Nasdaq 100 Holds Near Highs as Bonds Break Again

Nasdaq 100 Holds Near Highs as Bonds Break Again

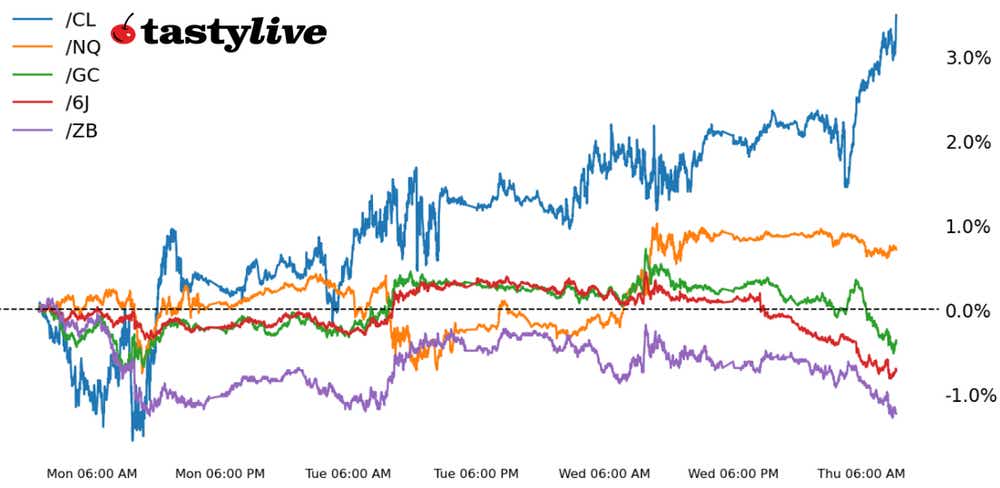

Also 30-year T-bond, gold, crude oil and Japanese yen futures

- Nasdaq 100 E-mini futures (/NQ): -0.11%

- 30-year T-bond futures (/ZB): -0.65%

- Gold futures (/GC): -0.75%

- Crude oil futures (/CL): +1.34%

- Japanese yen futures (/6J): -0.86%

Lackluster earnings results and a thin macroeconomic calendar today have U.S. equity indexes trading sideways to lower at the start of the U.S. cash equity session. But the big move is coming in bonds, where weakness at the long end of the curve is having a knock-on effect through metals and FX. The weekly U.S. jobless claims report came in right on the nose, suggesting the labor market remains resilient.

Symbol: Equities | Daily Change |

/ESH4 | -0.09% |

/NQH4 | -0.11% |

/RTYH4 | -0.09% |

/YMH4 | +0.08% |

Nasdaq 100 E-mini futures (/NQH4) pulled back from all-time highs Thursday morning as traders awaited the next round of data that could influence the Federal Reserve. Tomorrow’s update to the consumer price index is in focus, with the annual revisions expected to recalibrate rate cut bets if they deviate substantially from initial data. This morning’s initial jobless claims figure came in under forecasts, underpinning the narrative that the Fed has some room to start cutting rates.

Strategy: (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 17400 p Short 17500 p Short 18600 c Long 18700 c | 38% | +1075 | -925 |

Short Strangle | Short 17500 p Short 18600 c | 58% | +8410 | x |

Short Put Vertical | Long 17400 p Short 17500 p | 71% | +500 | -1500 |

Symbol: Bonds | Daily Change |

/ZTH4 | -0.05% |

/ZFH4 | -0.15% |

/ZNH4 | -0.27% |

/ZBH4 | -0.65% |

/UBH4 | -0.91% |

A 30-year Treasury bond auction is in focus for bond traders today, but the results will also influence broader market sentiment, especially concerning U.S. equity markets. The Treasury is set to auction $25 billion worth of the bonds, which will close a week of several high-impact auctions. Yesterday, a 10-year auction was met with slightly better-than-expected demand, pressuring the note’s yield. 30-year T-bond futures (/ZBH4) fell about 0.7% ahead of the Wall Street open.

Strategy (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 116 p Short 117 p Short 124 c Long 125 c | 53% | +406.25 | -593.75 |

Short Strangle | Short 117 p Short 124 c | 65% | +1546.88 | x |

Short Put Vertical | Long 116 p Short 117 p | 77% | +250 | -750 |

Symbol: Metals | Daily Change |

/GCJ4 | -0.75% |

/SIH4 | -0.60% |

/HGH4 | -0.72% |

A strong dollar and rising Treasury yields punished gold prices this morning, with /GCJ4) falling 0.64% and extending its weekly loss to nearly 1%. Still, the metal has remained above the crucial 2,000 mark since early December as U.S. yields remained below the highs traded in October. Meanwhile, silver futures (/SIH4) are treading water, remaining above January lows. Tomorrow’s consumer price index (CPI) revisions and next week’s inflation report will likely provide the roadmap for gold’s direction over the next week.

Strategy (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2000 p Short 2010 p Short 2070 c Long 2080 c | 34% | +610 | -390 |

Short Strangle | Short 2010 p Short 2070 c | 57% | +3490 | x |

Short Put Vertical | Long 2000 p Short 2010 p | 71% | +340 | -660 |

Symbol: Energy | Daily Change |

/CLH4 | +1.34% |

/HOH4 | +0.82% |

/NGH4 | -1.17% |

/RBH4 | +1.91% |

Energy markets are continuing to show signs of rebalancing following last week’s aggressive sell-off, with crude oil prices (/CLH4) working on a fourth consecutive daily gain. Although the latest weekly report from the U.S. Energy Information Administration (EIA) showed crude stocks were building faster than anticipated, traders seem more focused on the longer-term outlook provided by the EIA earlier this week: U.S. oil production would not increase in 2024, diminishing a potential supply-side issue for oil.

Strategy (36DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 72 p Short 72.5 p Short 77.5 c Long 78 c | 29% | +350 | -150 |

Short Strangle | Short 72.5 p Short 77.5 c | 57% | +3480 | x |

Short Put Vertical | Long 72 p Short 72.5 p | 65% | +170 | -330 |

Symbol: FX | Daily Change |

/6AH4 | -0.51% |

/6BH4 | -0.38% |

/6CH4 | -0.12% |

/6EH4 | -0.24% |

/6JH4 | -0.86% |

The Japanese yen is faltering against a strong dollar, with futures (/6JH4) breaking into fresh yearly lows as it sinks nearly 1%. Traders will now watch the November low at 0.00672 as a level of support. The Yen has disappointed bulls this year who expected the chance for a pivot in Bank of Japan policy to support the currency. Japan’s commercial banks have increased cash in accounts that draw negative interest in a sign that the country’s bankers are betting on such a policy shift. That is one of the things the central bank encouraged banks not to do with the policy of negative interest.

Strategy (29DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.00655 p Short 0.0066 p Short 0.0069 c Long 000695 c | 66% | +175 | -450 |

Short Strangle | Short 0.0066 p Short 0.0069 c | 72% | +425 | x |

Short Put Vertical | Long 0.00655 p Short 0.0066 p | 85% | +100 | -525 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.