Monthly Futures Seasonality, October 2024: Stocks Face Cross-Currents

Monthly Futures Seasonality, October 2024: Stocks Face Cross-Currents

Heading into 4Q ’24, stocks are up 20% year-to-date. Does that means more gains to come?

Seasonality was not a great guide in September for U.S. equities, FX markets and precious metals—even though it was spot on for bonds. The S&P 500 traded higher last month for the first time since 2019, bucking the trend of September being the worst month of the year. Heading into 4Q ’24, stocks are up around 20% year-to-date (YTD). Surely, that means more gains to come?

The answer, of course, is “what’s your timeframe?” For October, recent history suggests stocks should start turning higher. Indeed, since World War II, if any month produces a bottom for a turn higher, it’s been October: a full one-third of every rally that persisted for more than 10% started in October. Sure enough, the S&P 500 has averaged a gain of 2.1% in the fourth quarter when it enters the final stretch of the year up by more than 20% YTD.

And yet, all is not sanguine. For the 10th time since World War II, the S&P 500 enters October up more than 20% YTD. The other nine times? Stocks have fallen 77.8% of the time for an average loss of 3%. That’s not to say anything about how stocks have performed every four years in October during the run-up to the presidential election, but it’s not great either: The first half of October has been the second-worst two-week period during presidential election years for the S&P 500 since 1928.

