How to Manage the 5 Biggest Risks to Your Portfolio

How to Manage the 5 Biggest Risks to Your Portfolio

By:Kai Zeng

The stock market has shown incredible resilience, and now it’s time to safeguard your gains

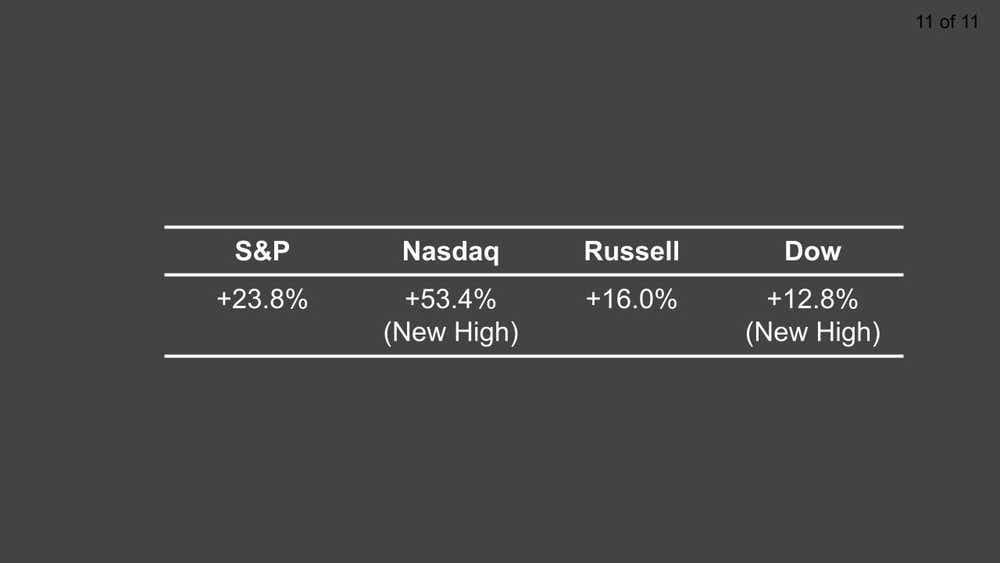

Despite the challenges we faced at the beginning of 2023, the stock market has shown incredible resilience. The NASDAQ Composite Index has performed exceptionally well with an annualized return of over 53% (2023), exceeding recovery levels seen in 2009.

As we celebrate the market's rebound and anticipate potential lower interest rates, it is important to remain cautious and protect our gains by effectively managing these portfolio risks:

• Market directional risk

• Correlation risk

• Allocation risk (BPR/Capital Risk)

• Tail risk

Let’s look at each in more detail.

Directional risk

Directional risk is a significant factor to consider in any trade because it is closely tied to the trade's delta. A lower delta indicates lower directional exposure, while a higher delta increases the risk exposure. As part of risk management, it is essential to assess the overall directional risk of your portfolio.

This can be done through the use of Beta Weighted Delta, using the SPDR S&P 500 ETF Trust (SPY) as a benchmark. If your portfolio's delta leans too heavily toward either long or short positions, it may be necessary to reassess and realign with the current market conditions and your long-term strategy. This ensures your portfolio is sufficiently diversified and minimizes the impact of directional risk.

