Nasdaq 100 Futures Drop as ‘War Trade’ Returns

Nasdaq 100 Futures Drop as ‘War Trade’ Returns

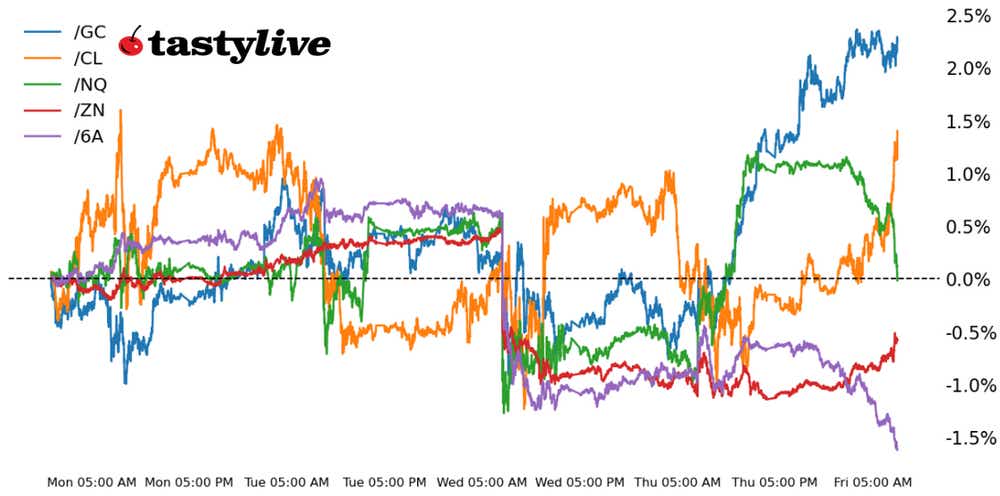

Also 10-year T-note, gold, crude oil and Australian dollar futures

Nasdaq 100 E-mini futures (/NQ): -0.98%

10-year T-Note futures (/ZN): +0.49%

Gold futures (/GC): +1.69%

Crude Oil futures (/CL): +2.39%

Australian Dollar futures (/6A): -0.98%

Disappointing earnings from banks and reports of an imminent attack by Iran against Israel are shaking market confidence as the trading week comes to an end. Price action on Friday has a distinct “war trade” feel, where bonds, crude oil and gold are all higher.

Meanwhile, global equity markets and all currencies except the Japanese Yen are weaker against the U.S. dollar. Like the price action seen last Friday, there appears to be a rapid increase in perceived geopolitical risk heading into the weekend. This may inspire a greater round of deleveraging and shift into defensive positioning before the week comes to a close.

Symbol: Equities | Daily Change |

/ESM4 | -0.83% |

/NQM4 | -0.98% |

/RTYM4 | -0.66% |

/YMM4 | -0.79% |

Nasdaq 100 futures (/NQM4) moved lower this morning, dropping 0.98% as traders moved out of risk assets ahead of the weekend. Markets are bracing for an Iranian response against Israel, which has the potential to broaden the ongoing conflict and plunge the Middle East into a worsening crisis.

Meanwhile, earnings season has officially kicked off this morning, with several big banks, including JP Morgan (JPM) and Citi (C). Those earnings show consumers are struggling under higher interest rates, with Citi reporting higher credit card consumption.

Strategy: (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 16750 p Short 17000 p Short 19500 c Long 19750 c | 67% | +1200 | -3800 |

Short Strangle | Short 17000 p Short 19500 c | 72% | +4280 | x |

Short Put Vertical | Long 16750 p Short 17000 p | 86% | +600 | -4400 |

Symbol: Bonds | Daily Change |

/ZTM4 | +0.15% |

/ZFM4 | +0.33% |

/ZNM4 | +0.49% |

/ZBM4 | +0.81% |

/UBM4 | +0.97% |

Treasuries climbed this morning as traders sought out the safety of bonds amid the rising geopolitical tension in the Middle East. Yesterday’s 30-year auction drew a high yield of 4.671% vs. a when-issued yield of 4.661%, indicating some weakness in demand for the long-dated Treasuries. Auctions from the Treasury will resume next week, with 20-year bonds and five-year TIPs on the radar.

Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 105 p Short 105.5 p Short 111.5 c Long 112 c | 68% | +93.75 | -406.25 |

Short Strangle | Short 105.5 p Short 111.5 c | 73% | +453.13 | x |

Short Put Vertical | Long 105 p Short 105.5 p | 90% | +46.88 | -453.13 |

Symbol: Metals | Daily Change |

/GCM4 | +1.69% |

/SIK4 | +3.65% |

/HGK4 | +2.06% |

The risk-off tone across financial markets is helping to propel gold prices (/GCM4) higher. The metal was up 1.69% ahead of the Wall Street open. The demand for bonds is helping to clear a path for the metal by pushing yields down.

At the same time, geopolitical tensions ahead of the weekend are sucking capital from the equity market. Meanwhile, the gold-silver ratio dropped sharply and is trading at the lowest level since December as silver outpaces gold gains.

Strategy (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2225 p Short 2250 p Short 2550 c Long 2575 c | 64% | +650 | -1850 |

Short Strangle | Short 2250 p Short 2550 c | 72% | +3370 | x |

Short Put Vertical | Long 2225 p Short 2250 p | 86% | +270 | -2230 |

Symbol: Energy | Daily Change |

/CLK4 | +2.39% |

/HOK4 | +1.92% |

/NGK4 | -1.64% |

/RBK4 | +2.15% |

Crude oil prices (/CLK4) surged as open-source intelligence showed that an Iranian attack on Israel appeared imminent, but the commodity is still tracking a loss for the week. The fundamental situation behind oil has likely exhausted the bullish backing for the short term, with China showing some weakness in its export data most recently.

At the same time, Asian crack spreads are moving lower, which should reduce the demand for foreign oil in the region. U.S. stockpiles are rising and should continue that trend for at least the next couple of weeks.

However, markets shouldn’t discount the possibility of a larger geopolitical risk premium being priced in if Iran proceeded with a direct attack on Israel, which would risk dragging other actors into the conflict.

Strategy (34DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 77 p Short 78 p Short 95 c Long 96 c | 65% | +250 | -750 |

Short Strangle | Short 78 p Short 95 c | 73% | +1700 | x |

Short Put Vertical | Long 77 p Short 78 p | 83% | +120 | -880 |

Symbol: FX | Daily Change |

/6AM4 | -0.98% |

/6BM4 | -0.80% |

/6CM4 | -0.58% |

/6EM4 | -0.86% |

/6JM4 | +0.40% |

Australian dollar futures (/6AM4) broke below its April range Friday morning and the currency now threatens the February lows, which mark the bottom for 2024 trading. The risk-sensitive currency is taking a one-two punch from a risk-off mood in U.S. equity markets and weak Chinese economic data. If those factors persist into next week, the currency will likely be in for more pain.

Strategy (56DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.625 p Short 0.63 p Short 0.67 c Long 0.675 c | 64% | +150 | -350 |

Short Strangle | Short 0.63 p Short 0.67 c | 71% | +500 | x |

Short Put Vertical | Long 0.625 p Short 0.63 p | 86% | +90 | -410 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.