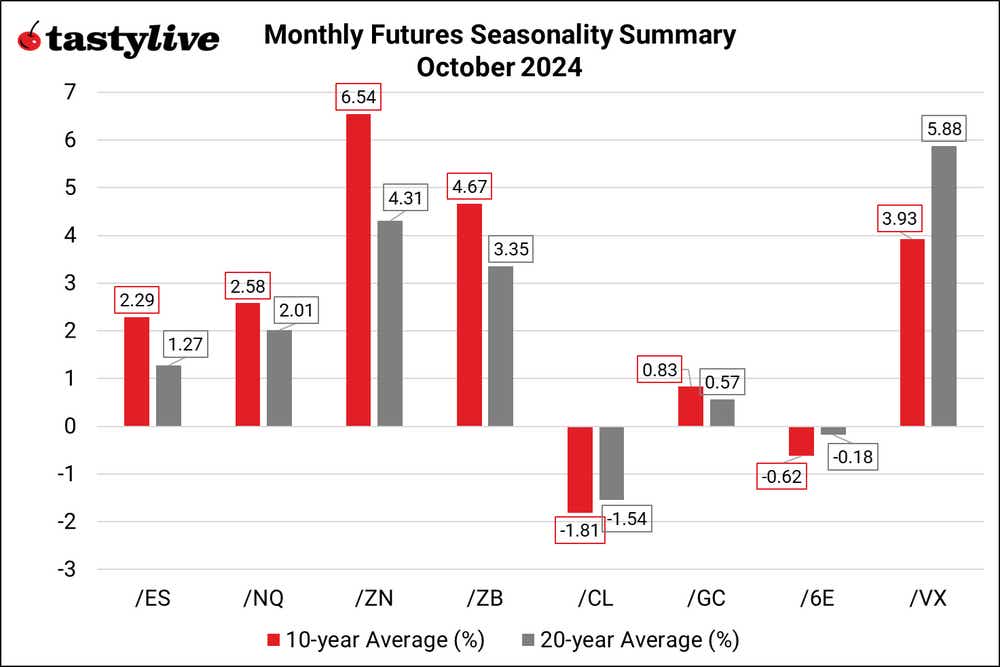

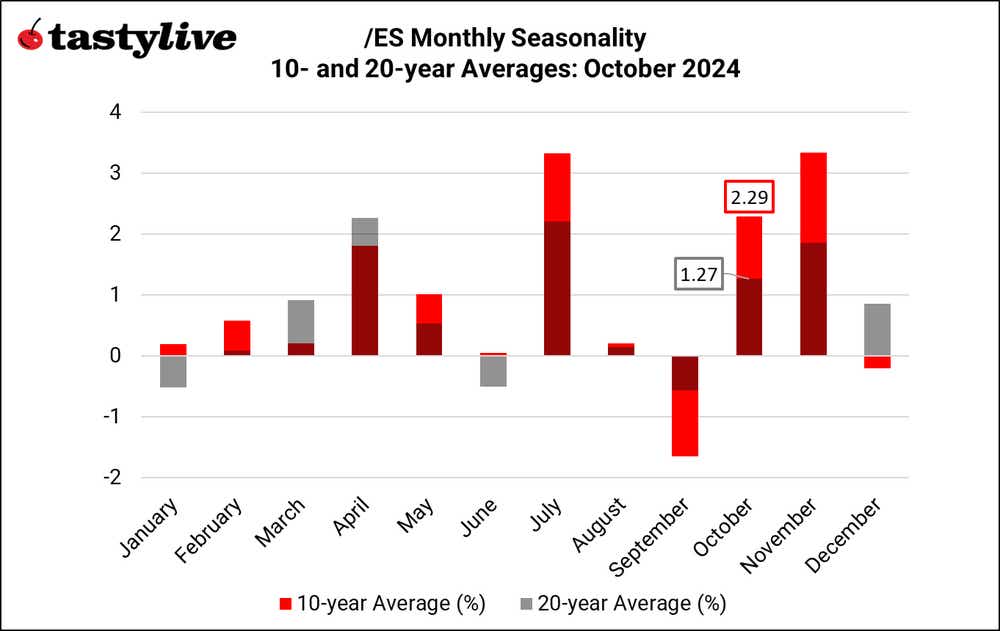

Monthly Seasonality in S&P 500 (/ES)

October is a bullish month for /ES, on a seasonal basis (using our traditional look-back periods), though the particular nature of October 2024 (arriving with the S&P 500 up 20% YTD and in the lead-in to the presidential election) warrants a less optimistic interpretation. Over the past 10 years, it has been the third-best month of the year for the index, averaging a gain of 2.29%. Over the past 20 years, it has been the fourth-best month of the year, averaging a gain of 1.27%.

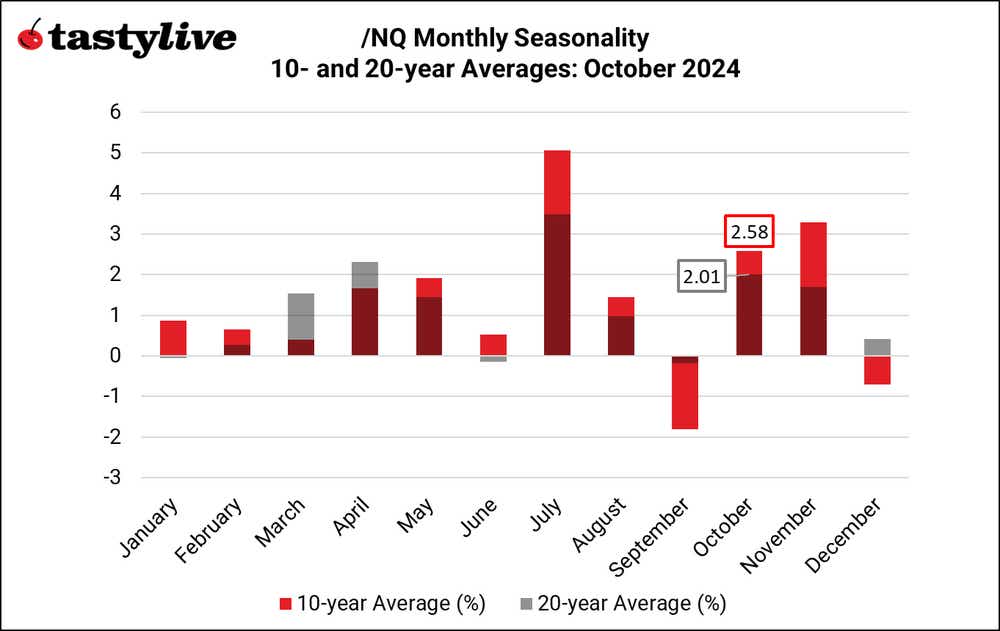

Monthly Seasonality in Nasdaq 100 (/NQ)

October is a very bullish month for /NQ, on a seasonal basis (though the prior disclaimer about the S&P 500 applies here as well; seasonality offers an unclear signal at best). Over the past 10 years, it has been the third-best month of the year for the index, averaging a gain of 2.58%. Over the past 20 years, it has been the third-best month of the year, averaging a gain of 2.01%.

