 2570 p Short 2585 p | 83% | +250 | -1250 |

Symbol: Energy | Daily Change |

/CLF5 | +0.13% |

/HOF5 | +0.13% |

/NGF5 | -3.21% |

/RBF5 | +0.33% |

Energy markets have mostly calmed down as we approach the midpoint of the trading week, although natural gas prices (/NGF5) continue to whipsaw around as traders digest the latest two-week ahead temperature forecasts for the lower 48 states, which show much warmer weather than previously expected moving forward. As a result, front-month gas prices have started to trade below back-month; it’s rare that winter gas prices are cheaper than summer gas prices. The “widowmaker” trade is in full swing as the March/April spread has moved into contango, the earliest such flip in nine years.

Strategy (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2.4 p Short 2.55 p Short 3.8 c Long 3.95 c | 61% | +540 | -960 |

Short Strangle | Short 2.55 p Short 3.8 c | 70% | +1720 | x |

Short Put Vertical | Long 2.4 p Short 2.55 p | 71% | +400 | -1100 |

Symbol: FX | Daily Change |

/6AZ4 | -0.99% |

/6BZ4 | -0.16% |

/6CZ4 | -0.2% |

/6EZ4 | -0.42% |

/6JZ4 | -0.44% |

Doubts over the strength of Chinese stimulus are percolating across asset classes today, and the FX market is exhibit A. The Australian Dollar (/6AZ4) has erased all of yesterday’s gains and is now back to trading at levels that would constitute closing lows for the year. U.S. Dollar strength is broad, with each of the British pound (/6BZ4) and euro (/6EZ4) failing to gain traction with their inverse head and shoulders patterns.

Strategy (59DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.6 p Short 0.61 p Short 0.66 c Long 0.67 c | 67% | +230 | -770 |

Short Strangle | Short 0.61 p Short 0.66 c | 71% | +480 | x |

Short Put Vertical | Long 0.6 p Short 0.61 p | 90% | +100 | -900 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.