Nasdaq 100 Churns as Chinese Equity Rally Loses Steam

Nasdaq 100 Churns as Chinese Equity Rally Loses Steam

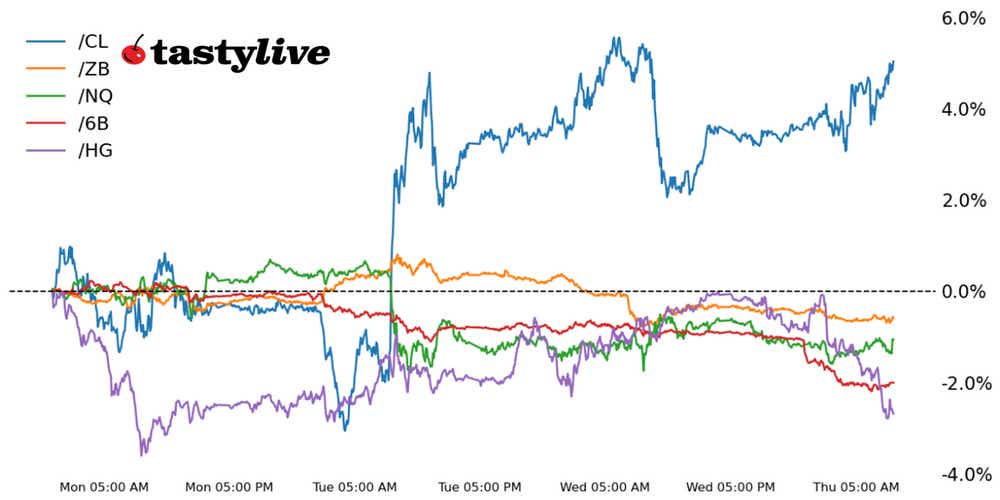

Also, 30-year T-bond, copper, crude oil and British pound futures

- Nasdaq 100 E-mini futures (/NQ): -0.16%

- 30-year T-bond futures (/ZB): -0.2%

- Copper futures (/HG): -2.52%

- Crude oil futures (/CL): +2.51%

- British pound futures (/6B): -1.06%

China’s Golden Week is coming to an end, and traders are beginning to calm down in their run-up of stocks in the world’s second-largest economy. The sugar rush that has been the Chinese stock market (now the world’s best performing year-to-date) seems to have had little overall impact on risk-taking broadly, with commodities (and perhaps bonds) as the only segment of the market to see a significant shift since last week. Elsewhere, tensions continue to percolate in the Middle East, squeezing energy prices further and contributing to the ongoing bump in global bond yields.

Symbol: Equities | Daily Change |

/ESZ4 | -0.32% |

/NQZ4 | -0.16% |

/RTYZ4 | -0.94% |

/YMZ4 | -0.74% |

Nasdaq futures fell this morning after jobless claims data spurred some concerns about the labor market ahead of tomorrow’s jobs report. Wolfspeed (WOLF), a semiconductor company focused on silicon carbide power, fell 7% this morning after an analyst downgraded the outlook, citing supply headwinds. Hims & Hers Health (HIMS) fell 15% in the first hour of trading after the Food and Drug Administration announced that GLP-1 supply shortages have eased. Nvidia (NVDA) rose after the company said that it is seeing strong demand for its next-generation AI processors.

Strategy: (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 18250 p Short 18500 p Short 21750 c Long 22000 c | 66% | +970 | -4030 |

Short Strangle | Short 18500 p Short 21750 c | 71% | +4690 | x |

Short Put Vertical | Long 18250 p Short 18500 p | 84% | +610 | -4390 |

Symbol: Bonds | Daily Change |

/ZTZ4 | -0.08% |

/ZFZ4 | -0.17% |

/ZNZ4 | -0.2% |

/ZBZ4 | -0.23% |

/UBZ4 | -0.23% |

Treasury yields climbed as bond prices fell along the curve, with mixed economic data leaving the rate cut path for the Federal Reserve slightly less dovish than before. The services sector showed a strong performance for September, while jobless claims data ticked higher. Traders remain focused on Federal Reserve Chair Jerome Powell’s commentary from earlier this week, when he said the central bank is in no rush to cut interest rates too quickly. The Treasury will auction four- and eight-week bills today.

Strategy (50DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 116 p Short 118 p Short 128 c Long 130 c | 61% | +578.13 | -1421.88 |

Short Strangle | Short 118 p Short 128 c | 67% | +1359.38 | x |

Short Put Vertical | Long 116 p Short 118 p | 86% | +250 | -1750 |

Symbol: Metals | Daily Change |

/GCZ4 | -0.04% |

/SIZ4 | +0.14% |

/HGZ4 | -2.52% |

The China trade is running out of steam, not just in overseas equity markets but also in global commodity prices. Part and parcel to this belief is yesterday’s dramatic reversal in copper prices (/HGZ4), which are once again finding rejection at the July 2024 swing highs. Nevertheless, sitting at the midpoint of its six-month range with exceptionally high volatility (IVR: 99.4), /HGZ4 is a prime target for tastytraders.

Strategy (53DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4.11 p Short 4.14 p Short 5 c Long 5.15 c | 63% | +600 | -3150 |

Short Strangle | Short 4.14 p Short 5 c | 70% | +2287.50 | x |

Short Put Vertical | Long 4.11 p Short 4.14 p | 81% | +125 | -625 |

Symbol: Energy | Daily Change |

/CLX4 | +2.51% |

/HOZ4 | +1.65% |

/NGZ4 | +3.01% |

/RBZ4 | +1.66% |

Crude oil prices (/CLX4, /CLZ4) continue to experience a high degree of volatility (IVR: 105.7) as traders await the Israeli response to the Iranian missile attack at the start of the week. President Joe Biden said today the U.S. and Israel are weighing hitting Iranian oil facilities; Iran produces just under 3.3 million barrels per day. Iran has previously threatened to retaliate against Saudi and Qatari energy facilities; the prospect of a significant energy supply disruption, centering around the Strait of Hormuz, has increased.

Strategy (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 61.5 p Short 63 p Short 82.5 c Short 84 c | 63% | +420 | -1080 |

Short Strangle | Short 63 p Short 82.5 c | 72% | +2490 | x |

Short Put Vertical | Long 61.5 p Short 63 p | 79% | +250 | -1250 |

Symbol: FX | Daily Change |

/6AZ4 | -0.53% |

/6BZ4 | -1.06% |

/6CZ4 | -0.27% |

/6EZ4 | +0.01% |

/6JZ4 | -0.17% |

One of the few remaining holdouts in the global rate cutting cycle has been the Bank of England (BOE). That’s changed as of today. BOE Gov. Andrew Bailey hinted that aggressive rate cuts were around the corner, a signal that the bank will now fall in line behind the Fed. The prospective closing of rate differentials between the Fed and the BOE is proving unfavorable for the British pound (/6BZ4), which is now having its worst week since July 2023.

Strategy (64DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.255 p Short 1.27 p Short 1.35 c Long 1.365 c | 63% | +275 | -662.50 |

Short Strangle | Short 1.27 p Short 1.35 c | 69% | +681.25 | x |

Short Put Vertical | Long 1.255 p Short 1.27 p | 87% | +131.25 | -806.25 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.