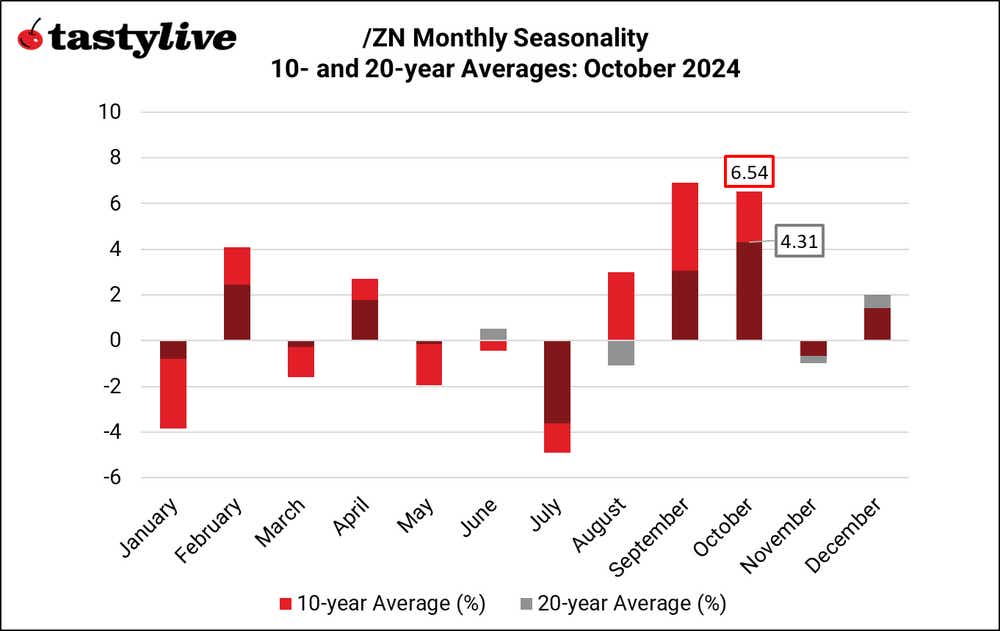

Monthly Seasonality in Treasury Notes (/ZN)

October is a very bullish month for /ZN, on a seasonal basis. Over the past 10 years, it has been the second-best month of the year for the 10-year notes, averaging a gain of 6.54%. Over the past 20 years, it has been the best month of the year, averaging a gain of 4.31%.

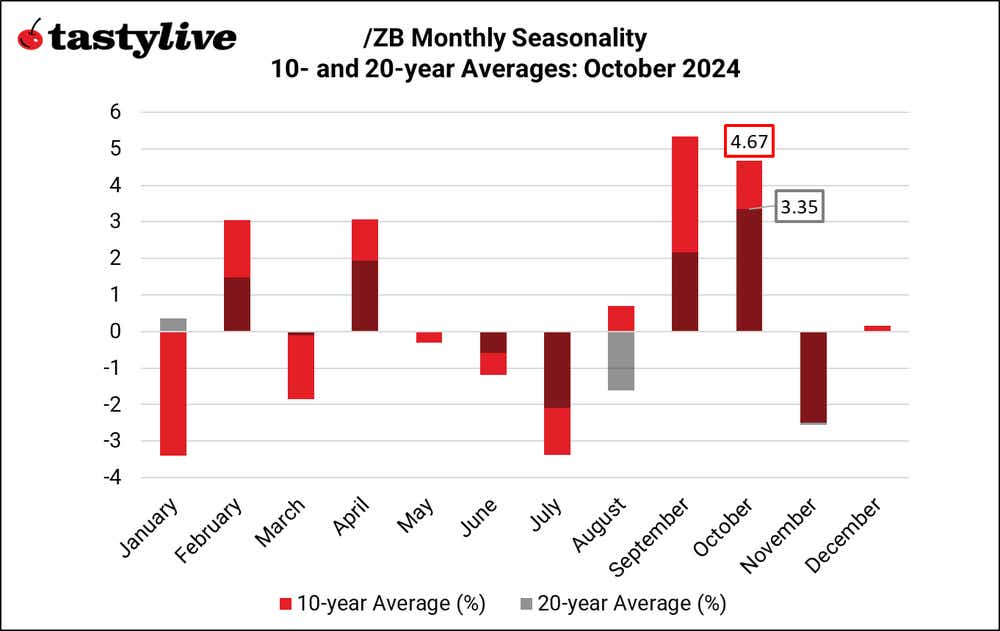

Monthly Seasonality in Treasury bonds (/ZB)

October is a very bullish month for /ZB, on a seasonal basis. Over the past 10 years, it has been the second best month of the year for the 30-year bonds, averaging a gain of 4.67%. Over the past 20 years, it has been the best month of the year, averaging a gain of 3.35%.

