My Year-Long (Crypto) Trade for 2025

My Year-Long (Crypto) Trade for 2025

By:Mike Butler

Mike Butler intends to collect premium on this iShares Bitcoin Trust strangle. Here's his plan.

- IBIT is a very clean exposure to the price change of bitcoin.

- With a price point of $55 and immense liquidity, strategies are limitless for a mid-size account.

- Similar to DraftKings in 2024, Mike will hold short premium in IBIT for the entirety of 2025..

- If realized volatility is less than implied volatility at the end of the year, it should be a nice trade with a high return on capital.

The new crypto product on the block is the iShares Bitcoin Trust (IBIT). It’s a very clean way to gain exposure to the price movement of bitcoin, and the options market recently opened. With a price point of around $55 currently, many different-sized brokerage accounts can partake in bullish, bearish or neutral assumptions on bitcoin's price movement.

One of the big barriers to entry for bitcoin is the process required to acquire an actual bitcoin if the intention is cold storage. IBIT seeks to remove this barrier to entry with a pure exposure to bitcoin listed on the NASDAQ. Recently, IBIT has had more stock trading volume than the S&P 500 ETF (SPY).

IBIT strangle—options strategy decision

When it comes to short premium strategies with a long time horizon, the goal is to collect as much extrinsic value as possible over time. Similar to my 2024 year-long trade in DraftKings (DKNG), I see no issue with the potential to collect a lot of extrinsic value by the end of 2025.

Extrinsic value offsets intrinsic value risk beyond the strikes for short premium trades, so a large collection at the end of the year will push my breakevens well below the put strike, and well above the call strike for a strangle that's rolled through the year. The goal is to have the stock price stay within the range I set with my strikes while collecting extrinsic value through the year.

In DraftKings, I started with a 35 strike straddle and collected about $4.00 or $400 real dollars in premium. By the end of the year, I collected over $1,800 in extrinsic value. The net profit on the trade was around $1,100 using about $800 in buying power.

On 12/23/24 I sold a 50/65 strike strangle in IBIT and collected $5.65, with the stock price around $53.

IBIT has a high implied volatility (IV), and likely will throughout the year, making it easier to collect extrinsic value premium relative to notional value risk. The higher implied volatility is, the more extrinsic value premium there is in the options market compared to a low implied volatility product. This means I'll be able to get far away from the current stock price, and also collect a good amount of premium in doing so.

The best-case scenario for an IBIT Strangle

The best case scenario for any short premium options strategy is for the options to expire out-of-the-money (OTM) and worthless. With a strangle, this is also true as the strategy consists of a short OTM put and a short OTM call sold in the same expiration cycle. The nice aspect of a year-long strangle is that I know I'll be in the trade the whole year, so I have the ability to take aggressive stances if the market moves in a big way.

Either way, the ideal scenario is for IBIT to chop around between the 50-65 strikes, and I'll roll each month to collect more and more premium. If I keep the strikes the same, the more premium I collect the wider my breakevens move beyond the strikes.

I assume I'll move the strikes through the year as IBIT moves around, but the idea is the same—collect a lot of extrinsic value, manipulate the strikes as the market moves to ensure I'm maximizing extrinsic value and have the stock price stay within the implied volatility projected through the year.

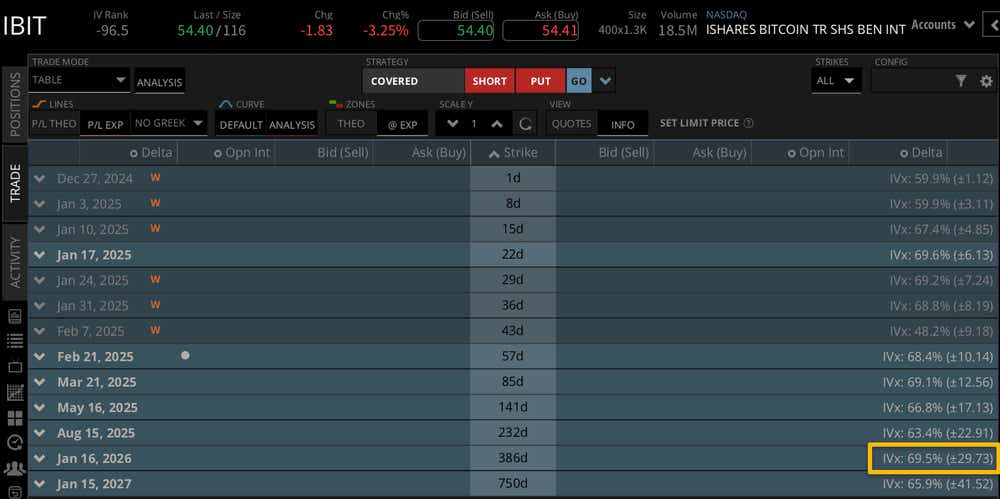

Currently, IBIT has a +/- $29.73 price range through the January 2026 cycle. With a stock price of $55, that means IBIT has a price range of $25.27-84.73. If IBIT stays within that range, implied volatility would have overstated realized volatility, and short premium strategies should flourish.

The worst-case scenario for an IBIT Strangle

The worst-case scenario for an IBIT strangle is simply for the stock price to move well outside of the expected range. If this happens slowly over time, it's not as much of a problem for a strangle that can be manipulated through the months. If it happens quickly and it's one-sided, that's truly the worst-case scenario, because intrinsic value can quickly outweigh extrinsic value collections.

For example, if IBIT drops from $55 to $10 in February and never recovers, my $50 strike will be underwater and I won't collect enough extrinsic value to offset intrinsic value losses.