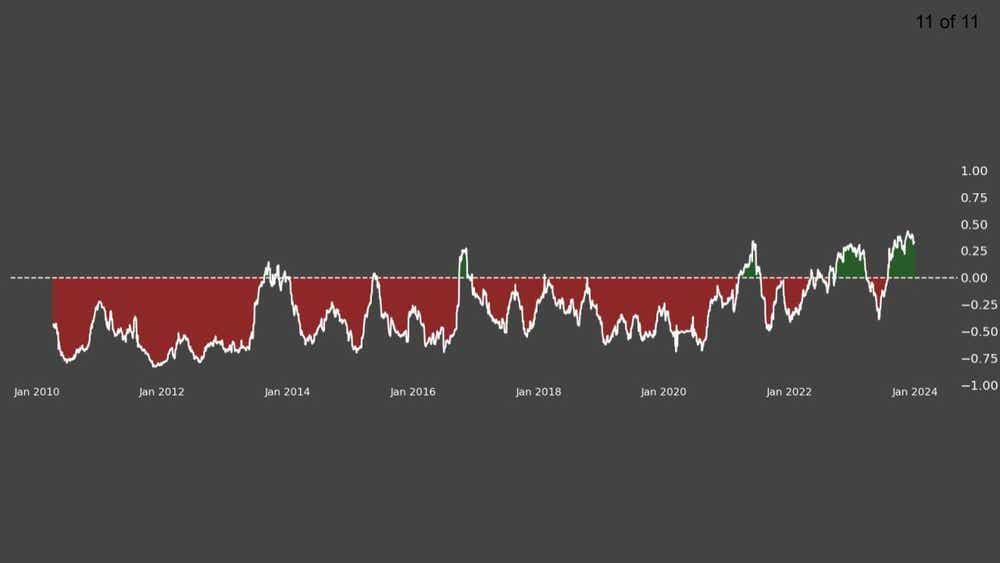

Correlation risk

Correlation risk refers to the risk that assets move in the same direction, which can lead to potential trouble if one asset declines. To mitigate this risk, it is advisable to balance your portfolio with assets that have low or no correlation. For example, one can combine the SPY with the iShares 20+ Year Treasury Bond ETF (TLT) because the two have low correlation.

It is recommended to aim for a correlation range between -0.5 and +0.5 (light colors in the correlation matrix) to maintain low correlation and also diversify options strategies to minimize risk.

Capital/BPR Risk

Strategic use of buying power reduction (BPR) and careful capital risk management are crucial for maximizing returns and minimizing losses in the market. While BPR can greatly benefit during favorable market conditions, it also increases the risk of losses when market conditions turn unfavorable. It is important to maintain a prudent capital allocation range of 25% to 50%, with a maximum cap of 75%, to ensure a healthy risk profile.

It is essential to be aware that BPR can expand under market pressure. Over-allocating during turbulent times can lead to being cornered, making it difficult to defend positions and prevent losses. For example, allocating 25% of capital to SPY 30 delta puts during the 2008 crash would have allowed for navigating the market downturn and preserving half of the portfolio's value.

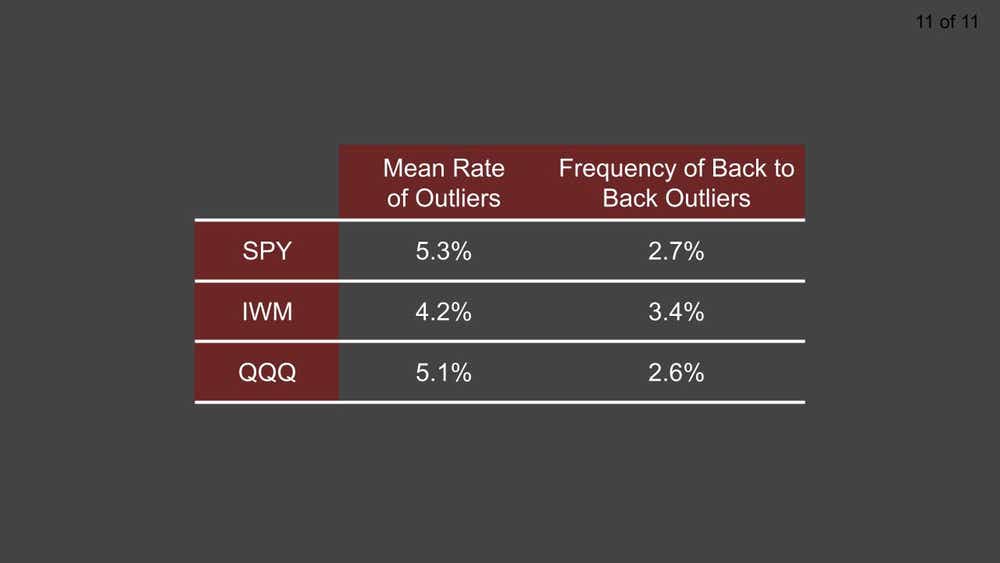

Tail risk

Financial markets can sometimes experience unexpected and extreme movements, often in a downward direction, that exceed typical levels of volatility. These events, known as tail risks, are estimated to have a 5% probability of occurring but can have significant consequences.

To minimize the effects of tail risks, traders should take the following precautions:

• Reduce the size of their positions;

• Give preference to strategies that have a defined level of risk instead of those with undefined risk;

• Consider longer-duration positions, such as those lasting 60 days or more, because major market corrections usually do not persist for longer than two months.

Now is the time to capitalize on the market's momentum while also carefully protecting your investments. With effective risk management, you can confidently navigate the evolving landscape and continue to flourish. Safe Trading!

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.