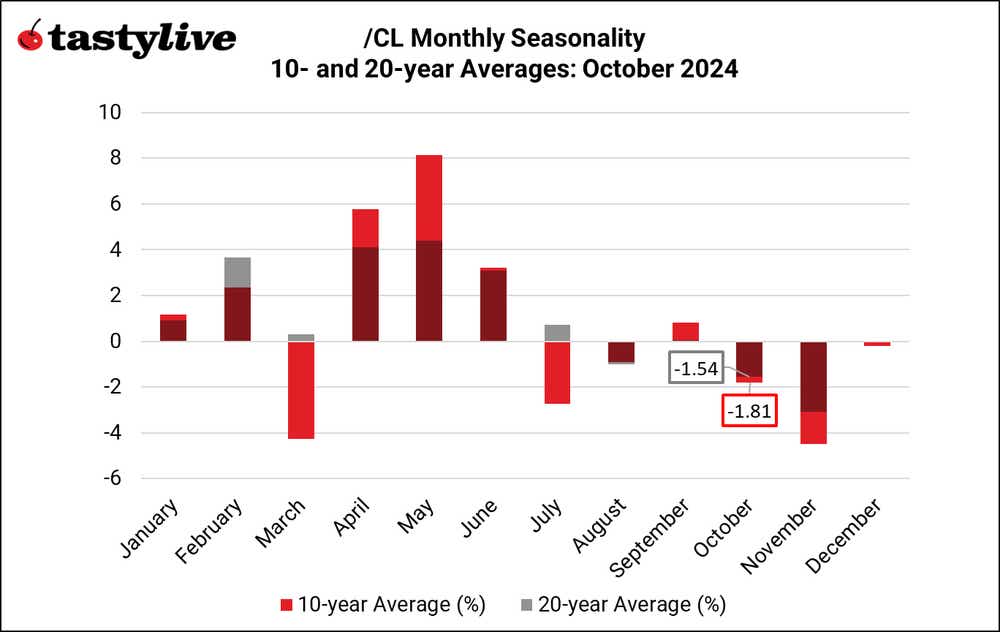

Monthly Seasonality in Crude Oil (/CL)

October is a bearish month for /CL, on a seasonal basis. Over the past 10 years, it has been the fourth-worst month of the year for the energy product, averaging a loss of 1.81%. Over the past 20 years, it has been the second-worst month of the year, averaging a loss of 1.54%.

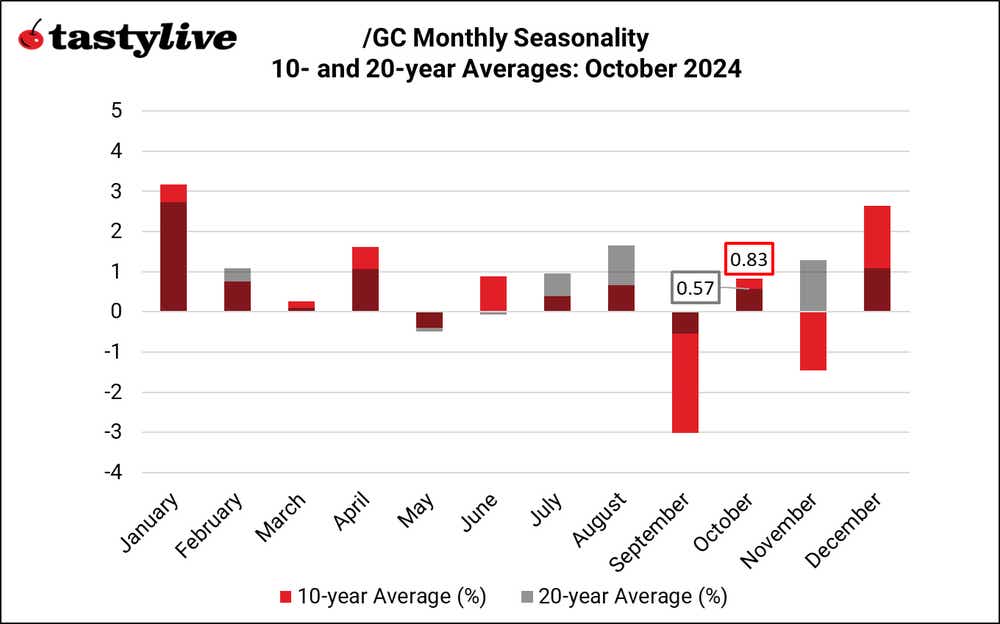

Monthly Seasonality in Gold (/GC)

October is a slightly bullish month for /GC, on a seasonal basis. Over the past 10 years, it has been the fifth-best month of the year for the precious metal, averaging a gain of 0.83%. Over the past 2 -years, it has been the fifth-worst month of the year, averaging a gain of 0.57%.