If IBIT rallies from $55 to $200 in March, the same concept applies—my short call at $65 will have substantial losses and I won't have the ability to move strikes up in time to offset intrinsic value losses.

Strangle defense tips

With all that said, we do have a lot of flexibility with strangles in products we can afford that also have high implied volatility. Rolling strangles out in time, or any short premium strategy for that matter, is simply a transaction of buying back the current options and selling new options further out in time.

In a high-IV product, the credit collected from those rolls will be significantly higher than a low-IV product. Rolling from February to March will yield a credit of dollars instead of cents, and those dollars can be given up to move the strikes further OTM.

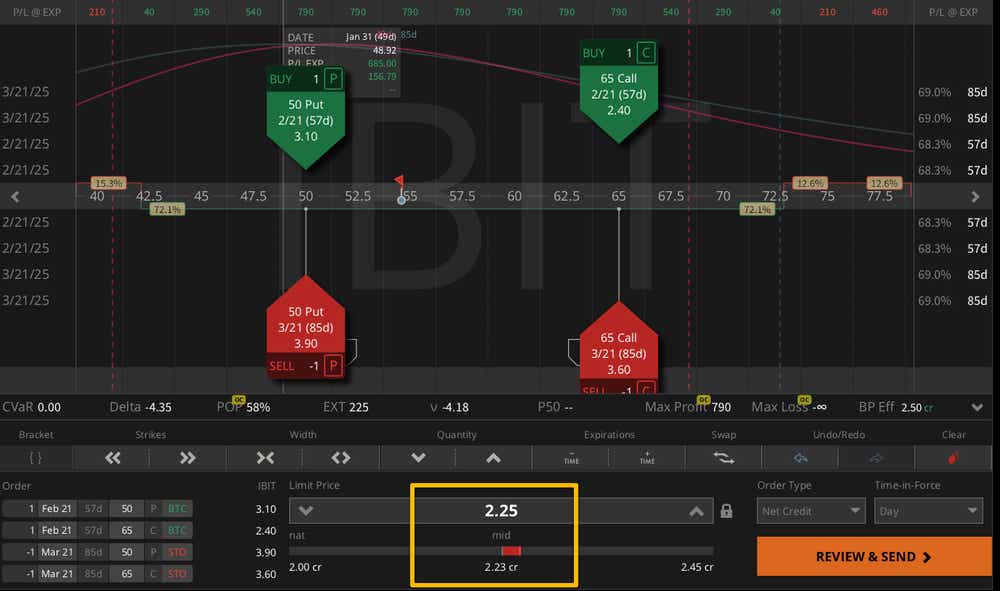

For example, if I roll the IBIT strangle from February to March right now and use the same strikes, I could collect a $2.25 credit. This brings my total credit received from $5.65 to $7.90, and offsets my current breakevens another $2.25 beyond the put and call strikes.

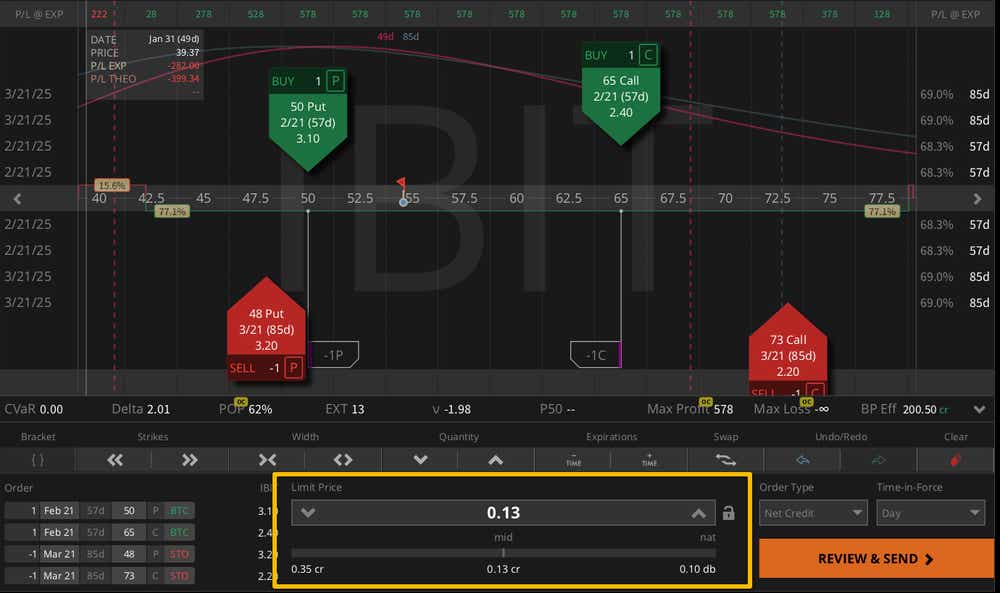

Instead, I could choose to give up the credit and move my strikes further OTM. I could roll from February to March, and move my NEW strikes to the 48/73 strangle:

This would still net a credit of around $0.13 which is meaningless, but the new strikes of 48 on the downside and 73 on the upside would significantly move my breakevens.

Not with a bigger credit, but by shifting strikes further from the stock price.

This is the kind of flexibility that we can execute with short premium in trades in high-IV stocks, as long as the stock doesn't move in one direction too quickly.

Be sure to follow the progress of my year-long trade in IBIT on the tastytrade follow page, and check out Options Trading Concepts Live from 11 a. to 12 p.m. CST every day the stock market is open!

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.