Why We Sell Small Delta Options

Why We Sell Small Delta Options

By:Kai Zeng

When trading options, it's important to minimize risk and improve odds. A method to achieve this is by focusing on selling options with smaller deltas.

Minimizing risk becomes especially important when the threat of a correction looms.

Selling options with a 10 or 5 delta, can be conservative.

Two-standard-deviation strangles can have a success rate as high as 95%.

With the looming threat of a market correction, the importance of minimizing risk and improving odds becomes even more pronounced. A popular method to achieve this is by focusing on options trading, specifically by selling options with smaller deltas.

Deltas can be used as a proxy for the probability of profit. Selling options with a 10 or 5 delta, which represents a 10% or 5% chance of the option ending in the money, can be a conservative approach compared to selling 20 or 30 delta options. That’s because smaller delta options are farther out of the money, thus less likely to be exercised.

Strategies like selling two standard deviation (SD) strangles, which typically have a delta of around 2.5, can have a success rate as high as 95%. This is particularly appealing to traders who prioritize a high success rate in their trading endeavors.

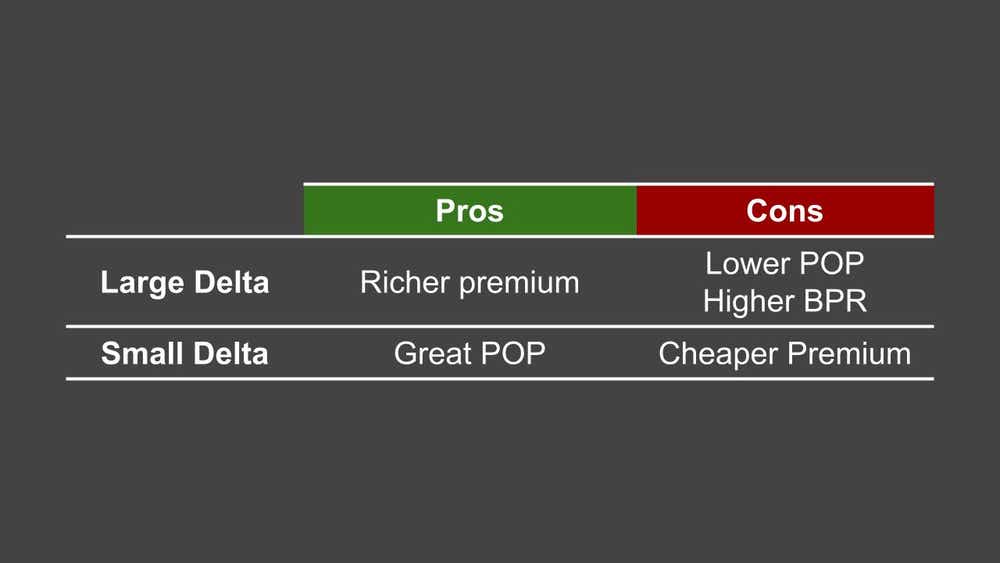

However, it's crucial to weigh the pros and cons of each strategy. While smaller delta options boast a higher success rate, they often come with a lower return on capital (ROC) because of the reduced credit received upon selling such options.

This is a trade-off between risk and potential reward that traders must consider based on their individual risk tolerance and trading goals.

So, which strategy has performed better historically—large or small delta? To understand, we conducted a test on SPY 1SD strangles (16 deltas, representing a relatively larger delta) and 2SD strangles (2.5 deltas, representing a relatively smaller delta), both with 45 days to expiration.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

The results show both strategies have achieved remarkable success rates. In particular, the 2SD strangles nearly reached a perfect success rate, though they resulted in a lower average profit and loss (P/L) and return on capital (ROC) per position.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

From a broader perspective, when evaluating long-term portfolio performance by simulating these strategies in an account of equal size and allocating 25% of the asset value to each strategy, 2SD strangles have been found to underperform 1SD strangles by 27%. However, they offer superior volatility control, an aspect that can be crucial during turbulent market phases.

.jpg?format=pjpg&auto=webp&quality=50&width=1000&disable=upscale)

In conclusion, for traders who prioritize a higher success rate and wish to maintain tight control over volatility, smaller delta options like 2SD strangles present a compelling choice. These strategies may yield lower P/L and ROC, but their ability to provide a cushion against market fluctuations can be invaluable, especially in uncertain times.

Traders must carefully consider their risk appetite and trading objectives when choosing the right strategy, as each comes with its own set of trade-offs.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has 20 years of experience in markets and derivatives trading. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.