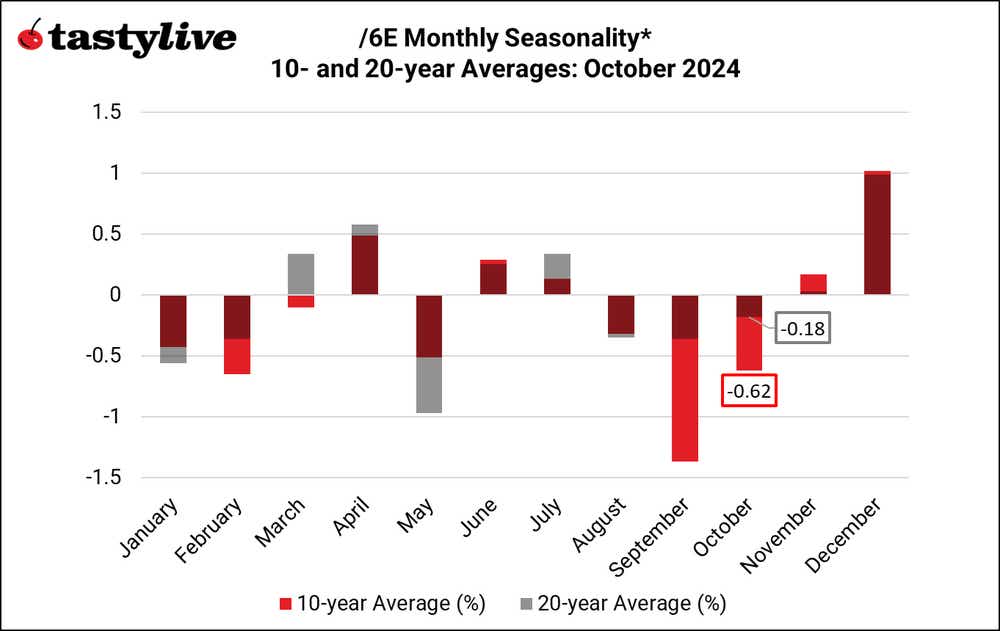

Monthly Seasonality in Euro (/6E)

October is a bearish month for /6E, on a seasonal basis. Over the past 10 years, it has been the third-worst month of the year for the pair, averaging a loss of 0.62%. Over the past 20 years, it has been the sixth-worst month of the year, averaging a loss of 0.18%. Note: the time series for Euro futures (/6E) does not extend beyond 2018; the data series has been backfilled using EUR/USD spot rates as a proxy.

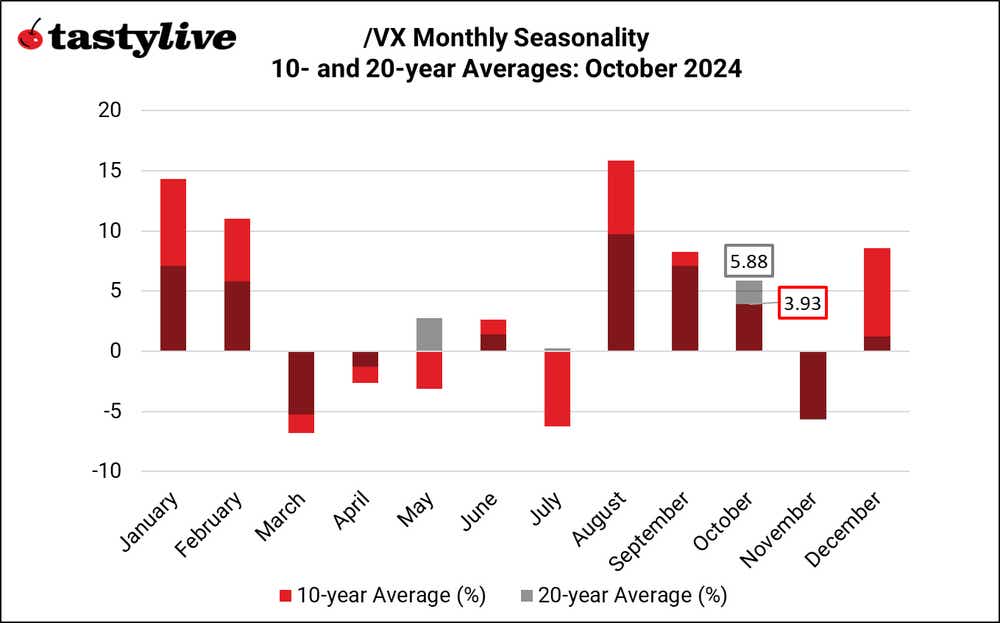

Monthly Seasonality in VIX (/VX)

October is a bullish month for /VX, on a seasonal basis. Over the past 10 years, it has been the sixth-best month of the year for volatility, averaging a gain of 3.93%. Over the past 20 years, it has been the fourth-best month of the year, averaging a gain of 5.88%.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.