Naked Risk is Slightly Clothed | Managing Risk

Naked Risk is Slightly Clothed | Managing Risk

By:Josh Fabian

At tastylive, we talk a lot about selling naked options. Sometimes we sell them as part of a strategy like a strangle. Other times, we might just sell a call by itself because we’re bearish and the premium is attractive. This type of trade has what we call undefined risk. But is the risk realllllly undefined?

Let’s discuss.

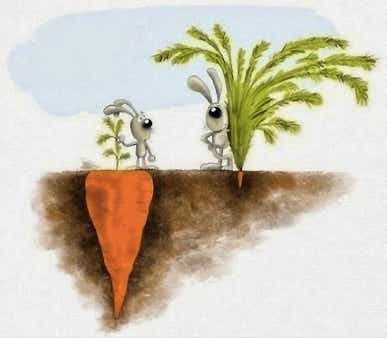

When selling a put, we know our maximum loss occurs if the stock falls to zero. Yes, we did collect some premium initially when selling the put, but trust us, if a stock goes to zero, we won’t be patting ourselves on the back over that premium. Still, we know the furthest a stock can fall is zero and that allows us to easily quantify a theoretical worst case scenario.

Calls, on the other hand, are different. Because a stock can theoretically go to infinity, we don’t have that zero boundary like we have when selling a put. What’s to say Apple (ticker: AAPL) can’t go to $200, $300 or even $1,000 within a set time period? How do we know where our risk is if we sell a naked call? And what would it take for a stock to go infinitely high? Every asset and future asset into perpetuity (think every can of beans and every future can of beans) on our planet and nearby heavenly bodies would have to be used to buy that stock. Could it happen? I’ll let you speculate on that.

That’s why there is a big difference between theoretical and statistically likely risk of a short call. We are much more concerned with probabilistic outcomes and not what’s theoretically possible. When determining strike price selection for options that we want to sell, we can use a stock’s expected move for help.

The expected move calculation allows us to determine a one standard deviation move. One standard deviation is the amount by which we can expect a stock to move, up or down, 68% of the time. Doubling a stock’s expected move allows us to determine how far a stock will move 95% of the time (or two standard deviations). Tripling the move allows us to see how far the stock will move 99.7% of the time (or three standard deviations).

What about that 0.3%? Well, that’s what we’re referring to when we discuss a “black swan” event. Yes, it is possible for a stock to move more than three standard deviations but it is not a likely outcome. That is risk we are willing to take. Beyond a black swan? Start hoarding those cans of beans.

At tastylive, we tend to focus on selling premium around that one standard deviation. That is where we typically get the best risk vs. reward. Premium offered near those two and three sigma moves usually is not worthwhile for us.

So if you want to impress your next Tinder date, ask him/her to pick a stock, any stock. Calculate the expected move and then bet a second date the stock will move within that one standard deviation. On second thought, don’t do that unless you don’t want that second date.

Josh Fabian has been trading futures and derivatives for more than 25 years.

For more on this topic see:

From Theory to Practice | Expected Move Calculation: January 27, 2016

The Skinny on Options Math | The Skinny on Expected Moves: February 12, 2015

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.