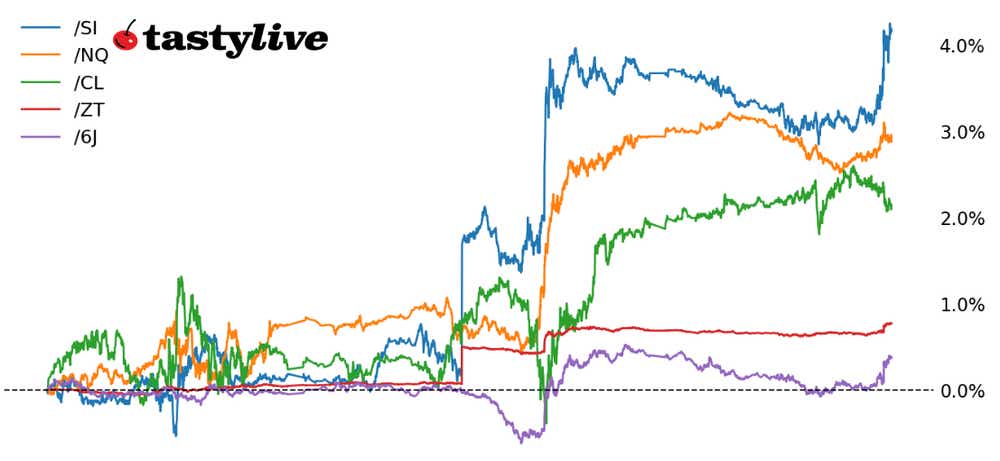

Nasdaq 100, 2-year T-Note, Silver, Crude Oil, and Japanese Yen Futures

Nasdaq 100, 2-year T-Note, Silver, Crude Oil, and Japanese Yen Futures

This Morning’s Five Futures in Focus:

- Nasdaq 100 E-mini futures (/NQ): +0.04%

- 2-Year T-note futures (/ZT): +0.06%

- Silver futures (/SI): +0.35%

- Crude oil futures (/CL): +0.59%

- Japanese yen futures (/6J): -0.04%

A slew of U.S. labor market data has kicked off a retrenchment in Fed rate hike odds over the past 24 hours. Starting with the July U.S. Job Openings and Labor Turnover Survey (JOLTS) report yesterday and continuing with the August U.S. ADP employment change report today, signposts are appearing that the U.S. labor market is cooling off. That's leading traders to speculate that no further rate hikes will be needed. The rebound in U.S. equities, U.S. Treasuries, and precious metals has continued, while the U.S. dollar sell-off has accelerated.

Symbol: Equities | Daily Change |

/ESU3 | +0.04% |

/NQU3 | +0.04% |

/RTYU3 | -0.19% |

/YMU3 | +0.11% |

So much for range trading this week. Each of the S&P 500 (/ESU3), the Nasdaq 100 (/NQU3), and the Russell 2000 (/RTYU3) have traded above the daily outside engulfing bars/key reversals set last Thursday, suggesting that the technical path of least resistance is now to the upside. Even though liquidity conditions are thinning out ahead of the Labor Day holiday, it makes sense that volatility could see another kick higher at the end of the week with the release of the August U.S. nonfarm payrolls report.

Strategy: (15DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 15150 p Short 15200 p Short 15600 c Long 15650 c | 30% | +655 | -345 |

Long Strangle | Long 15150 p Long 15650 c | 43% | x | -4545 |

Short Put Vertical | Long 15150 p Short 15200 p | 67% | +290 | -710 |

Symbol: Bonds | Daily Change |

/ZTU3 | +0.06% |

/ZFU3 | +0.15% |

/ZNU3 | +0.18% |

/ZBU3 | +0.26% |

/UBU3 | +0.15% |

While “staying high for longer” remains the primary focus of bond markets, no further rate hikes are currently being priced in, according to /ZQ and /SR3 futures curves. To this end, there has been a rapid adjustment across the U.S. Treasury yield curve, thanks to a meaningful rally in 10-year Notes (/ZNU3) and 30-year Bonds (/ZBU3). Evidence is piling up in the options market that bonds may have bottomed out for at least the next several weeks.

Strategy (23DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 101 p Short 101.125 p Short 101.875 c Long 102 c | 27% | +125 | -125 |

Long Strangle | Long 101 p Long 102 c | 55% | x | -421.88 |

Short Put Vertical | Long 101 p Short 101.125 p | 97% | +15.63 | -234.38 |

Symbol: Metals | Daily Change |

/GCV3 | +0.43% |

/SIU3 | +0.35% |

/HGU3 | -0.07% |

Gold prices (/GCV3) are inching higher against its 50-day exponential moving average (EMA) this morning as economic woes in Europe deepened after inflation data in Germany and Spain came in above expectations, causing yields to shoot higher across the Eurozone. Silver prices (/SIU3) have hit fresh monthly highs. A weaker-than-expected print (+177,000 actual versus +195,000 expected) in the U.S. ADP jobs data for August also helped to boost precious metals amid cooling speculation of further Fed rate hike bets.

Strategy (27DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 24.85 p Short 24.9 p Short 25.6 c Long 25.65 c | 19% | +200 | -50 |

Long Strangle | Long 24.85 p Long 25.65 c | 45% | x | -4255 |

Short Put Vertical | Long 24.85 p Short 24.9 p | 58% | +110 | -140 |

Symbol: Energy | Daily Change |

/CLV3 | +0.59% |

/NGU3 | -0.89% |

Crude oil (/CLV3) is up about $0.51 per barrel after the American Petroleum Institute (API), on Tuesday, reported a larger-than-expected inventory draw of 11.49 million barrels for the week ending Aug. 25. All eyes are on today’s report from the U.S Energy Information Administration. Meanwhile, a Bloomberg survey shows that traders expect Saudi Arabia to extend its production cut into October.

Strategy (14DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 80.25 p Short 80.5 c Short 82.75 c Long 83 c | 19% | +200 | -50 |

Long Strangle | Long 80.25 p Long 83 c | 51% | x | -2210 |

Short Put Vertical | Long 80.25 p Short 80.5 c | 58% | +110 | -140 |

Symbol: FX | Daily Change |

/6AU3 | +0.46% |

/6BU3 | +0.41% |

/6CU3 | +0.16% |

/6EU3 | +0.43% |

/6JU3 | -0.04% |

The dramatic repricing of Fed rate hike odds over the past 24-hours has had a seismic impact on FX markets. The daily bearish outside engulfing bar/key reversal in the DXY Index has been led by significant rallies in the British pound (/6BU3) and the euro (/6EU3). Our focus, however, is on the Japanese yen (/6JU3), which continues to linger near its November 2022 Yentervention level. A pullback in U.S. Treasury yields may be curating a more favorable environment for the Japanese Ministry of Finance to step into the market to prop up the yen.

Strategy (9DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.00675 p Short 0.006775 p Short 0.006975 c Long 0.007 c | 57% | +75 | -237.50 |

Long Strangle | Long 0.00675 p Long 0.007 c | 32% | x | -112.50 |

Short Put Vertical | Long 0.00675 p Short 0.006775 p | 80% | +31.25 | -281.25 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.