Nasdaq 100 Churns in Low Volume After South Korea Declares Martial Law

Nasdaq 100 Churns in Low Volume After South Korea Declares Martial Law

Also, 30-year T-bond, silver, natural gas and Japanese yen futures

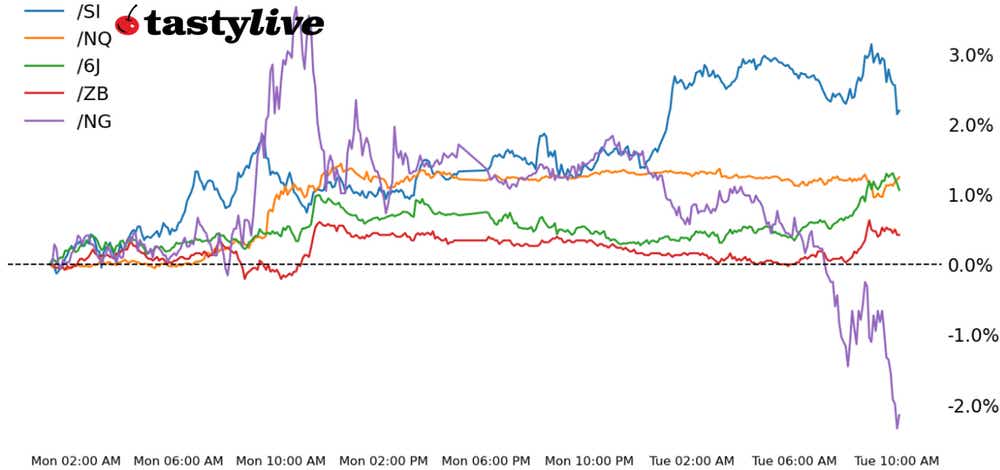

- Nasdaq 100 E-mini futures (/NQ): -0.12%

- 30-year T-bond futures (/ZB): +0.1%

- Silver futures (/SI): +2.06%

- Natural gas futures (/NG): -3.8%

- Japanese yen futures (/6J): +0.33%

Today’s trading remains marked by low volume, although some surprising news this morning is garnering attention from traders. South Korean President Yoon Suk Yeol declared "emergency martial law" earlier today, accusing the opposition of controlling parliament, sympathizing with North Korea and paralyzing the government with anti-state activities. During a televised briefing, Yoon vowed to "eradicate pro-North Korean forces and protect the constitutional democratic order."

When the news hit, bonds rallied and stocks slumped. Semiconductors were hit as well—no surprise because South Korea’s largest company is Samsung, which supplies to Nvidia (NVDA). Overall, S&P 500 companies derive approximately 1.5% of their revenues from South Korea—barely cracking the top 10 foreign countries. Any market reaction to the news seems to be amplified by the soft trading volume.

Symbol: Equities | Daily Change |

/ESZ4 | -0.12% |

/NQZ4 | -0.12% |

/RTYZ4 | -0.43% |

/YMZ4 | -0.24% |

The Nasdaq 100 (/NQZ4) has been the leader this week, surging out of the gate on yesterday only to be met by more tepid conditions on today. Weakness in Tesla (TSLA) may be a contributing factor after a court struck down Elon Musk’s $56 billion pay package. Salesforce (CRM) reports earnings after the closing bell. implied volatility rank (IVR) for /NQZ4 has been below 10 since Nov. 26.

Strategy: (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 19750 p Short 20000 p Short 22250 c Long 22500 c | 60% | +1425 | -3575 |

Short Strangle | Short 20000 p Short 22250 c | 66% | +5005 | x |

Short Put Vertical | Long 19750 p Short 20000 p | 88% | +435 | -4565 |

Symbol: Bonds | Daily Change |

/ZTH5 | +0.11% |

/ZFH5 | +0.07% |

/ZNH5 | +0.03% |

/ZBH5 | +0.1% |

/UBH5 | +0.1% |

Bonds are continuing to twist as geopolitical surprises and stronger U.S. economic data offset one another. The October U.S. job openings and labor turnover survey (JOLTs) report showed an increase in job openings in October, underscoring the continued resiliency of the labor market. The Atlanta Federal Reserve GDPNow growth tracker for 4Q ’24 is up to 3.2% annualized in real terms. Fed interest rate cut odds are steady, holding near 70%. The Treasury auction calendar is light this week, with no major auctions scheduled.

Strategy (52DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 113 p Short 115 p Short 124 c Long 126 c | 66% | +500 | -1500 |

Short Strangle | Short 115 p Short 124 c | 70% | +968.75 | x |

Short Put Vertical | Long 113 p Short 115 p | 86% | +250 | -1750 |

Symbol: Metals | Daily Change |

/GCG5 | +0.16% |

/SIH5 | +2.06% |

/HGH5 | +1.83% |

Political turmoil in South Korea may be helping to resuscitate geopolitical risk broadly speaking, which may be renewing some interest in the recently downtrodden precious metals. While precious metals are teetering on the edge of topping patterns, no discernible breaks have transpired. Silver prices (/SIH5) are staging a modest rebound, although it should be noted that silver volatility continues to trend lower; contracting volatility has been a hallmark of softer price action in 2024.

Strategy (56DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 28 p Short 28.5 p Short 34.5 c Long 35 c | 64% | +725 | -1775 |

Short Strangle | Short 28.5 p Short 34.5 c | 71% | +3350 | x |

Short Put Vertical | Long 28 p Short 28.5 p | 81% | +400 | -2100 |

Symbol: Energy | Daily Change |

/CLF5 | +2.06% |

/HOF5 | +1.86% |

/NGF5 | -3.8% |

/RBF5 | +2.01% |

Crude oil prices (/CLF5) may be enjoying a tailwind from temporarily increased geopolitical risks, but it’s natural gas (/NGF5) that’s in the spotlight on today as traders are continuing to jump ship after the latest two-week ahead temperature forecasts from NOAA. /NGF5 is now down over 8% this week.

Strategy (56DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2.3 p Short 2.4 p Short 3.9 c Long 4 c | 65% | +310 | -690 |

Short Strangle | Short 2.4 p Short 3.9 c | 73% | +1570 | x |

Short Put Vertical | Long 2.3 p Short 2.4 p | 76% | +220 | -780 |

Symbol: FX | Daily Change |

/6AZ4 | -0.07% |

/6BZ4 | -0.03% |

/6CZ4 | -0.11% |

/6EZ4 | +0.1% |

/6JZ4 | +0.33% |

South Korean political turmoil may be helping the long-end of the yield curve, and those lower U.S. Treasury yields are helping to prop up Asia’s regional safe haven, the Japanese yen (/6JZ4). /6JZ4 is on pace to rally for a fifth consecutive session and is quickly approaching the midpoint of its six-month trading range. Elevated volatility in FX futures alongside many markets sitting at relative price extremes may prove appealing for the average tastytrader.

Strategy (66DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0063 p Short 0.0064 p Short 0.0071 c Long 0.0072 c | 68% | +287.50 | -962.50 |

Short Strangle | Short 0.0064 p Short 0.0071 c | 73% | +800 | x |

Short Put Vertical | Long 0.0063 p Short 0.0064 p | 90% | +112.50 | -1137.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.