Microsoft Earnings Preview—Another Earnings Beat Ahead?

Microsoft Earnings Preview—Another Earnings Beat Ahead?

By:Mike Butler

Investors will want to hear about AI developments and involvement in the Stargate AI project

- Microsoft will report quarterly earnings on Jan. 29 after the market closes.

- The company has exceeded earnings per share (EPS) and revenue estimates four quarters in a row.

- EPS and revenue estimates are both higher for the quarter.

- MSFT stock surged after the Stargate AI project news was released.

Microsoft (MSFT) is scheduled to report earnings on Jan. 29 after the market closes, and the stock price has realized a sharp recovery from lows in the past few trading sessions. At the beginning of the year, Microsoft was moving in the opposite direction compared to other Magnificent Seven stocks. After reaching a low of $410.72 this year, the stock currently sits at $446—up about 5% from the 2025 opening print.

Satya Nadella, Microsoft CEO, had strong positive words in the last earnings call: “AI-driven transformation is changing work, work artifacts and workflow across every role, function and business process ..."

She went on to say that “we are expanding our opportunity and winning new customers as we help them apply our AI platforms and tools to drive new growth and operating leverage.”

MSFT stock jumped after the Stargate AI project was announced, which plans on investing up to $500 billion in AI infrastructure by 2029 in the US. This is obviously beneficial for any big player already entrenched in the artificial intelligence space, and Microsoft is one of those beneficiaries.

While Microsoft continues to post strong numbers quarter after quarter, the recent stock price chop may have investors worried about the near-term future.

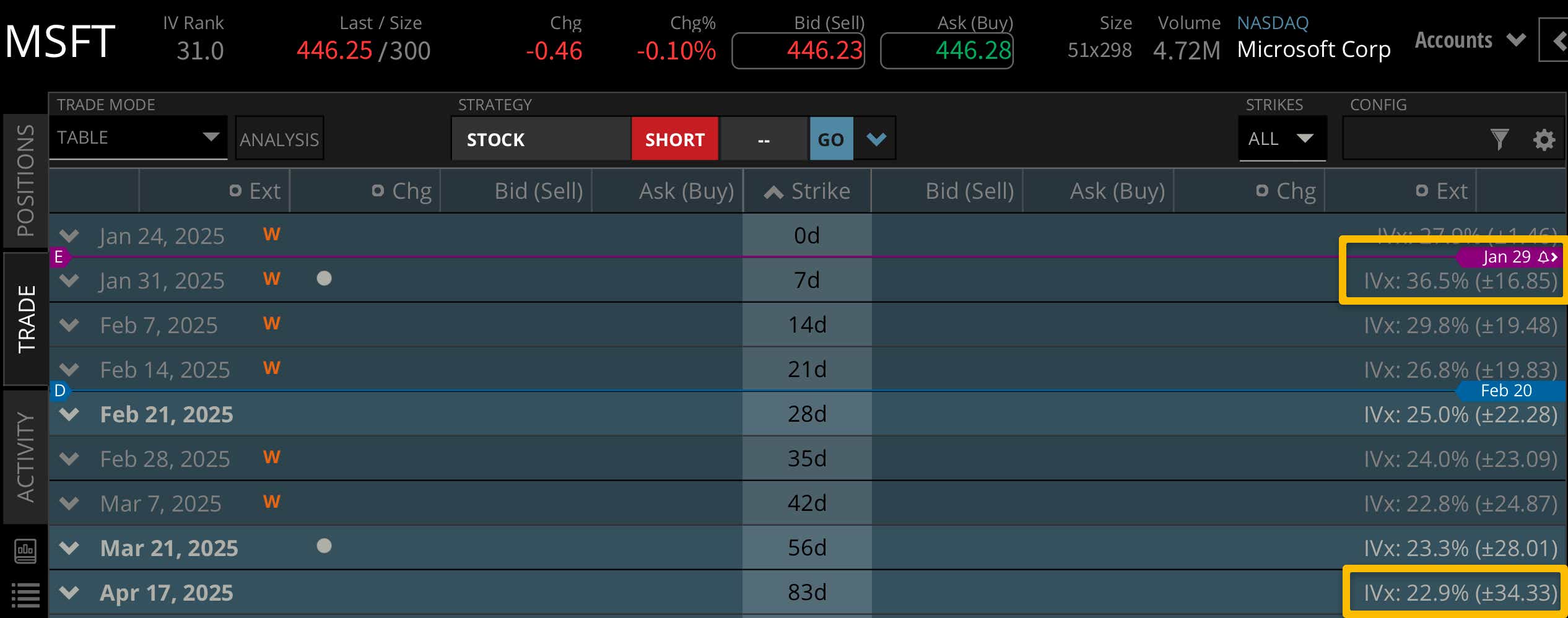

We can look to the options world to determine how high or low the stock price might be expected to move next week after the earnings announcement. Implied volatility helps us put context around next week, and we can compare next week to future expiration cycles.

Based on current implied volatility of next week's options cycle, we can see a +/- $16.85 expected stock price move. This is about 3.5% of the stock price, which is very low for an earnings announcement. Normally, we see companies land between 5%-10% of the notional value of the stock price for earnings.

However, looking to the April options cycle we can see a +/- $34.33 expected stock price move. This tells us that even though the market isn't expecting anything too crazy next week, it still makes up for a big chunk of the expected move for the next few months.

Bullish on Microsoft stock for earnings

If you're bullish on MSFT for earnings, you want to hear more about AI developments and potential involvement in the Stargate AI project. The Magnificent Seven software stock has had very strong earnings reports the past four quarters, so to see the stock price continue to rise we'll also need to see another EPS and revenue beat next week.

Bearish on Microsoft stock for earnings

If you're bearish on MSFT earnings, you may think the recent volatility in the stock price is a precursor for a failed earnings announcement next week. With such strong earnings history, if we see a miss in revenue or EPS, we could see the stock fall from the recent rally.

Tune in to Options Trading Concepts Live at 11 a.m. CST on Wednesday ahead of the Microsoft earnings announcement for some earnings trades!

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.